Have you ever thought about how interest rates affect market volatility?

Our subs have recently heard me say it’s clear interest rates are still the primary driving of these markets.

Time to unlock the interest rate-vol connection…

And form a trade idea w/a juicy risk-reward ☟

↓

↓

➠ DEEP DIVE INTO THE MOVE VS VIX RATIO

σ First, we need to understand the difference between MOVE and VIX.

MOVE measures bond market volatility, while VIX tracks stock market volatility.

Comparing these two gives us insights into the primary driver of macro vol.

↓

↓

➠ VIX OVERSHOOT: A MARKET MISCALCULATION?

σ Recent market trends show a decline in vol leading up to Easter.

But the MOVE vs. VIX ratio remains high, suggesting that interest rates are still the primary driver of macro vol.

Does this mean VIX has overshot to the downside?

Let’s explore this further…

↓

↓

➠ ANTICIPATING A VIX MEAN REVERSION

σ With the April VIX expiry approaching and earnings season in full swing, we anticipate a potential mean reversion.

The VIX curve appears too steep when comparing the 2nd and 4th month futures contracts.

HInting at limited downside for May23 VIX.

↓

↓

➠ BULLISH FLOWS: A SIGNAL FOR GROWTH?

σ Lately, we’ve seen more bullish flows in the VIX options market, supporting our view that the curve might be too steep.

We have also seen VVIX stabilize (recently been leading the moves)

The VIX beta indicator has been falling, usually a sign that VIX is running out of downside.

Giving us more confidence in our call.

So, what’s the thinking here?

If stocks trade lower due to earnings or a more hawkish

@federalreserve

, brace yourself.

As we could see VIX climbing back into the mid-to-high 20s in short order.

↓

↓

➠ VIX CALL DILEMMA: WHAT’S THE ALTERNATIVE?

σ How can we capitalize on these observations?

