This post is a selection of insights from my reports to subscribers this week, showcasing how I build the contextual framework to find daily trade ideas. This is a repeatable process aimed at finding high-risk-reward trades. Note that the onus is on the subscriber to pick and choose which trades fit their overall risk.

Before delving into the main content, I’d like to emphasize a crucial point that’s echoed in this week’s blog post title: sidestepping falling knives and adopting options as a defensive strategy. Here is the main takeaway: There are numerous avenues to profit from the markets going up without leaving oneself too exposed to the downside. This week’s content stands as a testament to this principle.

I am always in search of a well-balanced, risk-controlled approach to building option structures. Such strategies position us advantageously to reap profits while also providing a safety net in case our theses turn out to be wrong. Moreover, our proactive management of these positions, adapting to market shifts as trades evolve, offers an additional layer of protection, further minimizing portfolio risk.

Time For Mega-cap Tech To Make A Comeback?

To start the week, I mentioned to subscribers that price action last week was encouraging for equity bulls, as a mini mid-week capitulation saw markets rebound from key supports and implied volatility top out near the 20 level on the VIX.

I produced a video (see below) where I laid out the case to load up on your favorite stocks. The fact that the heavyweight tech stocks have cheapened up in this latest yield breakout is providing maybe one final “buy the dip” opportunity for 2023.

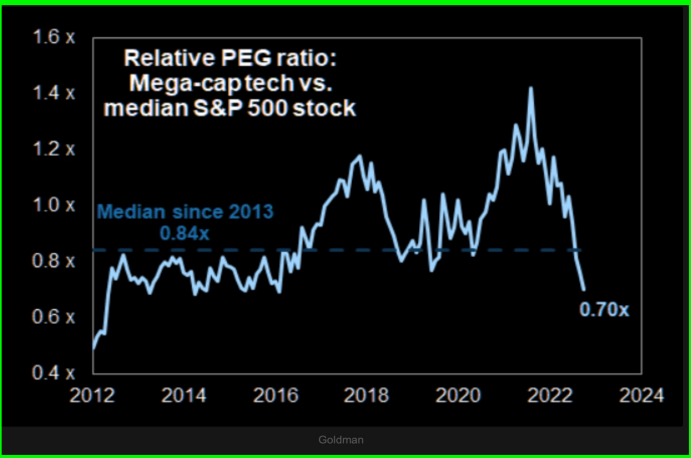

Whilst absolute valuations still look rich, when you adjust them for earnings growth via the PEG ratio, and compare to the median SPX stock. We see that at 0.7, the relative valuations actually appear cheap going back over a decade.

Snapshot of Relative EPG Ratio on Oct 2nd:

If the market latches on to this narrative and starts to chase performance into year end, we think that the SPX has a shot at getting back to the highs and equity positioning has dropped quickly in the last couple of weeks.

Snapshot of $NQ1! on Oct 2nd:

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar

Betting on a Bounce in TLT

The mover lower in Bonds has been aggressive, and after this capitulation, I thought it might be time for a rebound to squeeze the shorts.

This would likely need a catalyst such a weak data (NFP due on Friday,) but we have already seen a moderation in PCE inflation and misses on Chicago PMI. Given how much implied vol has popped in TLT after breaking below 93, I saw at least a few vol point reset if spot can get back up to the new resistance level in a corrective bounce. Note, though, the downtrend in Bonds is very much still intact.

Snapshot of $TLT chart:

