In the ever-fluctuating world of trading, it’s vital to keep your finger on the pulse of the market and adjust your strategies accordingly. The last few weeks have been a roller-coaster ride, and many are searching for the best trading options strategies to navigate these turbulent times.

Hedge Fund Woes and a Search for Balance

It has been a painful period for hedge funds, particularly those dealing with short positions. Both shorts and long-short books have experienced negative alpha, triggering a wave of massive de-risking across the long/short community.

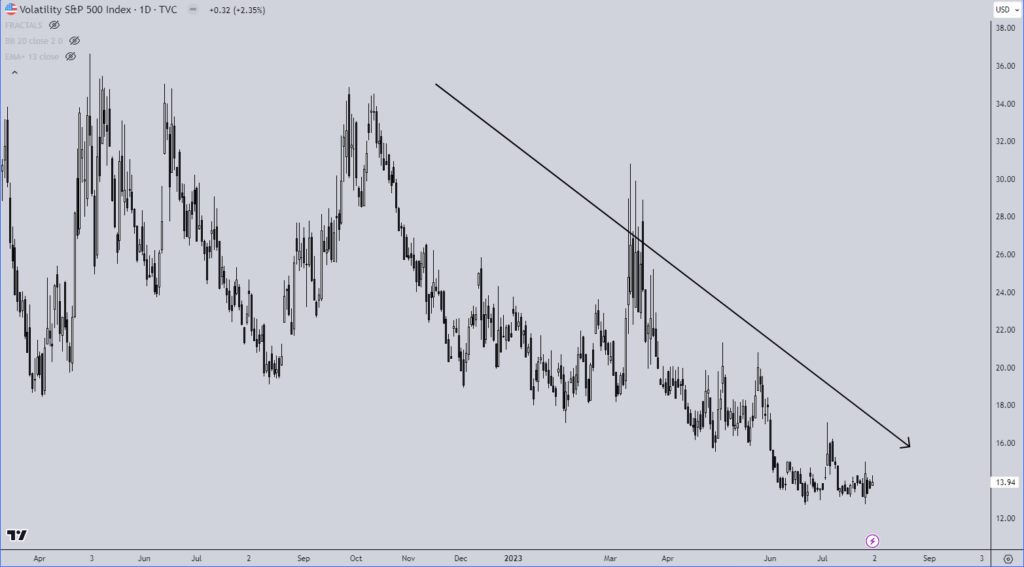

As the headline index volatility plummets and the VIX (Volatility Index) remains bidless, macro bears seem to have given up, with sentiment turning somewhat euphoric. Many are anticipating a soft landing as the base case. But is this confidence misplaced?

August: A Critical Month

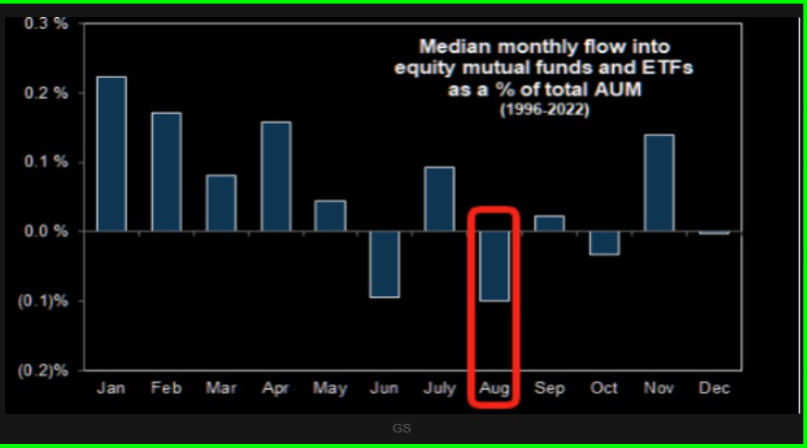

August is known for being the worst month for equity mutual fund flows.

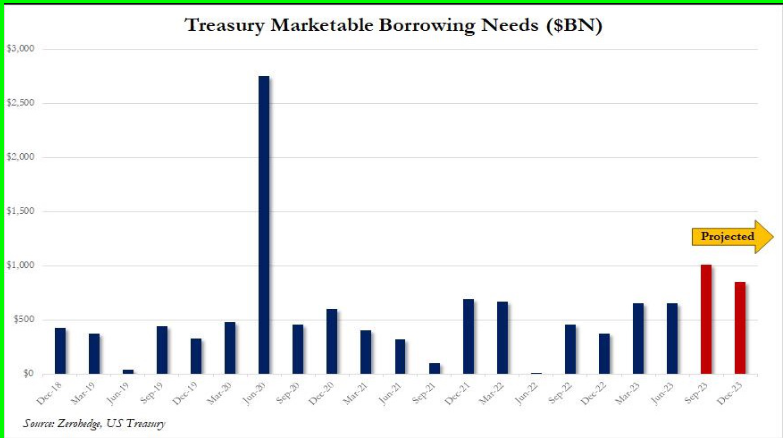

As we enter this crucial period, one must wonder, is anyone left to buy this market? The selling pressure is not limited to stocks; the treasury is issuing another trillion in debt to fund the record budget deficits, up 170% year over year (YoY).

