Imagine discovering sections of the volatility surface that are undervalued, while others seem overpriced.

Both open the door to comparable market opportunities.

That’s the magic of OPTIONS

Ready for some serious education? ☟

↓

↓

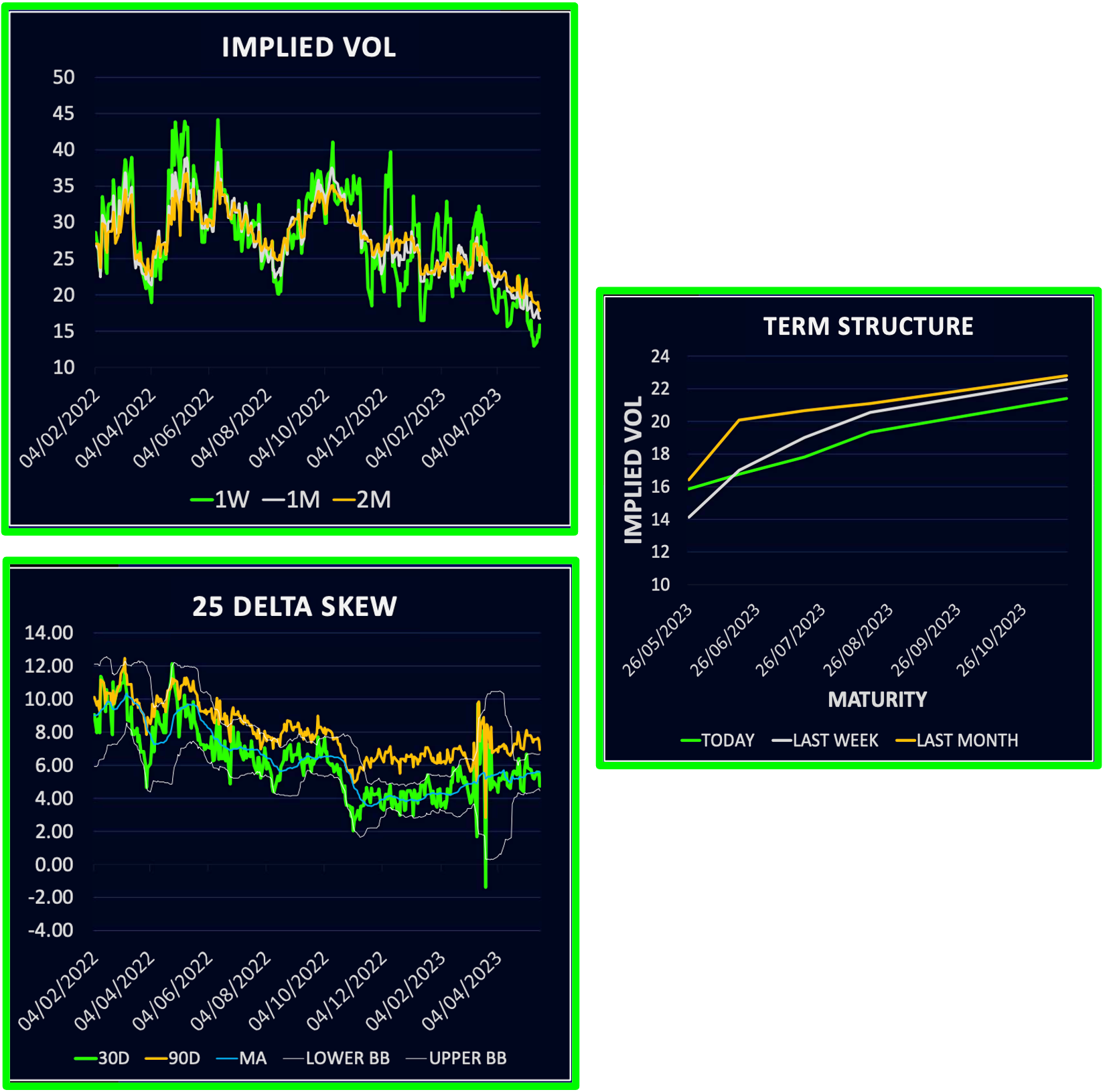

➠ INTRIGUING DISCOVERY IN$NDX VOL DASHBOARD

σ As the AI narrative keeps pushing on, spot prices bounce back dramatically, soaring to heights unseen since last August.

