I’ve made it my mission to help you complement your directional strategies with options.

Why options?

To better manage your trades for max profitability & mitigation of risk, just like the PROs.

Let’s dig in☟

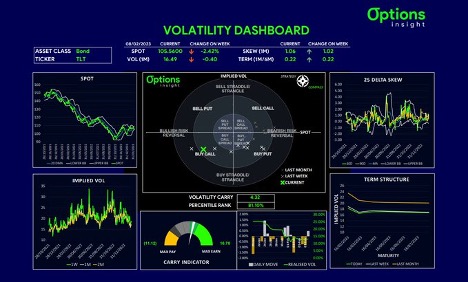

My vol dashboard, an instrumental part of my workflow, shows that buy calls in long-dated bonds is the optimal trade right now.

Have you been keeping an eye on the US yield curve inversion?

I’ve made it my mission to help you complement your directional strategies with options.

Why options?

To better manage your trades for max profitability & mitigation of risk, just like the PROs.

Let’s dig in☟

My vol dashboard, an instrumental part of my workflow, shows that buy calls in long-dated bonds is the optimal trade right now.

Have you been keeping an eye on the US yield curve inversion?

I’ve made it my mission to help you complement your directional strategies with options.

Why options?

To better manage your trades for max profitability & mitigation of risk, just like the PROs.

Let’s dig in☟

My vol dashboard, an instrumental part of my workflow, shows that buy calls in long-dated bonds is the optimal trade right now.

Have you been keeping an eye on the US yield curve inversion?

The implied vols are cheap compared to recent history, and the spot has had a correction from the highs.

That’s why I prefer longer-dated call spreads

While the bond market is unpredictable, I expect a recession scenario to be priced in by summer.

The positive volatility carry makes short-dated options costly.

However, with a flat skew, call spreads offer attractive returns, and using Jun23 expiry reduces risk

The implied vol exposure shouldn’t be too risky even if bonds don’t rally immediately

Besides, the position I am taking has a risk/reward ratio of 4/1, making it a great way to be long on bonds using options and limiting your risk.

Want to learn more about how you can also maximize your trading strategies with call spreads?

Comments below and let me know if you appreciate this info and want to find out more about how I can help you!

If you want these types of daily insights, go take advantage of our free 1-month offer at https://options-insight.com. Just enter RV2023 at checkout.

For a more thorough educational experience, join our 3-tier course with

@spotgamma https://academy.spotgamma.com and learn how to use options to trade bonds and any other asset like a pro!

#BondTrading #CallSpreads #OptionsTrading #InvestingTips