Let’s dive deeper into understanding the current market scenario and the importance of strategic trading.

The Current State of the Stock Market

The stock market experienced an explosive upswing into July, indicating the establishment of an uptrend. This rise was further reinforced by favorable data on growth and inflation, suggesting a balanced economic scenario, often referred to as the ‘Goldilocks’ situation.

However, the optimism was slightly derailed when there was a noticeable break below the 50-day Moving Average on the S&P 500.

Further concerns arose as the index threatened to dip below the 4400 mark. Why is this concerning? Simply put, if it does breach this level, many Commodity Trading Advisors (CTAs) might find themselves in a position where they need to stop out of their long exposure, jeopardizing the bullish sentiment.

The Bond Market’s Influence

The rising yields in the bond market have added another layer of complexity to the stock market’s trajectory. While this has caused some pause in the stock rally, intraday price action in bonds has shown a potential reversal. A decrease in yields could be on the horizon, marking a possible interim peak. Should this transpire, it might prove advantageous for stocks, with the technology sector reaping the most benefits.

The Road Ahead for Equities

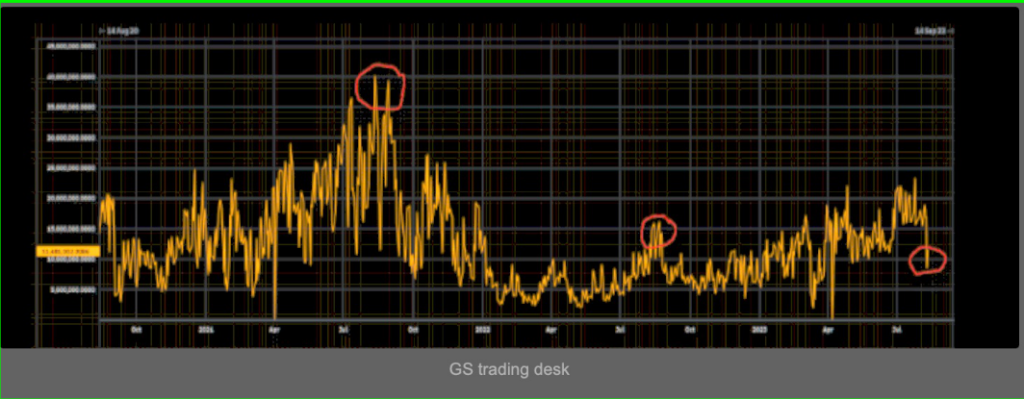

Despite the tumultuous tides, there’s a prevalent sentiment that equity markets will likely witness higher levels in the forthcoming months. However, with the liquidity at the top of the book dwindling by an alarming 50% since the end of July, there’s a looming question: Can the markets efficiently handle systematic selling if it emerges?

The Best Trading Options Strategies

In this volatile environment, the key lies in being agile. Traders are advised to:

- Opt for Cheap Optionality: This involves capitalizing on relatively low-cost options to own the upside in assets that continue to honor the ongoing uptrend.

- Go for Longer Maturities: Longer maturities offer the advantage of holding onto a position without the fear of getting stopped out by short-term volatility.

Final Thoughts

In summary, while the markets might seem daunting currently, the correct strategic approach can not only help traders navigate but also potentially benefit from the situation. Keeping abreast of the best trading options strategies and understanding the nuanced relationship between bonds and equities can make all the difference.

In the trading realm, knowledge, strategy, and timing are paramount. Stay nimble, be well-informed, and always look out for the best trading options strategies to maximize your returns.

For more insights into the best trading options strategies and how to stay ahead of the curve, subscribe to our newsletter and follow our blog for regular updates. Happy trading!

Psst, if you want to start your journey in learning how to master simple options trading strategies straight from a 20+ year veteran, start your Free 1-Month Subscription to Options Insight right now!

Just click the link below!

1 FREE MONTH TO OPTIONS INSIGHT!

σ

σ

Thank you for making it this far!

As always, if you have any questions, comments, and/or found this helpful, feel free to reach out and let us know at info@options-insight.com

Cheers!

Imran Lakha

Options Insight