Contrastingly, implied vols — particularly on the front end — experience a slump.

↓

↓

σ What about the term structure?

It tenaciously remains in contango as markets prudently assign risk premiums to longer maturities (typical behavior, folks!).

Though skew has retreated from recent highs, it still stands elevated when compared to where it began the year.

↓

↓

➠ YEARS OF EXPERIENCE = CONTINUAL IDEA GENERATION

σ Drawing from our rich legacy in trading volatility, we perennially seek strategies that articulate our market views proficiently.

While also optimizing for risk/reward dynamics.

This time, the current state of the vol surface compels us to…

☞ Own short-dated puts while selling medium-term puts.

Giving us exposure to possible market corrections.

What’s even better?

We’re also prepared to benefit from a booming market rally if it unfolds.

So, what comes next in the implementation process?

↓

↓

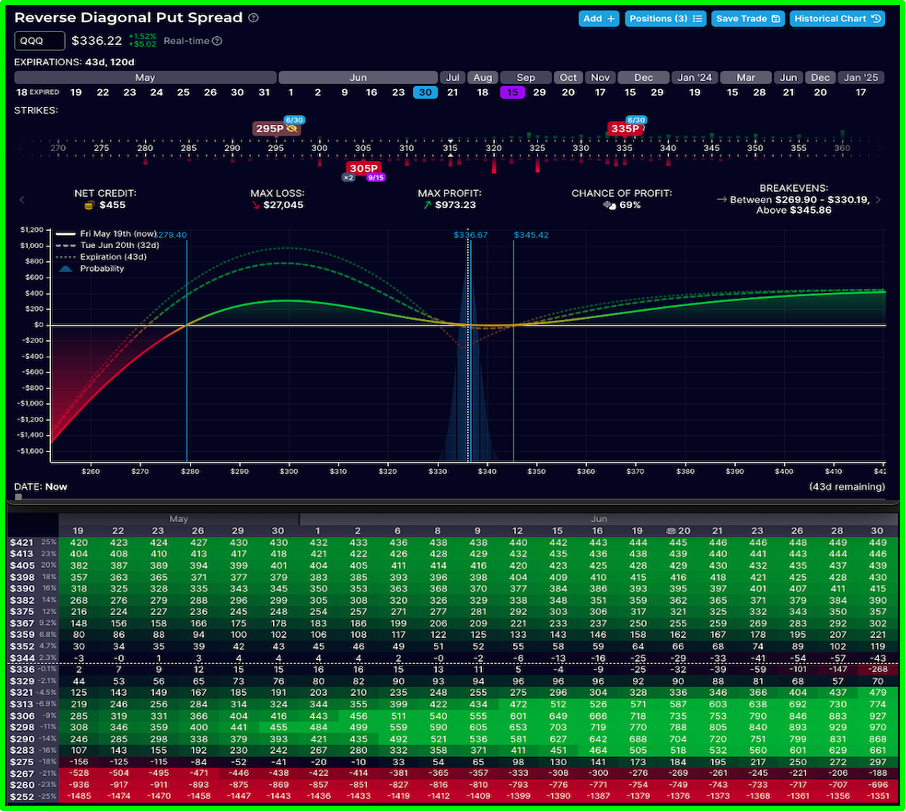

➠ SCENARIO ANALYSIS: TRUSTWORTHY GUIDE

σ When constructing options trades, scenario analysis is VITAL…

Visualizing different potential outcomes helps to identify a risk profile that aligns with your comfort level as various market scenarios play out and over time.

For example:

☞ Buying QQQ 30Jun23 335 Puts and selling twice the 15Sep23 305 Puts might have a high likelihood of profit…

BUT BEWARE:

The downside tail looks menacing

What’s the next?

↓

↓

➠ PLUGGING LEAKS, ACHIEVING PROFITS

σ Developing options trades is similar to repairing a leaky water system:

• Identify potential weaknesses

• Understand their impact

• Seal them efficiently to prevent unwanted losses.

