As we approach June’s D-day for debt ceiling negotiations, SPX’s performance appears to mirror 2011.

And though another meeting is scheduled today, political wrangling likely prevents any progress.

Let’s explore ☟

↓

↓

➠ DEBT CEILING DEADLOCK: 2011 VS 2023

σ While few believe the US will default, investors remain cautious of risk assets.

Remember – 2011’s US debt downgrade led to a subsequent 15% SPX loss in just two weeks!

↓

↓

➠ PESSIMISM RISES & SKEW ELEVATES

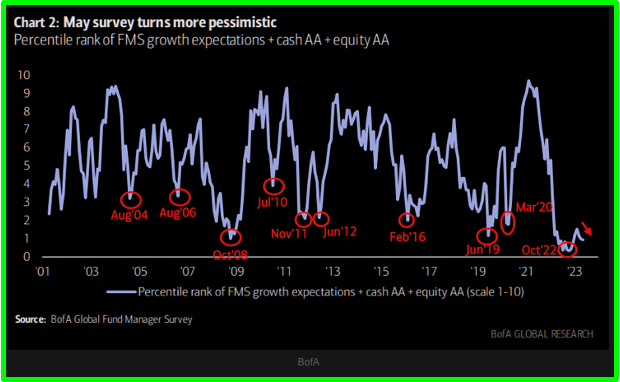

σ A recent @BankofAmerica survey reveals pessimism has risen in May.

But not as dire as levels seen last October.

US indices’ and VVIX’s elevated skew illustrate investors are reaching for downside tail protection.

But has anyone considered hedging the right tail if negotiations succeed and animal spirits return?

↓

↓

➠ TECH OPPORTUNITIES AMID NARROW LEADERSHIP

σ Currently, tech appears to be the only thriving sector.

Albeit, with limited leadership concentrated in a select few names.

But if the tech surge broadens, opportunities may still abound!

So, keep an eye on these developments in the coming weeks, and make sure you stay tuned Into what we are seeing across markets and volatility.

σ

σ

σ

➠ Get more color on this in the attached clip from today’s Macro Options Spotlight

➠ Watch today’s full Spotlight video below ↴

Debt Ceiling Fears & ARKK’s Next Wave? | Market Analysis & Opportunities | Macro Options Spotlight | May 16, 2023

σ

σ

σ

➠ Our Spotlight videos on YouTube only give you a part of our daily research.

And we often leave out the juiciest details, like trade ideas.

But, right now, you can get ALL of our research for completely free by using the code RV2023 at checkout.

➠ Just you the link below, select your product of choice, navigate to check out, and enter RV2023 ↴

1 FREE MONTH TO OPTIONS INSIGHT!

Then you’ll be all set for an entire month of free macro research and trade ideas sent directly to your inbox.

σ

σ

σ

Thank you for making it this far.

Please share this with any investors and/or traders in your life looking to successfully manage their money through all of this debt ceiling drama!

Cheers!

Imran Lakha

Options Insight