This post is a selection of insights from my reports to subscribers this week, showcasing how I build the contextual framework to find daily trade ideas. This is a repeatable process aimed at finding high-risk-reward trades. Note that the onus is on the subscriber to pick and choose which trades fit their overall risk.

SPX Short Gamma Is Back

I started the week warning subscribers that a CTA flush out could easily get us down to 4.3k in the SP500 this week. The US government shutdown that is looming should keep investors concerned and so it was unlikely that we get a material rally until that is resolved.

Snapshot of $SP500 on Sept 28th:

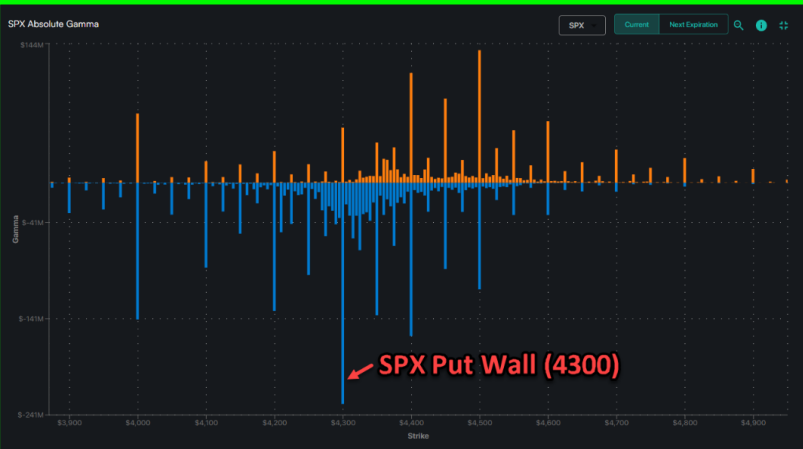

The downside vol in the SPX early in the week was a likely scenario given gamma positioning as shown by Spotgamma’s put wall at 4300, but with the JPM 29Sep “Long 4210 Put” also in the mix, creating more gamma, which helped fuel the downside momentum.

Once Friday’s expiry rolls off, this should have a calming impact on markets as fresh 3-month VEGA will be supplied courtesy of the roll of the JPM position into 29Dec. My plan, well telegraphed to subs, is looking to get out of long vol positions into any spike in vol.

Snapshot of the $SpotGamma put wall:

Despite my short-term bearish view this week, I am confident this may be a great set up to get long for a year-end rally to new highs in stocks. Timing-wise, I think the market may need a couple more weeks, and so-call calendars are an interesting way to start positioning now. This structure would make us take advantage of the shift higher in front-end vols, which will inevitably fall back down if spot rallies.

Snapshot of the trade idea on $SPY:

