This post is a selection of insights from our reports to subscribers this week, showcasing how we build the contextual framework to find daily trade ideas. This is a repeatable process aimed at finding high-risk-reward trades. Note that the onus is on the subscriber to pick and choose which trades fit their overall risk.

In this week’s blog post, as part of the insights and trade ideas shared with subscribers, we delved into a recap of the successful trade in the $AMD stock on the run-up to its earnings, the ridiculous levels of implied correlation on $SPX and how that represents a catastrophe awaiting to happen, and lastly the ETH gamma positioning due to large call overwriters, making it difficult to see a clear breakout short term.

For a deeper dive into how I structure my trade ideas and to learn my thorough process, join our next Free Options Trading Webinar.

$AMD Bearish Bet Plays Out

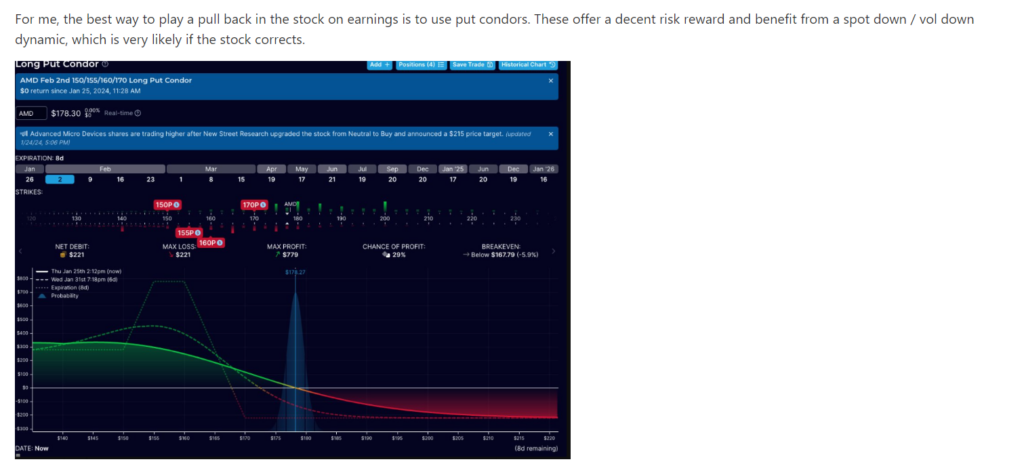

If you followed my trade ideas last week, you’d remember $AMD was on my radar. $AMD had been massively outperforming all the big Semi names since November. Well done if you owned it. However, with earnings (implied move 8.31%) published last Tuesday, we looked at smart ways to hedge the event.

Different ways to play the Semis, particularly $AMD, were discussed with our friends at Spot Gamma. This is what we shared last week:

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar.

Red Flags in the SPX Implied Correlation

The levels of implied correlation on $SPX are getting ridiculous. They are at 20-year lows and there are so many hedge funds on this crowded dispersion trade.

The amount of PNL destruction that would occur if SPX index vol found a reason to catch a bid is immense. I remember seeing dispersion traders having huge PNL swings in 2005-2015 when index vols didn’t just go down perpetually. Clearly a pain trade out there!

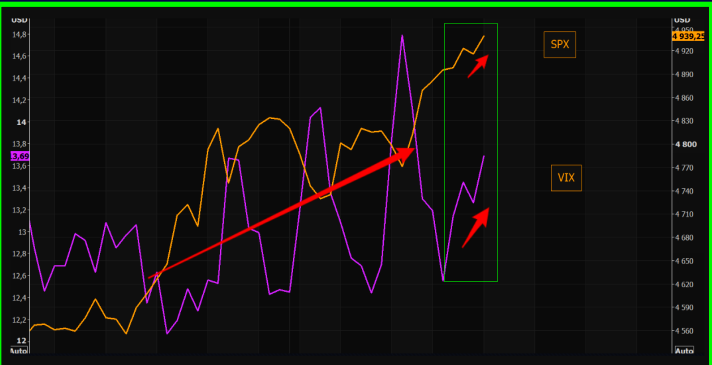

Besides, big tech earnings so far have been disappointing, and the the Goldilocks/Soft Landing narrative is fast becoming consensus. We have also observed some interesting price action in fixed strike vol in the last couple of weeks, as spot has traded higher and vol has been well bid.

This type of spot/vol correlation can often lead to a melt up type move and then sudden reversal as dealers don’t have the usual vol supply that keeps things more stable.

Skew is also trading at 1-year lows as no-one believes the market can ever go down again. All of these conditions are starting to set the stage for a vol spike in our opinion.

This is why we recommended to our subs a Put Ratio Backspread, which allows you to own the crash, but not take too much damage over the next few months if we don’t get a material down move.

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar.

ETH Dealer Gamma Positioning

This week we had headlines that the SEC is likely to approve spot Ethereum ETFs on May 23, according to a report by the Block, quoting Standard Chartered Bank.

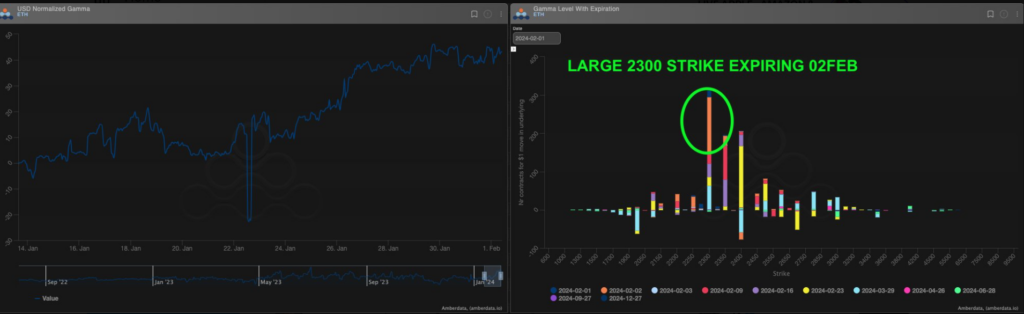

However, after an analysis of ETH gamma positioning by the dealer community, we believe even these type of headlines in the near term may not be enough for an $ETH breakout.

Again, this is due to dealer gamma positioning, which emanates from large call overwriters. There is a large 2.3k strike expiring Feb 2nd, so this may see some gamma offloading.

There was some sign of short covering mid-week, but the spot fade at $2.4k says it all. GAMMA matters! Longer dated call switches are still our favoured way to own ETH vs BTC. We are cognizant that the short-term gamma may act as a vol dampener in the near term, that’s why we would use far OTM calls.

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar.

Remember, not only do I share these trade ideas, but the ones I end up adding to my portfolio, are then tracked via a 20-30m weekly webcast that gives in-depth guidance. In it, you get to learn how to break down options trades by their Greeks and restructure trades in an optimal way to meet desired investment goals in real time. This is part of our Macro Options Overlay.

And that’s a wrap for this week!

Remember, you now have a chance to build your knowledge base via our FREE Options Insight webinar!

You will learn the process and tools I follow, from thesis to trade idea and actual execution.

This is a unique chance to learn how to master simple options trading strategies straight from a 20+ year career.

Just click the link below!

Free Options Trading Webinar

σ

σ

Thank you for making it this far!

As always, if you have any questions, comments, and/or found this helpful, feel free to reach out and let us know at info@options-insight.com

Cheers!

Imran Lakha

Options Insight