As the highly anticipated ETH upgrade approaches, crypto options market is buzzing with activity

But what does this mean for investors and traders alike?

Find out in this week’s Crypto Roundup ☟

↓

↓

➠ Realized Vol

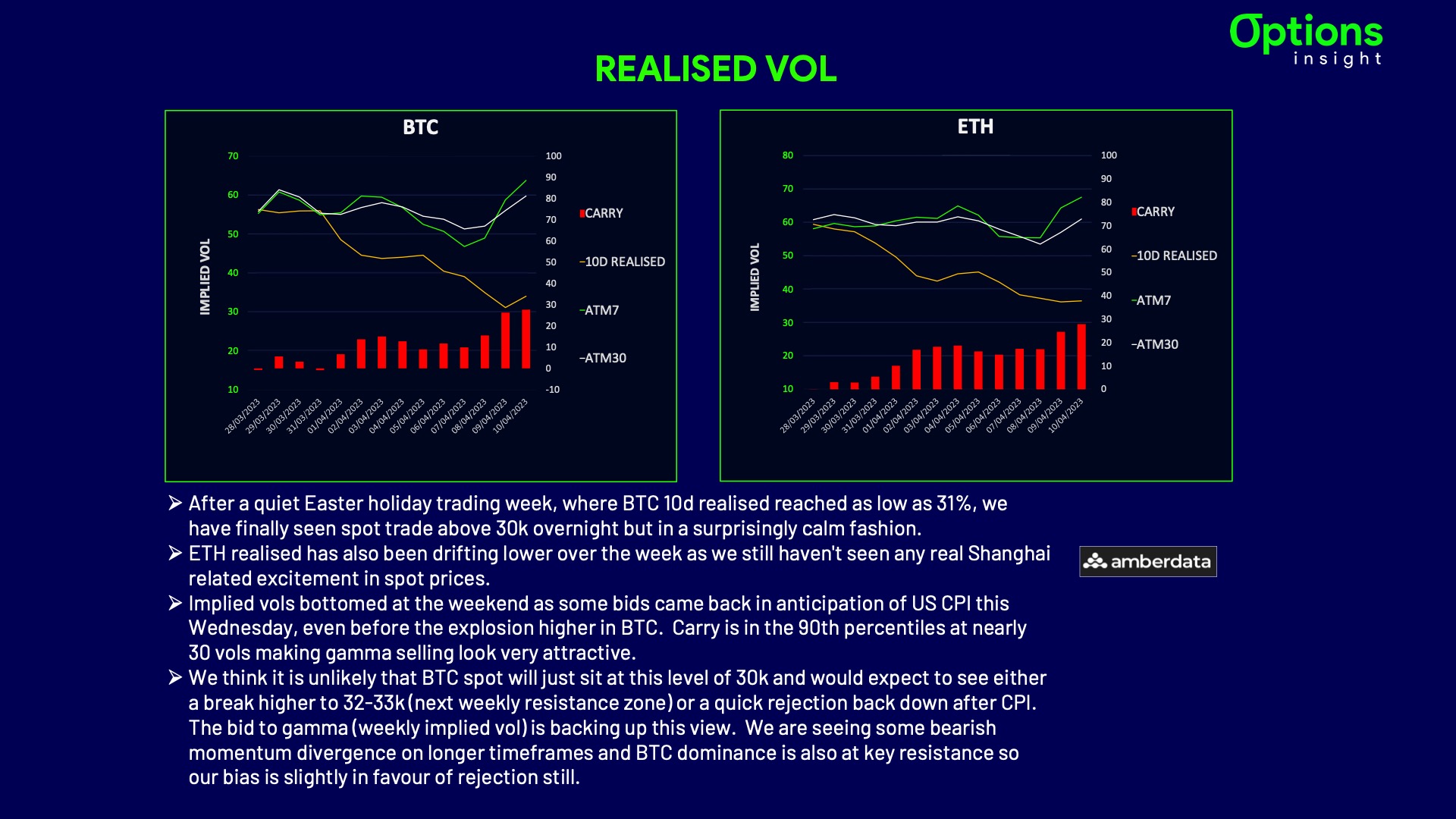

σ After a quiet Easter, where BTC 10d realized hit as low as 31%, we have seen spot trade > 30k but in an unsurprisingly calm fashion.

