In the world of trading, optimism is always appreciated.

However, a savvy trader knows to also look at the flip side of the coin.

As the market surges with bullish sentiments, we need to take a moment to analyze some underlying bearish undertones that might go unnoticed, specifically focusing on two crucial financial indicators:

The Volatility Index (VIX) and the Standard & Poor’s 500 Index (SPX).

⇩⇩⇩⇩⇩⇩⇩⇩

Probing the VIX

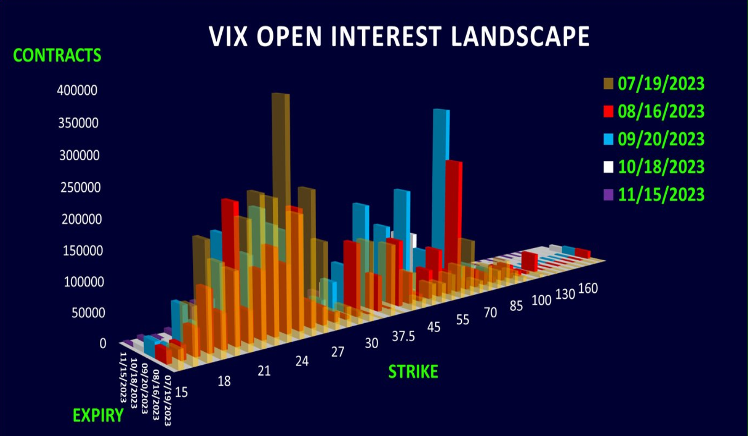

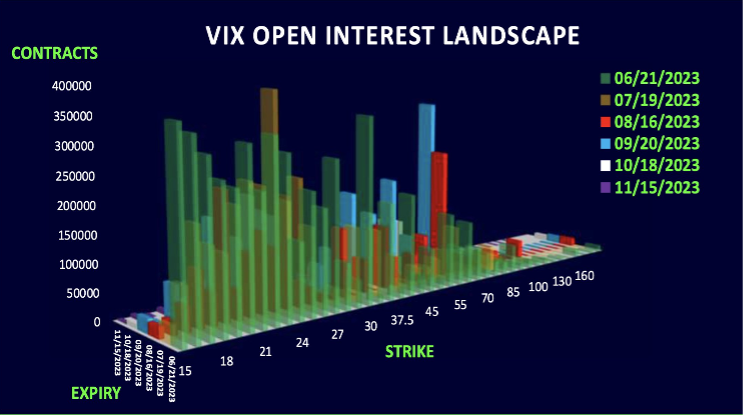

Let’s start with the VIX, often considered the ‘fear gauge’ of the market. An upward movement in the VIX usually signals increasing uncertainty or fear among investors. We’ve noticed a peculiar trend developing for July: a rise in open interest, with call options building between 21 and 25 strikes. For those new to options trading, a ‘call option’ gives the holder the right to buy an asset at a specified price within a specific timeframe.

The build-up between these strike prices indicates that traders are positioning for a potential spike in the VIX by the end of July. I’ve been exploring low-cost ways to leverage this possible move, which could benefit traders willing to take on a bit of risk in anticipation of a volatility spike.

The SPX – A Cautionary Tale

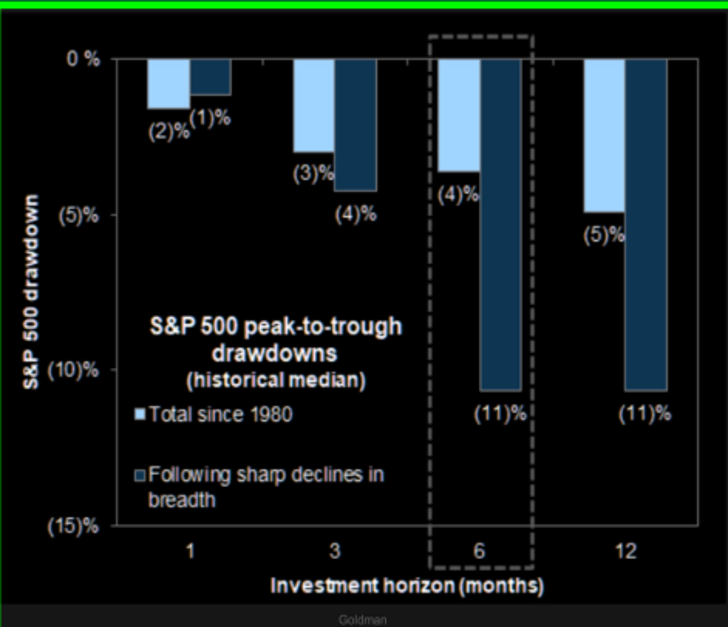

Moving to the SPX, a bearish undertone lurks beneath the recent bullish run. We are relishing that we might have dodged a recession or at least pushed it into next year. However, upon closer analysis, there are a few reasons to exercise caution.

For one, Goldman’s analysis points to the likelihood of a 7% drop in the SPX over a six-month period following sharp declines in breadth like we’ve recently seen. While the market peak may not have been reached, it’s wise to consider buying some cheap hedges. These can serve as a safety net, offering protection against potential losses if the market turns downward.

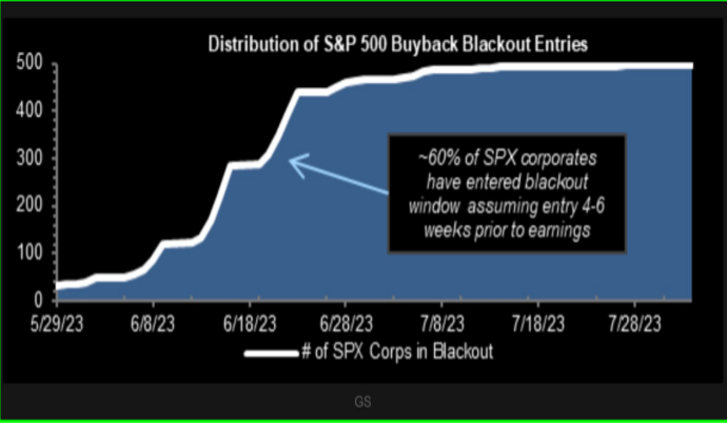

The Impact of Buyback Blackouts

Adding to the concern is that 60% of SPX companies are currently in a buyback blackout period, with this figure projected to rise to 85% by the end of the week. As these companies represent a significant portion of stock purchases, their absence from the market could thin out the demand for stocks. Add to this the anticipated quarter-end rebalancing, where institutional investors could sell equities, and you’ve got a recipe for a possible market pullback.

The Winds of Change

It appears that the bearish undertones I’ve been highlighting are starting to manifest. Over the past 24 hours, the Nasdaq 100 Index (NDX) has experienced a loss of 1.5%, while the SP500 Index has dipped by approximately 0.5%. Even if these changes might seem small, they can be the initial signs of a more significant shift in market dynamics in line with the reads we are getting, reinforcing the need for caution and preparedness.

Conclusion: Preparation is Key

In conclusion, while the markets are buzzing with bullish enthusiasm, it’s crucial for traders to stay vigilant and informed about the possible bearish undertones. Keep an eye on the VIX and be aware of the potential impacts of buyback blackouts and quarter-end rebalancing on the SPX. After all, the most successful traders can navigate not just the calm seas but also the stormy ones. Remember, preparation is the key to weathering any market condition.

Imran Lakha

Options Insight