This post is a selection of insights from my reports to subscribers this week, showcasing how I build the contextual framework to find daily trade ideas. This is a repeatable process aimed at finding high-risk-reward trades. Note that the onus is on the subscriber to pick and choose which trades fit their overall risk.

In this week’s blog post, I explored various trade ideas across multiple asset classes, focusing on Gold, the VIX, Tesla, and the USD/JPY. Observing the recent Gold sell-off and subsequent rebound, I saw potential in longer-dated upside exposures. With CTAs exhibiting the most short US equities since 2015, my strategy leaned towards avoiding short positions, given the historic end-of-year rallies in stocks. Tesla’s persistent downtrend and an unconvincing fundamental outlook led me to explore put options ahead of its earnings release. Lastly, Japan’s attempts to manage USD/JPY volatility amidst policy tweaks presented an intriguing case for owning some cheap JPY vol.

For a deeper dive into how I structure my trade ideas and to learn my thorough process, join our next Free Options Trading Webinar.

I started the week by taking note of the recent sell-off in Gold, which led to the asset reaching a strong weekly support area near 1800 on spot. We saw a strong reaction from that level, in part helped by the geopolitical tensions due to Hamas attacking Israel.

Snapshot of Gold chart:

Real yields exploding higher in recent weeks along with the dollar has not helped the case for a higher Gold either. However, if these macro factors can be reversed, then I thought Gold had the potential to recover strongly.

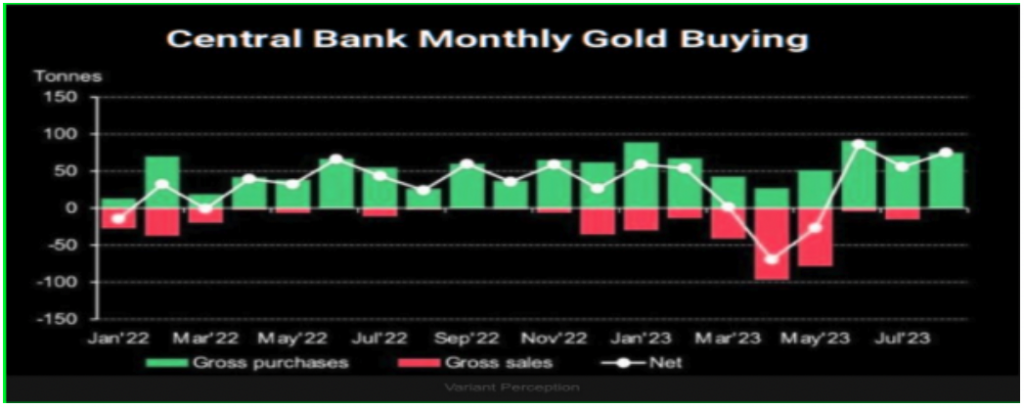

In general, central banks continue to accumulate, and with the latest hot jobs print unable to move rate hike odds materially, the outlook for Gold next year is improving, assuming the rate hiking cycle is done.

This is what led me to think owning longer-dated upside exposures was sensible.

Snapshot of Central Bank Gold Buying:

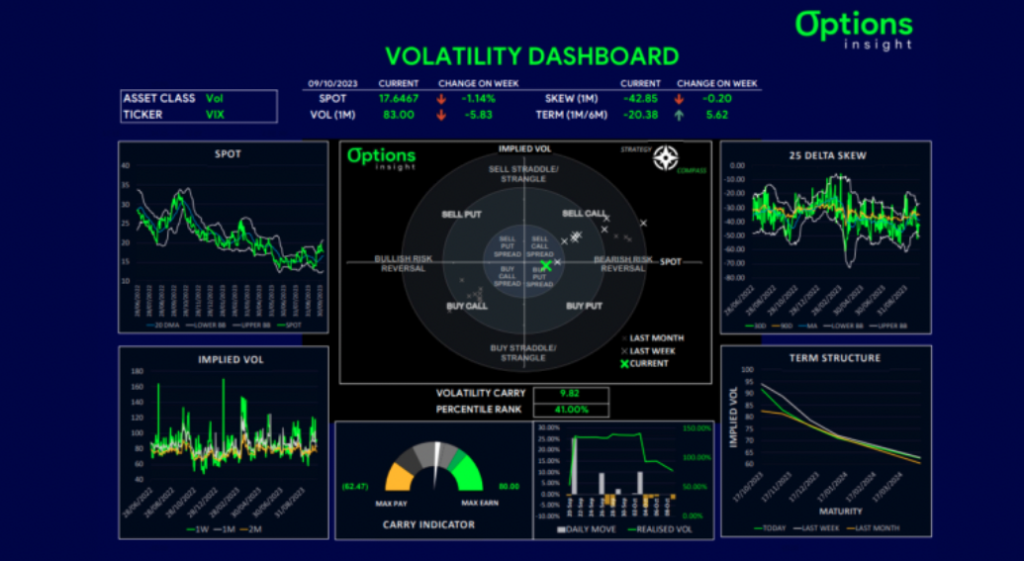

Our vol dashboard on GLD showed that implied vol was more elevated after spot prices broke down. With volatility carry still positive, I didn’t like rushing in to buy short-dated calls. However, long-dated vol was only up 2 vols, so that’s where I placed the focus to come up with the idea for our subscribers.