ETH realized has also been drifting lower over the week.

We still haven’t seen any real Shanghai-related excitement in ETH spot prices.

↓

↓

➠ Implied Vol

σ Implied vols bottomed at the weekend as some bids came back in anticipation of US CPI on Wed.

Carry is in the 90th percentile at nearly 30 vols, making gamma selling look very attractive.

We think it’s unlikely that BTC spot will sit at this level of ≈30k.

Expect either a break to 32-33k or a quick rejection back down as markets continue to digest today’s US CPI print.

↓

↓

☞ Is gamma (weekly implied vol) backing up this view???

Find out more in this week’s Crypto Options Weekly note to subs ☜

↓

↓

➠ Term Structure

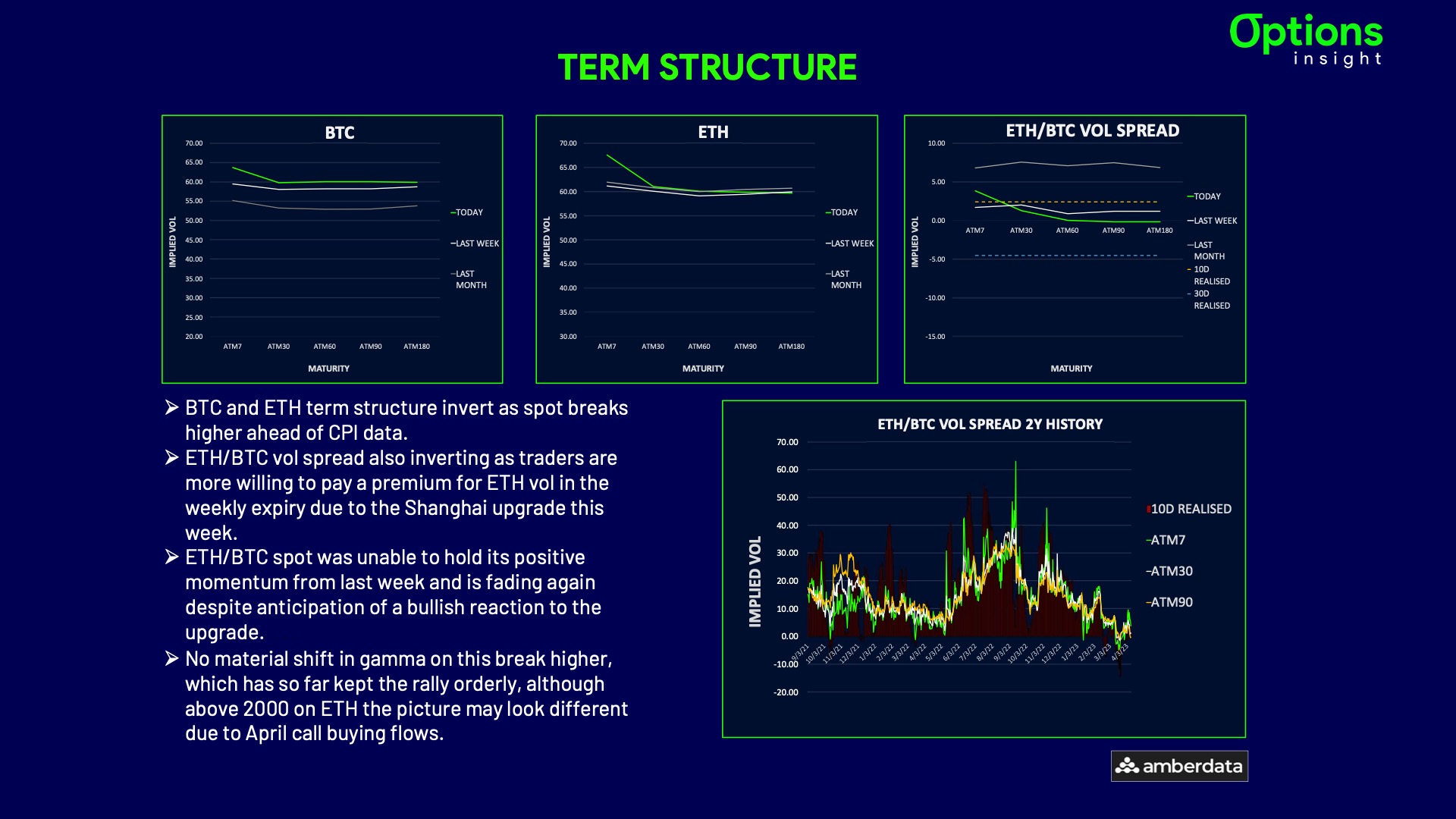

σ BTC and ETH term structure invert as spot breaks higher ahead of CPI data.

ETH/BTC vol spread also inverting as traders are more willing to pay a premium for ETH vol in the weekly expiry due to Shanghai.

ETH/BTC spot is fading again despite anticipation of a bullish reaction to the upgrade.

↓

↓

➠ Skew

σ Call skew catching a bid again on the break higher above 30k.

BTC front end is leading the move, with weekly skew up to 5 vols for calls and the whole curve firmly back in call premium.

ETH skew also bid for calls, flipping away from Put premium in the last day or so.

With short-dated expiries having the most dramatic moves taking weekly skew to 3 vols for calls.

↓

↓

➠ Options Flows

σ Options volumes dropped last week due to the holiday period.

We have seen more flow come in yesterday as spot took out 30k.

ETH flows were more stable with the Shanghai upgrade scheduled.

Primarily call buying interest, but traders more comfortable buying outright calls.

↓

↓

➠ Gamma Positioning

σ BTC dealer gamma flipped back into negative…

