The financial markets are ever-changing, and staying abreast of the latest trends and strategies is crucial for success. Lately, there has been a notable shift in the market’s behavior that has sent traders scurrying for protection. This phenomenon has raised the importance of understanding and utilizing the best trading options strategies. Let’s delve into what’s been happening and how savvy traders are adapting.

A Long-Awaited Reaction to Market Signals

It’s been a long time coming, but the equity market is finally showing a bid for volatility (vol) after the recent price action on the Fitch downgrade and an increase in bond yields. Bearish signs have been popping up in macro assets over the last few days, which hadn’t gone unnoticed. But the equity markets decided to wake up and join the party yesterday, bringing new focus to some of the best trading options strategies.

Skew and the Right Tail

Skew, a measure of the perceived risk of significant market moves, had been at historical lows for months. Investors had primarily been concerned with the right tail, indicating that they were more focused on potential gains than protecting against losses. This attitude persisted as concerns about a recession remained at bay, but recent developments have caused a shift in sentiment.

SDEX Spike and the Need for Protection

The SDEX (an index tracking market volatility) saw a decent spike yesterday. People finally started to reach for protection, and market makers were more than willing to buy volatility as their inventory levels quickly evaporated below a critical 4500 level. According to our friends at Spotgamma, there may be further downside acceleration at this level.

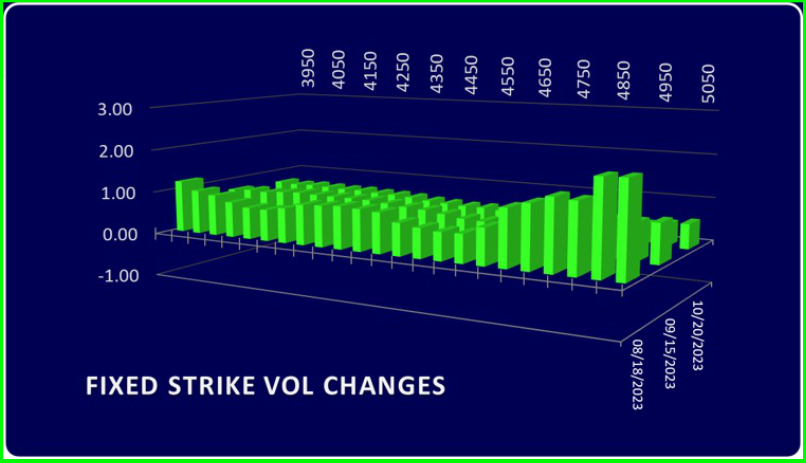

Fixed Strike Vol Monitor and Market Maker Response

Our fixed strike vol monitor also confirms the recent trend, highlighting how market makers have been quick to respond to changes. The market’s sudden appetite for volatility has left those who were unprepared scrambling for protection, thus emphasizing the importance of understanding the best trading options strategies.

Conclusion: Embracing the Best Trading Options Strategies

The recent market behavior underscores the importance of staying informed, flexible, and always ready to employ the best trading options strategies. Whether it’s hedging against potential losses or leveraging opportunities for gains, being in tune with market trends and responsive to shifts can make a world of difference in your trading success.

Case in point, we noticed how Fitch’s downgrade of US debt led to a market panic and a break in significant yield resistance levels. Despite initial concerns, there’s bullish divergence in TLT, and the downgrade’s impact is likely less significant than in 2011.

The move may be near completion as US treasury collateral quality remains high, and there’s no sign of a massive liquidation or significant increase in bond skew and volatility. Setting up for a swing higher in the near term appears sensible.

After these observations, we published the following trade idea on $TLT:

If you’re looking to enhance your trading skills, it may be wise to study the best trading options strategies in this ever-evolving market landscape. Learning how to adapt to market trends, like the current spike in volatility, can equip you with the tools you need to thrive in the world of trading.

For more insights into the best trading options strategies and how to stay ahead of the curve, subscribe to our newsletter and follow our blog for regular updates. Happy trading!

Psst, if you want to start your journey in learning how to master simple options trading strategies straight from a 20+ year veteran, start your Free 1-Month Subscription to Options Insight right now!

Just click the link below!

1 FREE MONTH TO OPTIONS INSIGHT!

σ

σ

Thank you for making it this far!

As always, if you have any questions, comments, and/or found this helpful, feel free to reach out and let us know at info@options-insight.com

Cheers!

Imran Lakha

Options Insight