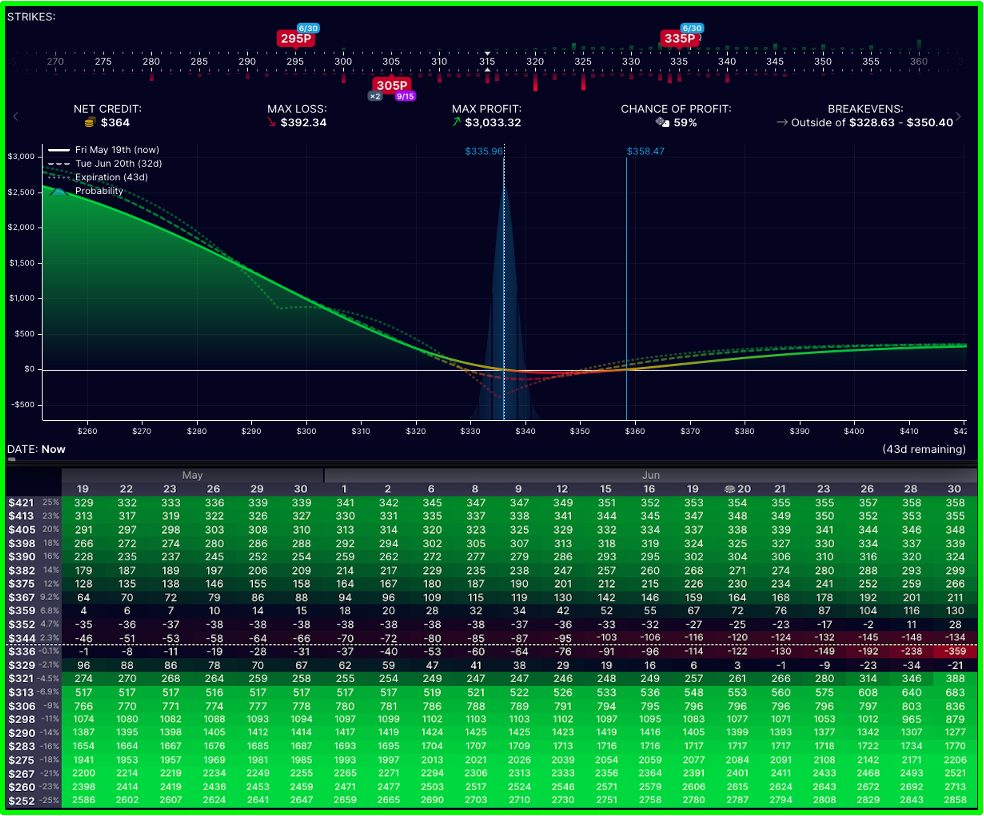

Now, let’s investigate the structure of our trade idea.

↓

↓

σ Purchasing QQQ 30Jun23 335 Puts & offloading 2x 15Sep23 305 Puts.

It promises a high probability of profit – but the downside tail can be disastrous.

But there’s a solution to this!

Secure the trade by buying 30Jun23 295 Puts for under a dollar.

This acts as your safety measure and significantly enhances your risk profile.

↓

↓

➠ THE UNHINDERED PIPE

Throughout the trade…

We act as vigilant “plumbers”

Managing a trade on the same way we would maintain an intricate plumbing system.

The initial setup might be impeccable, with water (the idea/PnL) flowing effortlessly through well-placed pipes (strikes).

But this is no set-&-forget type of task.

Similar to a responsible plumber who frequently reviews the system to adjust valves, secure connections, or unclog pipes for sustained performance.

We continuously monitor market conditions, modify positions, and patch up any leaks in the risk profile.

The secret lies in finding the perfect harmony and structure.

Sealing any gaps as needed, to maintain a smooth free flow of profits.

↓

↓

Time to suit up, financial plumbers!

Put on your trading helmets, and let’s prevent leaks from sinking our financial ship

We are thrilled to be your captain & navigator, steering you skillfully through the market’s ever-changing tides.

σ

σ

σ

➠ By the way, don’t forget…

Right now, you can access ALL our research and trades FREE by using the code RV2023 at checkout.

➠ Just click the link below, select your preferred product, navigate to checkout, and enter RV2023 ↴

1 FREE MONTH TO OPTIONS INSIGHT!

You’ll then be set for a full month of FREE macro research and trade ideas sent directly to your inbox.

σ

σ

σ

Thanks for making it this far.

Please share this with anyone you know that is curious about volatility and options!

Cheers!

Imran Lakha

Options Insight