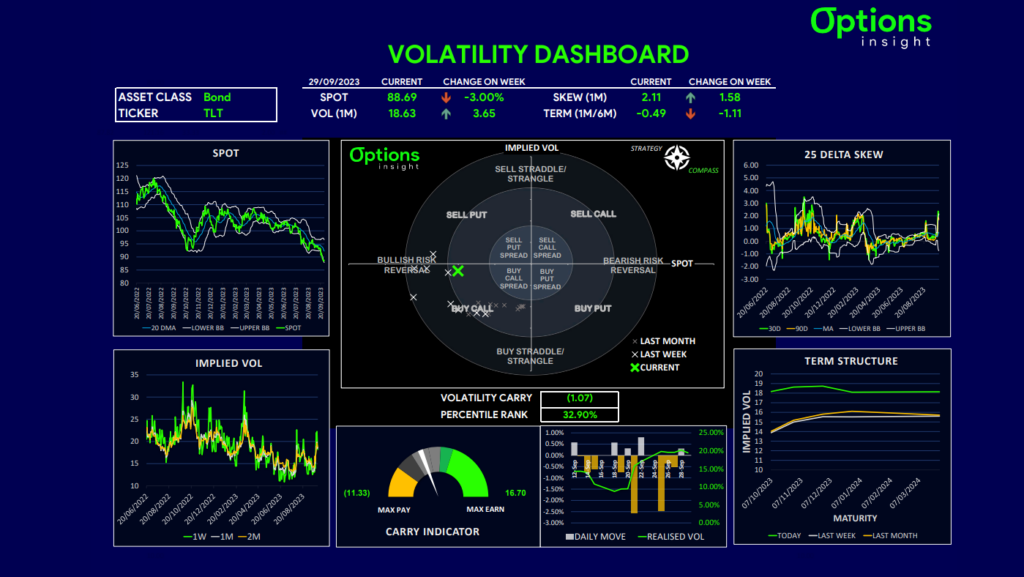

From our TLT dashboard, I observed that bullish risk reversals were screening well as implied vol was back up to mid-range and spot at the low end of the range. Given the potential for yields to go much higher, I didn’t like selling naked downside on TLT. I did however like selling upside VEGA as the term structure has stayed quite flat, meaning GAMMA(front-end maturity) is not trading at a premium to VEGA.

Snapshot of $TLT Vol Dashboard:

Snapshot of the trade idea on $TLT:

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar

Precious Metals Get Trashed

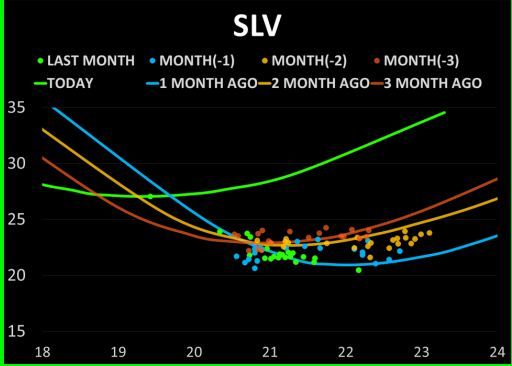

The breakdown in Gold last week triggered a collapse across the metals complex, and Silver, being the high beta asset, has had a dramatic drop. With the daily RSI deeply oversold, I was betting on some sort of technical bounce. Implied vols had reacted positively to the way down, which was the first time in months. This gives a nice opportunity to play a bounce with short upside-vol structures.

Snapshot of $SLV Realized Skew:

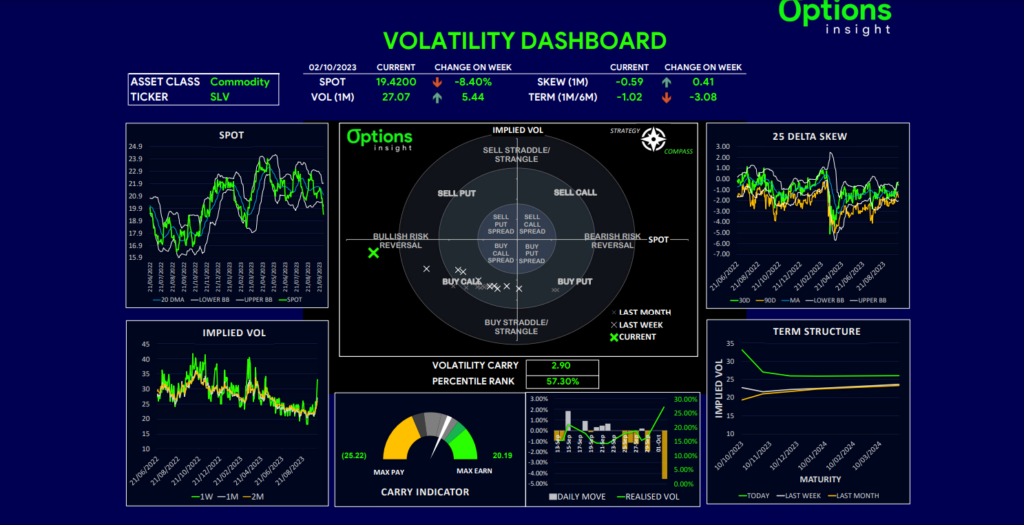

Our vol dashboard on Silver showed bullish risk reversals as the play, by I preferred not to catch a falling knife.

Snapshot of $SLV Vol Dashboard:

Hence, I looked for a way to play a bounce that didn’t involve selling downside. Given the upside skew that still existing in Silver, I liked call ladder structures, as we can structure a position that is neutral DELTA, but gets short VEGA on the upside.

Snapshot of the trade idea on $TLT:

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar

Have Utilities Bottomed Yet?

