𝞂 Trade Idea Tue. | Part 2 𝞂

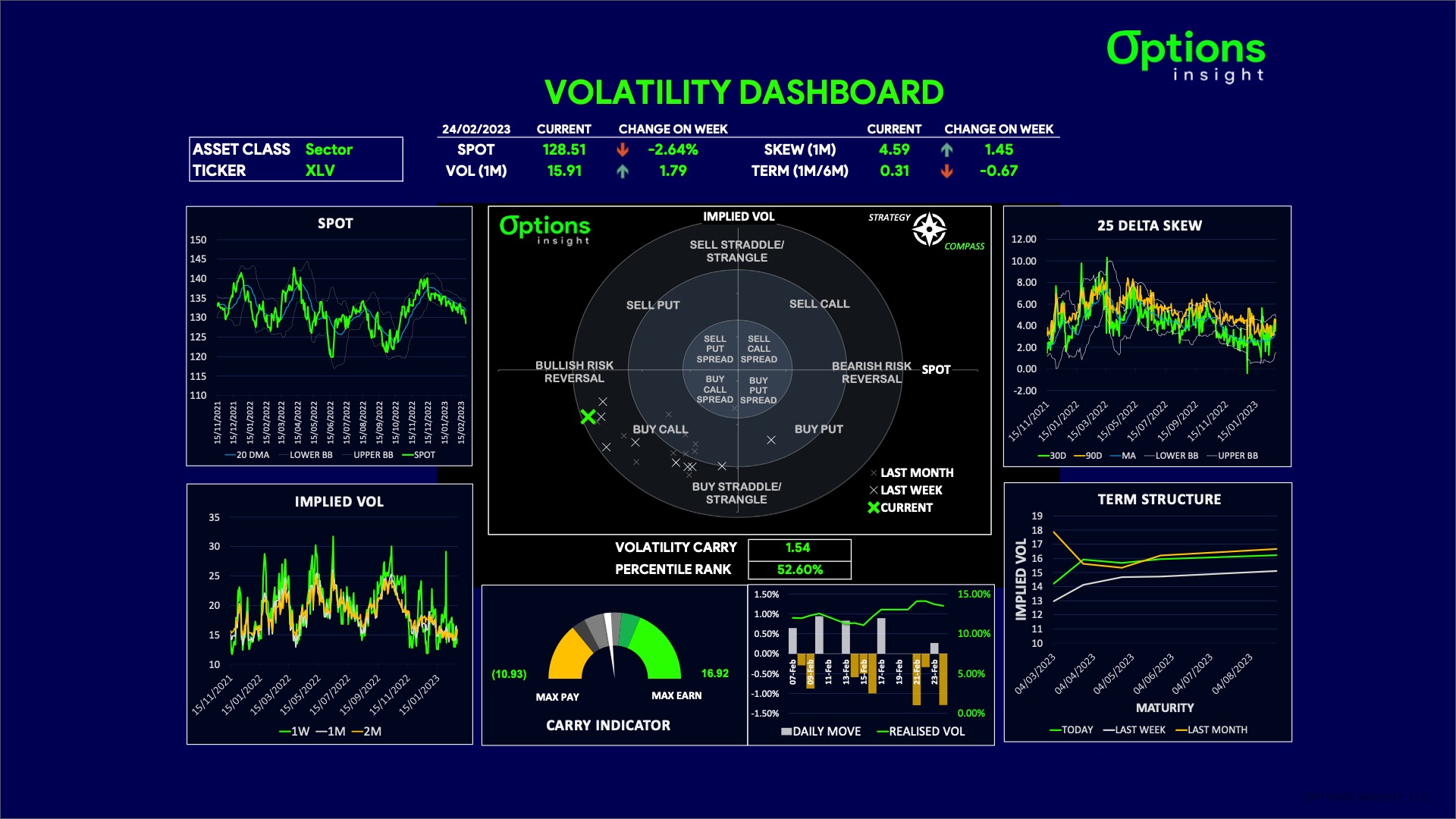

$XLV | Healthcare ETF

Where else might be an opportunity?

Pay Attn Option Traders

Short-term bullish momentum divergence & cheap IV on #XLV

Making short-dated calls a buy & set up a cheap tactical long w/the proper strat

Let’s explore

↓

↓

➠ BACKGROUND

𝞂 Many investors are questioning which sectors will outperform after the recent repricing in markets.

Especially as doubts resurface concerning cyclicals and #China optimism receding.

Volatile assets (such as Chinese equities & certain cyclical equities & #commodities, etc) tend to be the most affected during economic downturns.

↓

↓

Whereas sectors like Healthcare get labeled as ‘defensive.’

As the sector tends to remain stable during economic downturns.

It benefits from rising consumer demand, independent of the overall economy.

↓

↓

➠ OPTIONS PRICING

Alright, enough theory.

Let’s get to the meat of the bone…

XLV is being priced as cheap as it has been for months, making a tactical long with options a viable strategy.

Now, how can I tell XLV looks cheap?

↓

↓

Checkout our proprietary Vol Dashboard in the 1st image attached to find out

↓

↓

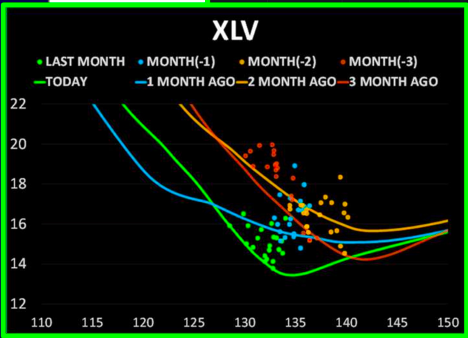

Need more convincing?

Our custom-designed Realized Skew Chart backs this view.

Checkout our Realized Skew analysis in the 2nd image attached

↓

↓

➠ TECHNICAL READS

Short-term timeframes are showing bullish momentum divergence.

Also, XLV implied vols have picked up slightly but are still significantly cheaper than a month ago.

Checkout the 3rd image attached to see the divergence I spotted w/my fav momentum indicator

↓

↓

➠ THE TRADE & MANAGEMENT

𝞂 Buying short-dated outright calls for a tactical bounce could make sense, especially for those underweight in stocks.

But Remember!

It is essential to monetize naked options quickly, as theta can eat into gains.

If you get the move you were looking for, cash out!

Or, at least, take some chips off the table…

↓

↓

See yesterday’s Top 3 Lessons I’ve Learned From Trading Options tweet for more on this!

↓

↓

𝞂 Buying either Mar23 or Apr23 expiries both looks reasonable.

The choice depends on conviction for a short-term rally before March #FOMC.

The safer play is April #Calls (but also less leverage to your capital outlay) if a quick bounce occurs.

↓

↓

➠ Wondering the exact strikes I’m using on XLV?

➠ How about the maturity I’ve chosen?

➠ And how do you size it and manage it most efficiently?

➠ Well then, don’t forget that right now, you can get a free month of everything Options Insight has to offer!

Just follow the link in my Twitter Bio and use code RV2023 at checkout.

I provide these types of trade ideas several times a week on #equities #bonds #commodities #forex #crypto #sectors

… and that’s a wrap on Trade Idea Tuesday!

In case you missed it, this was Part 2 of our first-ever Trade Idea Tuesday.

➠ You can find Part 1 in blog just prior to this one on a relative value trade idea for #Gold vs. #Silver

( $GLD / $SLV)

Let me know what you think of #TradeIdea Tuesday in the replies!

Also, if you enjoyed this info, please drop a reply as it helps the Twitter algo push it to more people

Cheers!