The stock market is a dynamic entity, often influenced by numerous factors, both known and unforeseen. Traders always seek strategies to capitalize on these changes, and understanding market indicators is crucial.

One of these indicators, relevant to our discussion, is the VIX term structure. Let’s dive deeper into what recent market movements tell us and how this can guide us in picking the best trading options strategies.

The Return of Fear in the Market

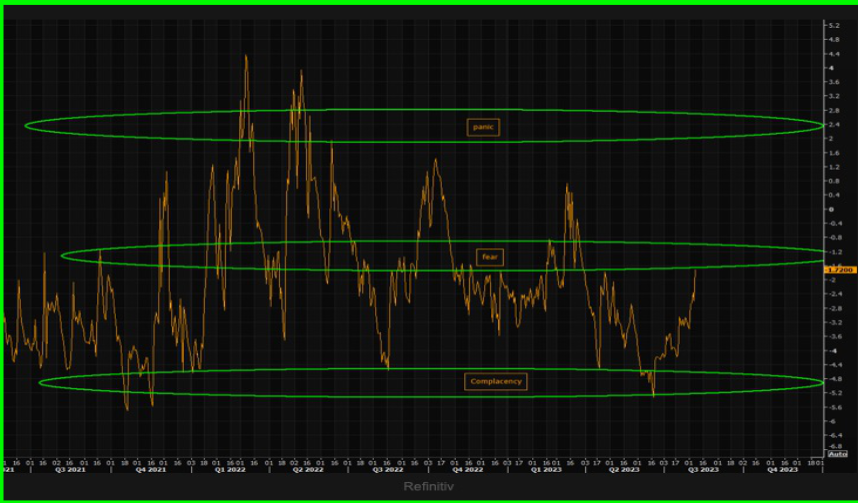

Yesterday’s movement highlighted an apparent return of fear, with the VIX curve spiking. This indicates an enhanced level of volatility. While it hasn’t reached a state of panic, this shift is notable. The VIX term structure, in particular, flattened significantly, hinting at the short-term uncertainties in the market.

The Role of VIX Gamma

Dealers, who had positioned themselves short on the VIX gamma through short call positions for August upside, found themselves compelled to delta hedge. Such a short gamma position is double-edged. The Aug23 VIX futures saw this in play when they dropped sharply from 18.5 to a current 16.

Analyzing the SPX Skew

The SPX skew has repriced at a considerably higher rate. For those in the know, this could suggest a potential interim bottom. But, as with all market movements, concrete evidence will be essential. The upcoming US CPI release on Thursday and its consequent influence on the rates markets will serve as this proof, directing the trajectory of stocks.

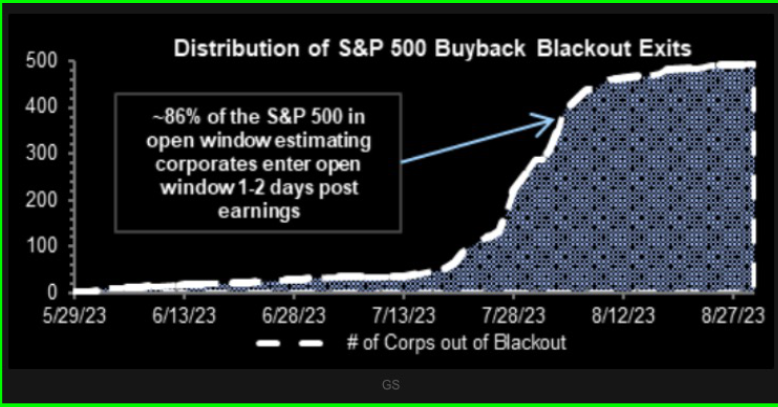

Corporate Buybacks to the Rescue

An exciting dynamic unfolding is the return of corporate buybacks. Emerging from their blackout windows, these buybacks can potentially counteract some of the selling pressure from CTA and vol control. This buyback might elucidate why, despite dealer positioning vanishing with the downward shift below 4500, the SPX hasn’t experienced a significant breakdown.

Crafting the Best Trading Options Strategies

Understanding the intricate workings of the market, from the VIX term structure to the influence of corporate buybacks, is essential for traders. By keeping an eye on these markers and interpreting their signals, traders can adapt and select the best trading options strategies, maximizing their potential for success. As always, it’s crucial to stay updated, be adaptable, and make informed decisions based on current market indicators.

On the back of this contextual setting, we published the following trade idea (call and put flies) on $NVDA ahead of the earnings call:

If you’re looking to enhance your trading skills, it may be wise to study the best trading options strategies in this ever-evolving market landscape. Learning how to adapt to market trends, like the current spike in volatility, can equip you with the tools you need to thrive in the world of trading.

For more insights into the best trading options strategies and how to stay ahead of the curve, subscribe to our newsletter and follow our blog for regular updates. Happy trading!

Psst, if you want to start your journey in learning how to master simple options trading strategies straight from a 20+ year veteran, start your Free 1-Month Subscription to Options Insight right now!

Just click the link below!

1 FREE MONTH TO OPTIONS INSIGHT!

σ

σ

Thank you for making it this far!

As always, if you have any questions, comments, and/or found this helpful, feel free to reach out and let us know at info@options-insight.com

Cheers!

Imran Lakha

Options Insight