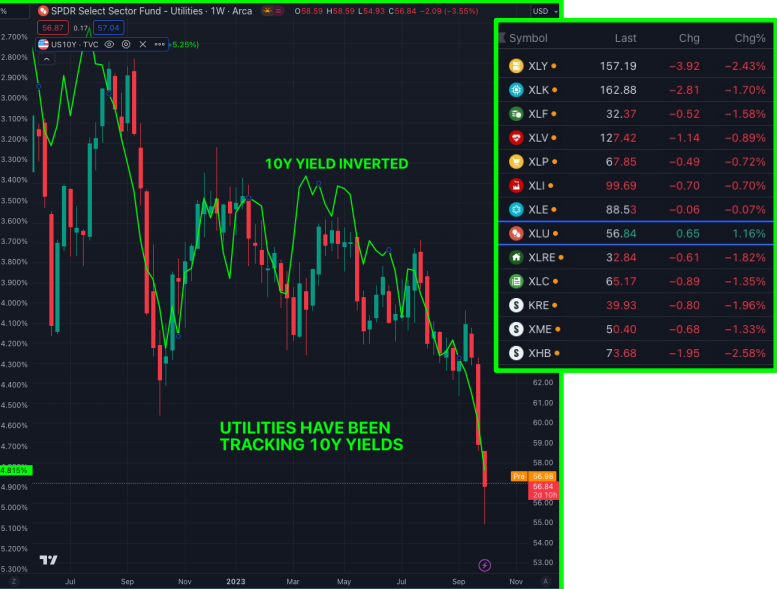

Another sector that caught my attention mid-week was Utilities (XLU). In the last couple of weeks, the moves have been dramatic as the sector has plummeted due to its bond proxy nature. On Tuesday, however, with a sea of red across most sectors, XLU managed to have a green day. This was despite bonds remaining weak ahead of auctions on Thursday.

Snapshot of $XLU chart and sectors watchlist:

Those who are underweight stocks, and want to add defensive exposures may find this sector attractive, especially if they expect the rates move to slow down soon. Given how oversold XLU has become, I thought getting into long-call spreads was the better way to play a bounce.

Snapshot of the trade idea on $XLU:

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar

Time to underwrite Commodities?

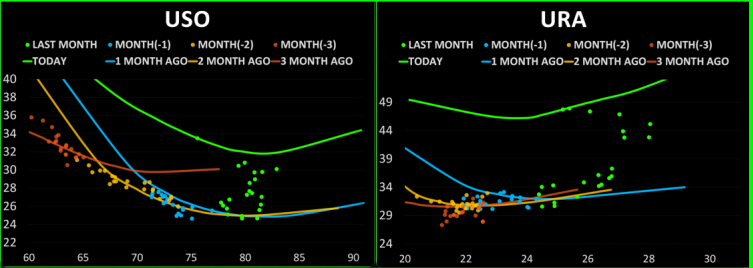

After getting very overbought and sucking in lots of speculative longs, the Oil and Uranium market had a sharp correction. The violent nature of the move has kept vol elevated, with Oil vol up 10 points and Uranium up nearly 20 points in the last month.

When we look back at what these downside strike vols were a couple of months ago, we see how relatively expensive the implied is trading, and this provides opportunity. For investors who missed the rally but want to get into the uptrend, selling OTM puts is an interesting trade.

Snapshot of $USO and $URA Realized Skew:

When selling puts to underwrite an asset, the safest way is to have the entire strike notional available as cash, so that once can take delivery of the shares at expiry if assigned. This way, you can think of the premium collected as a yield that you earn on the cash, whilst waiting to get delivered the desirable asset. Even if you don’t get delivered, you can fresh puts again after you position expires.

Snapshot of the trade idea on $USO and $URA:

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar

Remember, not only do I share these trade ideas, but the ones I end up adding to my portfolio, are then tracked via a 20-30m weekly webcast that gives in-depth guidance. In it, you get to learn how to break down options trades by their Greeks and restructure trades in an optimal way to meet desired investment goals in real time. This weekly broadcast is part of our Macro Options Overlay.

Find below a taste of it via how I risk-managed carry trades.

And that’s a wrap for this week!

Remember, you now have a chance to build your knowledge base via our FREE Options Insight webinar!

You will learn the process and tools I follow, from thesis to trade idea and actual execution.

This is a unique chance to learn how to master simple options trading strategies straight from a 20+ year career.

Just click the link below!

Free Options Trading Webinar

σ

σ

Thank you for making it this far!

As always, if you have any questions, comments, and/or found this helpful, feel free to reach out and let us know at info@options-insight.com

Cheers!

Imran Lakha

Options Insight