The Unforeseen Rise of Regional Banks

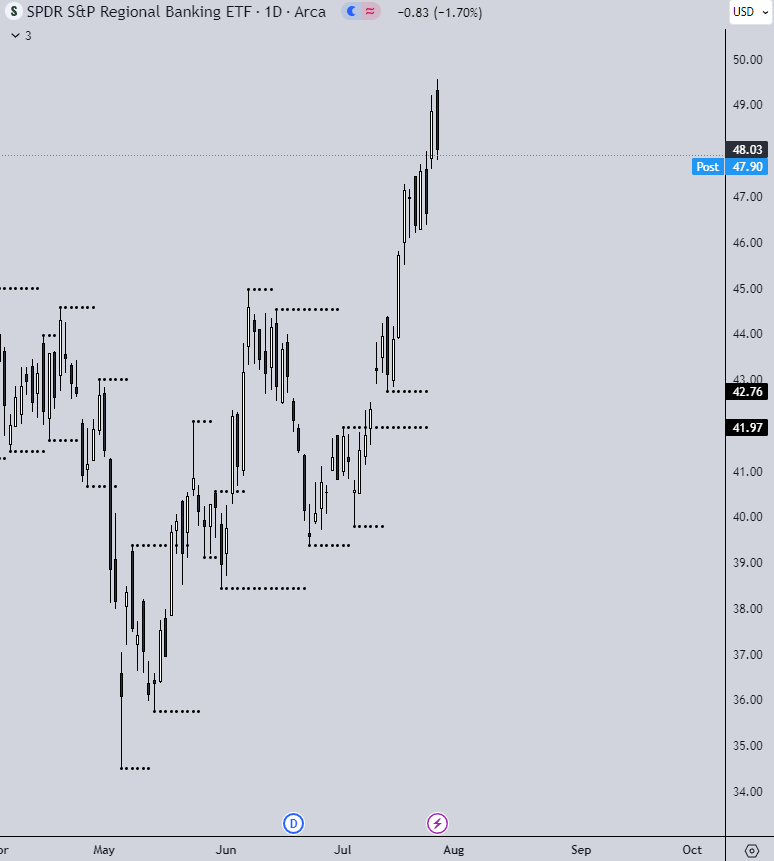

As financial markets continue to evolve, savvy investors have been tracking an intriguing trend in the banking sector. Regional banks have surprised market participants with an impressive rally, surging 42% off the lows since May. Despite most investors initially adopting a bearish stance, this unexpected upswing has attracted considerable attention.

Goldman’s Prediction and Investor Caution

Goldman’s credit analysts are forecasting this trend to continue, with regional banks appearing undervalued compared to the rest of the market. However, while this proposition is inviting, it’s prudent for investors to look beyond the surface. Many are favoring the more established, big banks featured in the Financial Select Sector SPDR Fund (XLF), over the riskier regional ones within the SPDR S&P Regional Banking ETF (KRE).

The Role of Strategic Option Trading

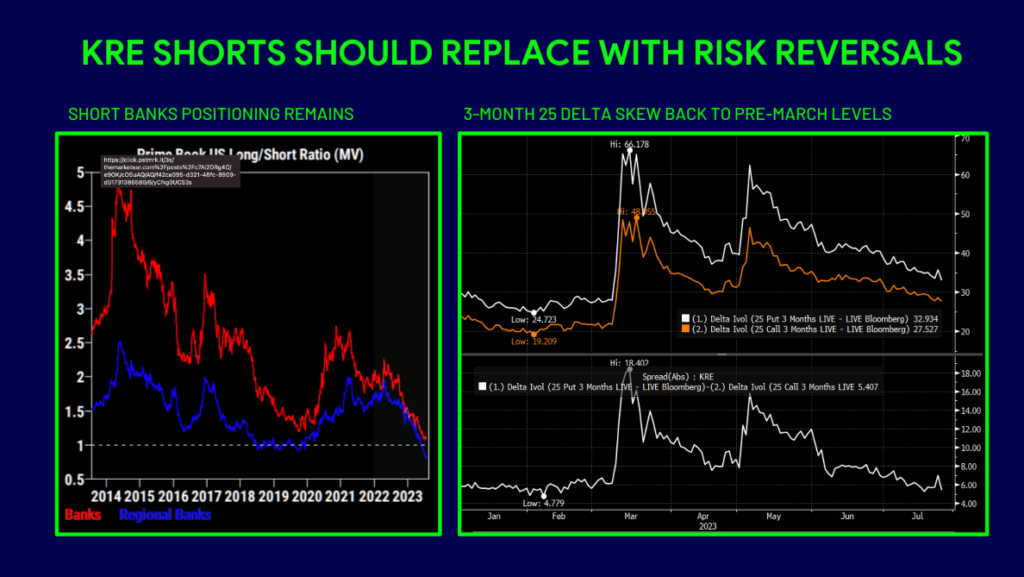

Considering the potential limitations on the upward trajectory due to the prevailing inverted yield curve, there is a distinct need for strategic option trading. For investors who are short or underweight on regional banks, considering the best trading options strategies could be a smart move. This is particularly so as the skew has normalized back down to levels reminiscent of the pre-March banking turbulence.

Technical Indicators and Entry Points

On a technical note, KRE is inching towards a 50% retracement of the sell-off, and there is a noticeable cluster of resistance between 50 and 54. This information is critical as it can guide investors in deciding their entry and exit points while trading options.

Conclusion: The Value of Trading Options Strategies

In conclusion, the upward movement of regional banks presents an opportune moment to apply the best trading options strategies. While the future of these banks might still be uncertain, the right trading strategy can help investors maximize their gains and limit their risks. Therefore, investors should consider broadening their trading toolbox, turning to strategic options trading to harness this market’s potential.

If you want to start your journey in learning how to master simple options trading strategies straight from a 20+ year veteran, start your Free 1-Month Subscription to Options Insight right now!

Just click the link below!

1 FREE MONTH TO OPTIONS INSIGHT!

σ

σ

Thank you for making it this far!

As always, if you have any questions, comments, and/or found this helpful, feel free to reach out and let us know at info@options-insight.com

Cheers!

Imran Lakha

Options Insight