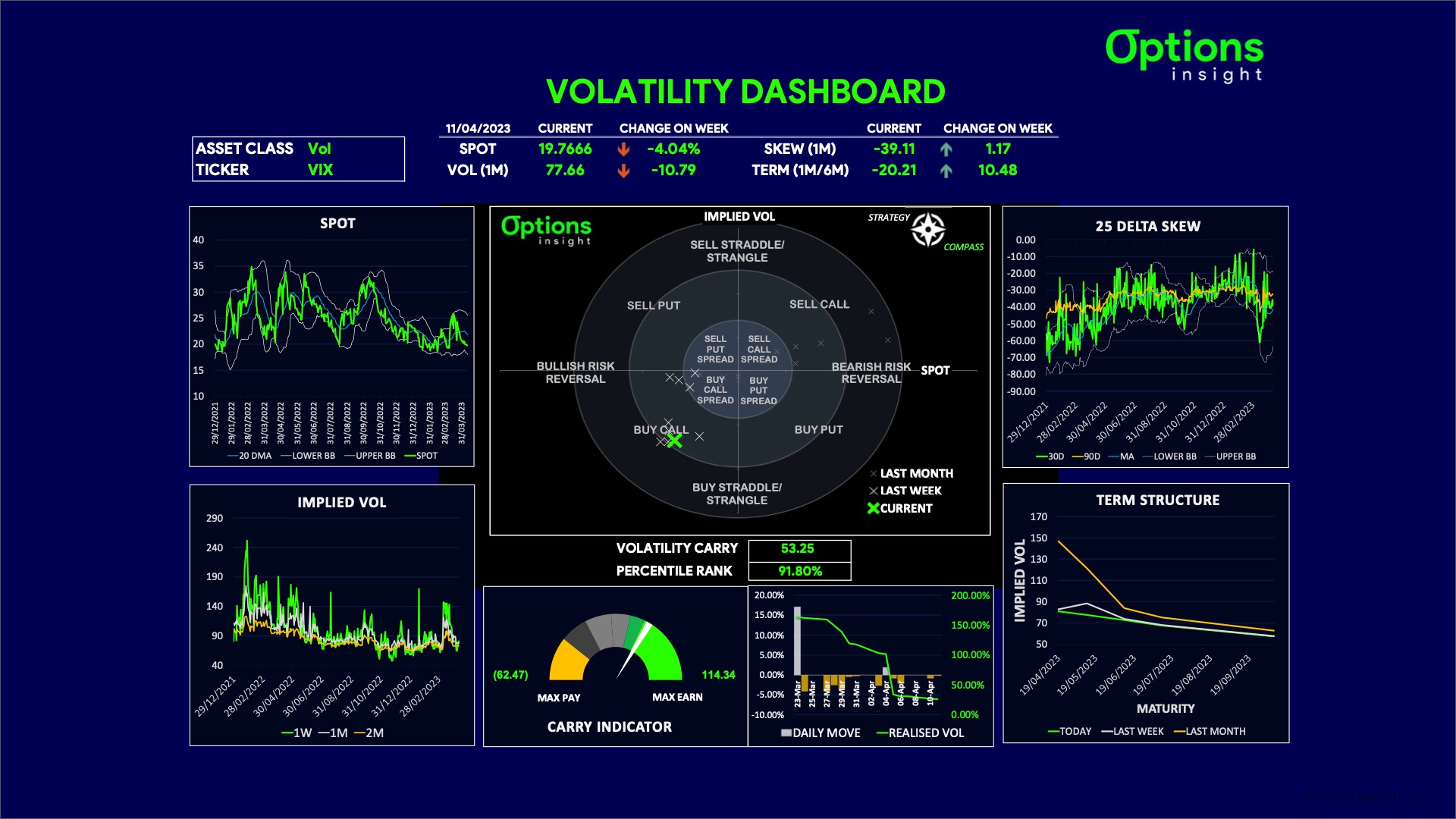

Our Volatility Dashboard for VIX indicates that buying VIX calls is the optimal play.

However, given the low VIX and implied vol, it’s hard to justify owning outright options when realized vol is so low.

So what can we do instead?

↓

↓

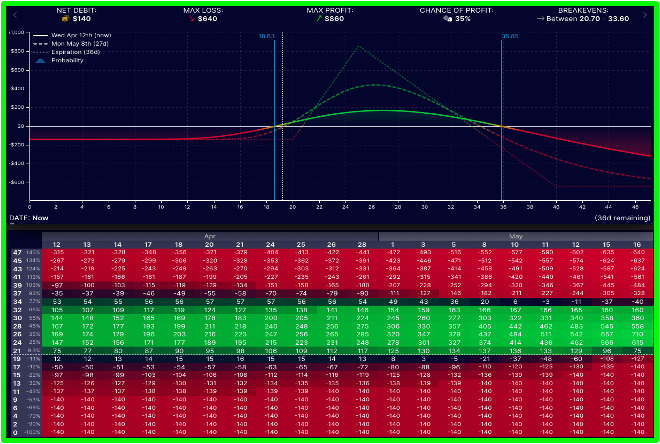

➠ BROKEN WING CALL FLY STRATEGY

σ Enter the Broken Wing Call Fly.

This approach allows us to:

• Target a VIX range of 22-30

• Use the expensive VIX upside skew to our advantage

• Manage our costs and risks more effectively

We believe the likelihood of VIX going above 34 is low, especially given the backdrop where a Fed pivot may not be miles away.

The result is we end up structuring a Call Fly with attractive breakevens and risk/reward.

↓

↓

➠ CAPITALIZING ON VIX WISDOM

σ Understanding the relationship between interest rates and market volatility can provide new perspectives and opportunities.

By being aware of these dynamics, you can make more informed decisions and capitalize on market fluctuations.

σ

σ

σ

☞ If you want even more color on these interest rate-volatility dynamics, check it out here ↴

Macro Options Spotlight | April 12, 2023

☞ Wondering about the exact strikes & expiration we’ve selected for our VIX Broken Wing Call Fly?

We encourage you to check out our Macro Options Daily service!

σ

σ

σ

☞ Ready to continue taking your options education to the next level?

We can help!

We’ll be holding our first Options Trading Bootcamp of the year on April 29-30.

A virtual deep dive into the world of options, with a syllabus & teaching to strengthen your options game no matter your experience level.

There’s no better time to learn how to profit from volatility than right now.

We, unfortunately, have a limited amount of attendees allowed on the call at once, so click the link below to register ASAP.

☞ Q2 2023 OPTIONS TRADING BOOTCAMP ☜

σ

σ

σ

Thank you for making it this far!

Please share it with others to help us in spreading professional options education.

Cheers!

Imran Lakha

Options Insight