ETH positioning stays more neutral even as call buyers come in to play the upside.

Above 2000 the picture changes…

↓

↓

➠ Crypto Strategy

σ Allowing hedge ratio to increase as crypto rally looks overdone vs. liquidity expectations.

☞ Get more details on our positioning in this week’s Crypto note to subs ☜

↓

↓

➠ Closing Thoughts

σ Positive spot/vol correlation in crypto remains in place as we continue to see new highs, which induce more call buying flows.

If CPI triggers a fade back down in spot due to hot inflation and a hawkish rates market reaction, we expect vols to get sold.

What would be the logic for that sell-off?

Has to do with call dynamics.

Short vol, short delta structures look interesting here.

σ

σ

σ

…that’s a wrap on this week’s Crypto Roundup!

Want more details on the current dynamics in crypto spot and vol mentioned above?

Watch this week’s Crypto Insight video below, right now! Powered by Amberdata

Crypto Insight | April 12, 2023

σ

σ

σ

➠ Ready to continue taking your crypto options education to the next level?

We can help!

We’ll be holding our first Options Trading Bootcamp of the year on April 29-30.

A virtual deep dive into the world of options, with a syllabus & teaching to strengthen your options game no matter your experience level.

Including dedicated time to specifically cover crypto options & crypto options analytics.

There’s no better time to learn how to profit from volatility than right now, and there’s no better place to trade vol than crypto.

We, unfortunately, have a limited amount of attendees allowed on the call at once, so click the link to reserve your seat ASAP.

Q2 2023 OPTIONS TRADING BOOTCAMP

σ

σ

σ

➠ Thank you for making it this far!

Cheers!

Imran Lakha

Options Insight