Investors are growing weary of getting squeezed on shorts like the rest of the market, leading to a natural question:

So, what are the best trading options strategies in this environment?

Best Trading Options Strategies: Finding the Right Approach

In a market that’s both risky and rewarding, it’s essential not to “be over your skis” by taking extreme long positions.

Here’s a glimpse of the best trading options strategies to consider:

- Risk Management: Make use of hedging strategies to minimize exposure and potential loss.

- Flexibility: Be prepared to shift strategies as the market evolves, adapting to new information and trends.

- Diversification: Don’t put all your eggs in one basket; diversify your portfolio across various assets and strategies.

- Market Analysis: Stay informed and consider macro trends, including governmental decisions such as issuing debt or other global economic factors.

Fortunately, as the premier online resource for options traders and investors of all kinds, we make your job really easy, providing you with the insights necessary to choose the best strategy that best suits your needs.

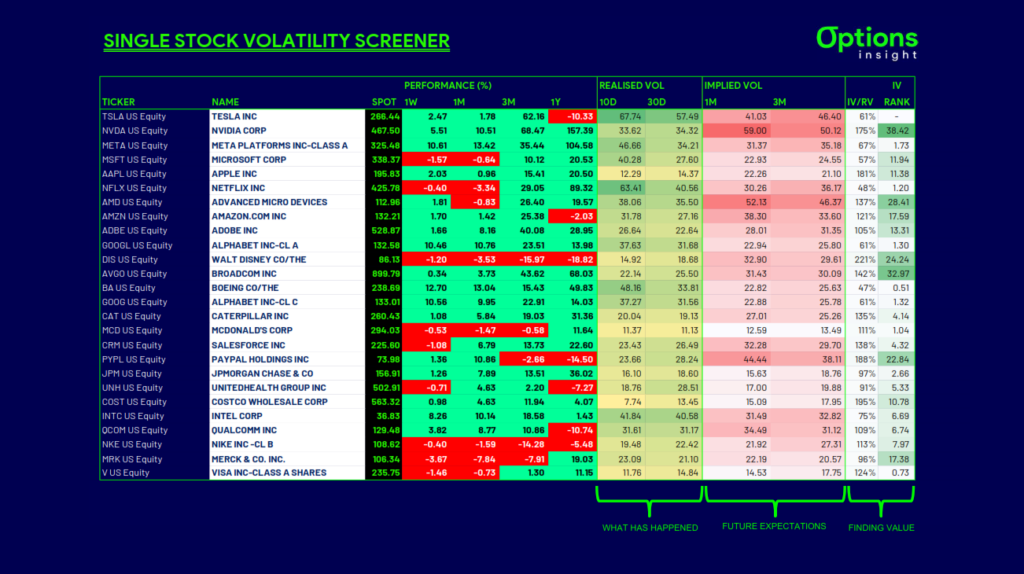

Whether it is by expressing views on commodities, bonds, stocks, etc, we cover it all. Case in point, find below as an example a small part of the intelligence in potential stocks’ plays that subscribers receive on a daily basis to decide on the best strategies to execute:

Conclusion

Navigating the current market requires an intelligent approach, and understanding the best trading options strategies can provide a solid footing. Whether you’re a seasoned trader or just starting, adapting your strategies to these unprecedented times will be key to staying ahead of the game.

Remember, the market is a complex organism that can change in the blink of an eye. Stay vigilant, stay informed, and most importantly, stay strategic. The best trading options strategies are those that allow for flexibility and foresight in this ever-changing financial landscape.

If you want to start your journey in learning how to master simple options trading strategies straight from a 20+ year veteran, start your Free 1-Month Subscription to Options Insight right now!

Just click the link below!

1 FREE MONTH TO OPTIONS INSIGHT!

σ

σ

Thank you for making it this far!

As always, if you have any questions, comments, and/or found this helpful, feel free to reach out and let us know at info@options-insight.com

Cheers!

Imran Lakha

Options Insight