☞ Please enjoy this peak at some of the research you can get directly to your inbox with our Macro Options Daily.

☞ Click here for your Free 1-Month Trial to Options Insight! Just enter RV2023 at checkout

——————————————————————————————————————

Last week, we saw the market push to new highs for the year, only to see spot prices fade after the quad witching June options expiry rolled off.

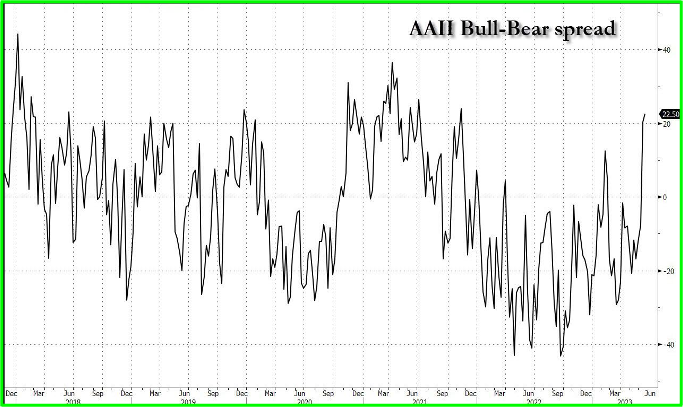

Despite this, the sentiment in the market has flipped into bullish or greed, and this feels like a precarious spot to be long.

As we move forward, we suspect that gravity needs to pull the market back to near 4300 at least – and suck some bears back in before we can rally again.

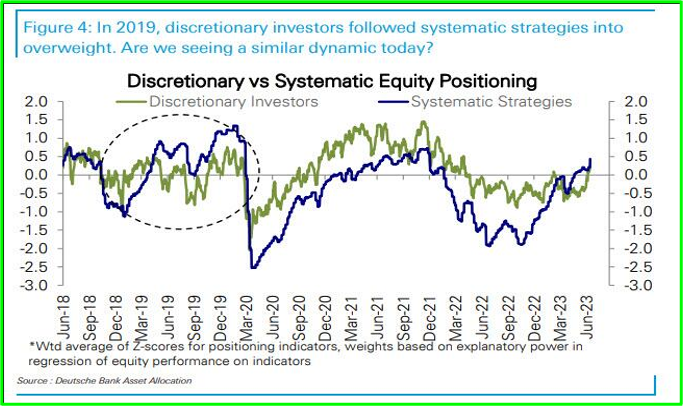

The systematic community has been getting longer all year, and in the last month, discretionary positioning has shot up as well.

This is probably because discretionary managers couldn’t take the pain of not participating any longer, rather than any material change in view.

Although the AI growth story may have improved the outlook, those names aren’t exactly cheap at these prices.

As traders, we need to be prepared to navigate through volatile markets.

Get the full picture on this turn in sentiment by watching today’s installment of Options Insight’s YouTube series – Master the Art of Trading ↴

Bullish Sentiment & Best Options Trading Strategies for an HYG Breakout | Master the Art of Trading Options | June 20, 2023

——————————————————————————————————————

To take advantage of the current bullish sentiment, we can explore different strategies that can help us capitalize while protecting our portfolio in the event of a market downturn.

Some of the best trading options strategies that can help in this situation are:

1. Long Call Options Strategy

This strategy is best suited for traders who want to benefit from the upside potential of a stock. A long call option gives traders the right but not the obligation to buy the underlying asset at a predetermined price (strike price) within a specific time frame. If the stock price goes up, the call’s value also goes up, resulting in profits for the trader. However, if the stock price goes down, the trader loses the premium paid for the option.

2. Bear Put Spread Strategy

This strategy is suitable for traders who are skeptical about the market’s current bullish sentiment and are looking for ways to hedge their positions. A bear put spread involves buying a put option with a higher strike price and selling a put option with a lower strike price. The trader profits if the underlying asset’s price goes down, but the losses are limited if the price goes up.

3. Straddle Strategy

The straddle strategy is best suited for traders who expect high market volatility but are uncertain about the direction of the price movement. It involves buying both a call and a put option on the same underlying asset with the same strike price and expiration date. This will profit if the price moves drastically in either direction while limiting the losses if the price remains stable.

As traders, it’s important to have a thorough understanding of the different trading options strategies to make informed decisions.

With the right strategies in place, we can navigate through the current bullish market sentiment while protecting our portfolio from any potential downturn.

If you want to start your journey in learning how to master these options trading strategies straight from a 20+ year veteran, start your Free 1-Month Subscription to Options Insight right now!

Just click the link below, then enter code RV2023 at checkout↴

1 FREE MONTH TO OPTIONS INSIGHT!

σ

σ

Thank you for making it this far!

As always, if you have any questions, comments, and/or found this helpful, feel free to reach out and let us know at info@options-insight.com

Cheers!

Imran Lakha

Options Insight