Understanding how market trends evolve is crucial to identifying the best trading options strategies. Last week, for instance, the markets exhibited an interesting rally where the SPX saw a rise of 2.5%. Interestingly, this upward trend didn’t significantly affect the implied volatility. So, what does this mean for your trading options strategy?

⇩⇩⇩⇩⇩⇩⇩⇩

A Closer Look at Market Dynamics

This recent market behavior contrasts sharply with the action we observed in the lead-up to June OPEX. Dealers, who had short positions on upside calls, were rushing to cover their short gamma exposure as SPX broke through the 4300 mark.

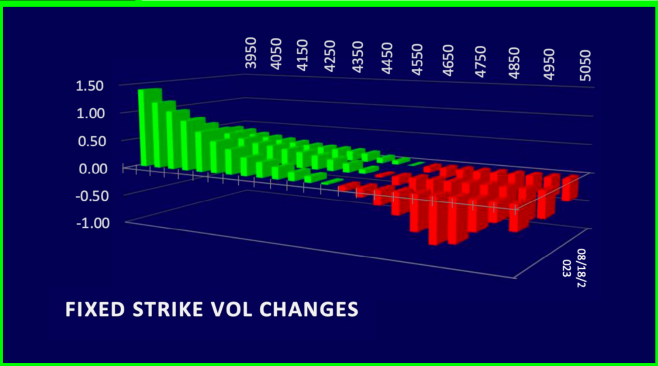

On Friday, we noticed that a substantial gamma had accumulated around the 4500 mark, where the market gravitated back. Looking at the fixed strike vol, it was apparent that dealers were likely long on gamma, and sufficiently supplied on the upside.

Given these dynamics, the possibility of market pinning around these levels into the coming Friday seems quite high. This is a pivotal point to remember when considering the best trading options strategies.

How Earnings Impact Market Behavior

With the earnings season in full swing, traders’ attention is largely on key financial events. High-profile earnings reports are due from major banks like Bank of America and Morgan Stanley, as well as industry giants Tesla and Netflix.

With traders focused more on these earnings announcements and less on macroeconomic data, it’s less likely that SPX will make an outsized move. This suggests a consolidation of recent strength as markets digest the impact of these earnings reports.

This trend is likely to cause a dispersion in stocks, as has been the case recently, with implied correlations dropping to new lows.

Concluding Thoughts

While market fluctuations can be complex, having a grasp on these developments can significantly optimize your trading options strategies. Remember, timing is key and keeping abreast with earnings reports and market volatility can give you a competitive edge.

Understanding and applying these insights can help traders uncover the best trading options strategies. And while the market’s future movements can never be predicted with certainty, being aware of these trends can better prepare you for whatever comes next.

So whether you’re just beginning your trading journey or looking to refine your approach, keep these market insights in mind to help inform your decisions and strategize more effectively.

If you want to start your journey in learning how to master simple options trading strategies straight from a 20+ year veteran, start your Free 1-Month Subscription to Options Insight right now!

Just click the link below!

1 FREE MONTH TO OPTIONS INSIGHT!

σ

σ

Thank you for making it this far!

As always, if you have any questions, comments, and/or found this helpful, feel free to reach out and let us know at info@options-insight.com

Cheers!

Imran Lakha

Options Insight