Snapshot of $GLD Vol Dashboard:

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar

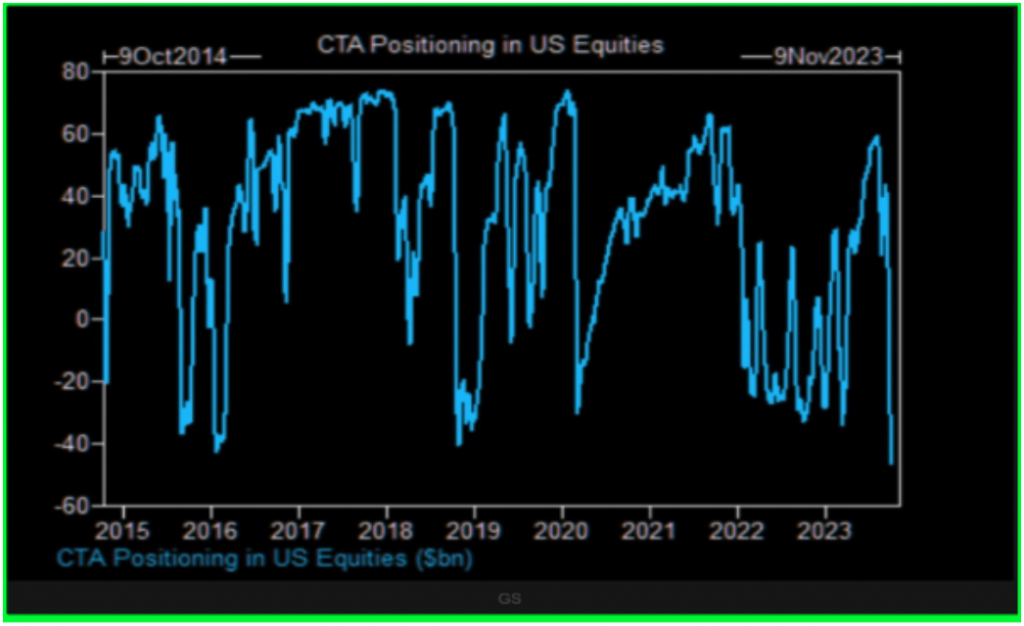

With so much of the marginal day-to-day flows being dictated by algos and systematic type investors, it has become increasingly important to follow what these players are doing. I took notice of the latest data by Goldman Sachs, revealing that CTAs had sold $88Bn in the last 2 weeks and were the most short US equities since 2015.

This only reinforced our cautious stance against being short, at least. Especially as this potentially large short positioning converges with a period of very bullish seasonality for stocks, where typically, the market rallies 4-5% into year-end from mid-October.

I, therefore, thought the setup was clearly there for a short squeeze.

Snapshot of CTA Positioning:

Snapshot of $SPY Seasonality:

I also anticipated in Tuesday’s note that just as VIX seasonality guided us to go long in mid-September, was now turning bearish and suggestive that vol is headed lower into year-end. This also lines up with the idea that investors have de-risked in the correction and will need to chase markets higher, should earnings season and the end of FED rate hikes provide bullish catalysts.

So far this year, keeping it simple, trading seasonality and fading bearish consensus have worked out well, we see no reason to change tactics.

Our vol dashboard on VIX showed that vol of vol had been falling along with VIX spot, so options on VIX are getting cheaper from a VEGA perspective. While I didn’t have the conviction that VIX would drop below 15 but Oct23 expiry (even though it could), further out and heading into Thanksgiving, I saw it much more likely. The idea I presented to subs could easily triple in value if VIX starts to get hit again.

Snapshot of $VIX Vol Dashboard:

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar

I decided to make the trade idea in $TSLA public on YouTube. In a nutshell, I thought that with TSLA’s downtrend still intact, there is merit in owning puts heading into next week’s earnings. There are lots of open calls that are expiring in the next two weeks which will decay, especially after earnings so in-line numbers could still see a sell off. Fundamentally, it’s not looking that rosy for TSSLA either.

Trade Idea on $TSLA in YouTube:

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar

Since the BoJ tweaked their YCC policy cap on 10Y yields to 1.00%, we have seen a managed move higher, with current levels around 0.75%. This was expected to be very Yen bullish, but the explosion higher in US yields has prevented USDJPY from selling off and in fact it has rallied up to levels where the MoF have threatened to intervene.

Overall, Japanese officials are fighting against volatility on two fronts, and I wonder how long they can keep it up. For this reason, I think that owning some cheap JPY vol may have some merit. Our volatility dashboard shows that USDJPY implied vol has been falling down towards its lows as realised vol has been dampened.

Snapshot of $JPY Vol Dashboard:

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar

As the mini-flash crash in USDJPY from 150 to near 147 may have cleaned out some resting orders, I think that a break above 150 could get interesting, and so there is potential for volatility in either direction. As usual, to find out about the trade idea, give my service I try.

Remember, not only do I share these trade ideas, but the ones I end up adding to my portfolio, are then tracked via a 20-30m weekly webcast that gives in-depth guidance. In it, you get to learn how to break down options trades by their Greeks and restructure trades in an optimal way to meet desired investment goals in real time. This is part of our Macro Options Overlay.

Remember, you now have a chance to build your knowledge base via our FREE Options Insight webinar!

You will learn the process and tools I follow, from thesis to trade idea and actual execution.

This is a unique chance to learn how to master simple options trading strategies straight from a 20+ year career.

σ

σ

Thank you for making it this far!

As always, if you have any questions, comments, and/or found this helpful, feel free to reach out and let us know at info@options-insight.com

Cheers!

Imran Lakha

Options Insight