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar

Correlations on the Rise

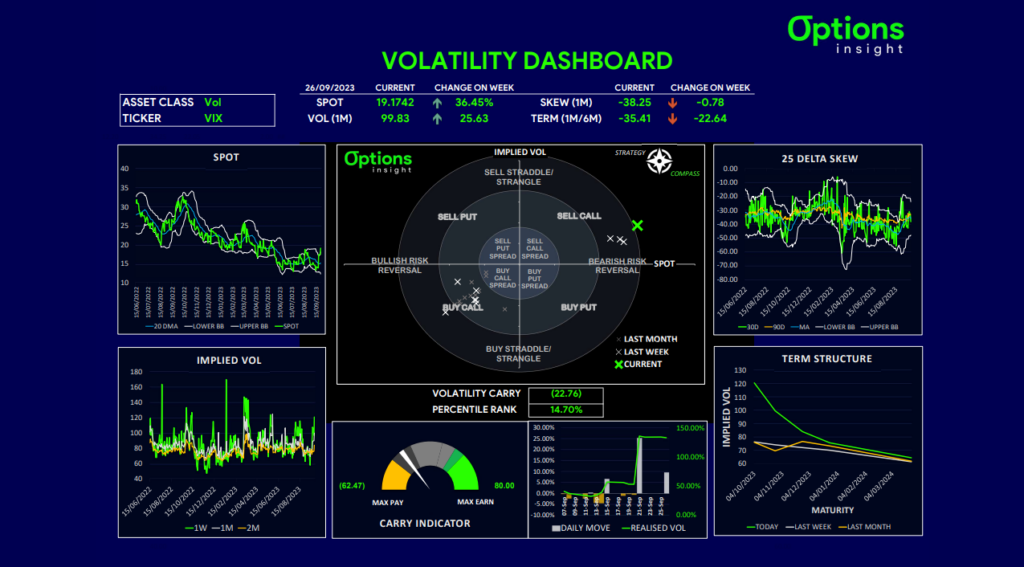

As the equity market sell-off continued into Wednesday, I started to see a few signs that things may be getting close to a crescendo. The VIX spiked up towards 20, with material repricings in skew and implied correlations bouncing hard from recent lows.

While there could still be some room to go, certainly on the correlation front. With many hedge funds having mandates to specifically sell correlation, we may be experiencing an unwind as some of these positions get tested.

Realised correlation also increased, which can be seen by breadth indicators turning south and reaching range lows that have historically coincided with local market bottoms. All these factors are lining up to suggest that the correction we are currently undergoing may be reaching its conclusion soon, and as a result, I sent a note to subs giving a heads up to taking profits on bearish, long-vol positions

Snapshot of $SP500 names and their 3M correlation:

The VIX Spike Materialized

After 15Sep monthly OPEX, we had said that the gamma unpinning of the market might lead to a more bearish tone, as higher yields dragged down stocks which long gamma positions had artificially held up. We were looking for a 20-30 increase in VIX, which is in line with seasonality, and this played out to perfection. VIX hit the top of the range on Wed and has now done enough for us to start looking for ways to play the inevitable move back down. This is what, in financial markets jargon is referred to as the VIX gravity!

Snapshot of $VIX on Sep 27th:

I, therefore, sent out a trade idea on the $VIX that would take advantage of a correction back down but without selling calls, which is far too dangerous and would require a huge margin. Also, with vol of vol so high, I didn’t like buying puts on VIX outright either.

The way I like to position for a VIX normalisation is via put calendars. Looking at the VIX dashboard, I noticed the term structure was very inverted so buying Oct23 puts looked expensive.

I was also not 100% convinced that October would give enough time for the market to get back to risk on for vols to return to the lows end of the range. Hence, I went further out. This trade also works as a fantastic hedge to a bearish or underweight book.

Snapshot of the trade idea on $VIX:

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar

Safely Fade The Vol Spike via VXX

On the back of the VIX trade idea (see above), another way I came up to express the view of a local top in the VIX vol spike was through the VXX ETN. This is a nice alternative to the VIX put calendar I pitched in for those who can’t trade options on futures.

I now expect VXX gravity to kick in too. These spikes, as shown in the chart below, tend to reverse quickly after completion. To retrace a 20-30% move higher in VXX normally takes a good 1-2 weeks from when vol tops out. I think that by late Oct, VXX could be back below 20.

Snapshot of $VXX:

The question is, with vol of vol spiking so much, how do you efficiently play a vol reset lower without paying too much premium?

The trouble with buying puts on volatility instruments after a vol spike is that usually, the implied vol of these options has also spiked significantly. So, the leverage that you get doesn’t look great. A way to play the downside in vol that is inevitable once this current bout of market weakness is over, is to use broken wing put flys on VXX.

Snapshot of the trade idea on $VXX:

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar

Remember, not only do I share these trade ideas, but the ones I end up adding to my portfolio, are then tracked via a 20-30m weekly webcast that gives in-depth guidance. In it, you get to learn how to break down options trades by their Greeks and restructure trades in an optimal way to meet desired investment goals in real time. This weekly broadcast is part of our Macro Options Overlay.

Find below a taste of it via how I risk-managed carry trades.

And that’s a wrap for this week!

Remember, you now have a chance to build your knowledge base via our FREE Options Insight webinar!

You will learn the process and tools I follow, from thesis to trade idea and actual execution.

This is a unique chance to learn how to master simple options trading strategies straight from a 20+ year career.

Just click the link below!

Free Options Trading Webinar

σ

σ

Thank you for making it this far!

As always, if you have any questions, comments, and/or found this helpful, feel free to reach out and let us know at info@options-insight.com

Cheers!

Imran Lakha

Options Insight