Attn All Would-Be Options Traders!

To take your skills to the next level, there’s 1 thing you absolutely need to do:

Learn the lessons the market teaches you.

& in my trading career, I’ve had plenty of learning opportunities

Top 3 Lessons I’ve Learned From Trading Options☟

↓

↓

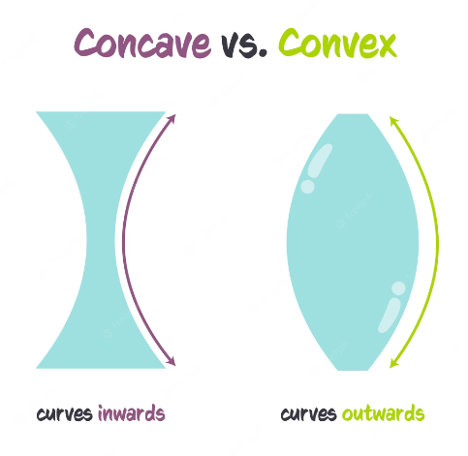

➠ 1) CONVEXITY TO RUN WINNERS

Don’t get too big in a position by being overconfident.

When you are making money, the natural reaction is to think that the winning streak will perpetuate forever & to up your size.

Wrong!

↓

↓

Generally, whenever I’ve got too big, I’ve defo lost $$$.

However, there is a right way to do it.

It must be done via convexity.

Have positions that start off relatively small, but they have explosiveness in their nature.

These are low delta options that become high delta options, and you let them run…

↓

↓

Here is the key

The positions grow naturally by themselves vs forcing an outsized exposure right off the gates.

That’s the way to get big.

You don’t start big, but your positions grow if you get them right.

And then you monetize them.

↓

↓

I’ve by far had my best years trading, sticking to this approach, and embracing convexity.

Now, you may be asking, isn’t that really hard to do?

When do you take profits?

That’s where pragmatism comes in.

You do take some chips along the way!

↓

↓

You gotta remember why you got in the trade in the first place.

Especially for those few trades that really run!

If your trade thesis is still valid, it could still be time to stick to your guns.

So, you can take some profit, say an amount sufficient to recover your initial risk.

This turns the remaining position into a free bet with high convexity potential.

Now, on the flip side…

↓

↓

➠ 2) CONCAVITY TO CUT LOSERS

There’s a phrase that has perpetually stuck in my mind:

The first cut is always the cheapest.

So, don’t be afraid to make cuts!

Make them, and make them frequent.

Recognize that you are going to make trades that lose $$.

The trick is keeping those losses relatively in check and not letting them snowball.

↓

↓

This is obviously easier said than done.

Who likes taking losses?

The best way is to get used to taking lots of small losses & be agnostic to it.

The more you do that, the more that encourages you to let your winners run cause this is what you are telling yourself…

↓

↓

“I can handle taking 3 or 4 losses in a row, because if I get one winner, it’s going to far exceed the losses and cover me…”

Developing this mindset of making big on the winners & keeping the losses down can make or break your trading career.

And the last lesson…

↓

↓

3) DON’T TAKE LIQUIDITY FOR GRANTED

You might currently be in a market environment w/ton of liquidity.

You can make huge trades, no problem.

You can manage them efficiently, again, no problem.

Getting out when you need to due to the rich liquidity.

The problem is…

↓

↓

In a month, the world can change, & that liquidity you’ve taken for granted could be gone!

That’s why you have to be on top of this.

Never blindly think liquidity will always be there.

↓

↓

I made that mistake in 2010, right before the sovereign debt crisis in Europe when Greece was going down.

That year, from March to May, the liquidity completely disappeared like something I had never seen before.

I was trading the most ridiculous size in March.

But then I couldn’t get a single trade on in May.

That’s how bad it got.

I got stuck with some massive positions that are still painful to remember to this day.

➠ And that’s a wrap on My Top 3 Lessons Learned From Trading Options

➠ Don’t forget that right now, you can get a free month of everything Options Insight has to offer!

Just follow the link in my Twitter Bio & use code RV2023 at checkout.

Also, if you enjoyed this info, please drop a reply as it helps the Twitter algo push it to more people

Cheers!