This post is a selection of insights from our reports to subscribers this week, showcasing how we build the contextual framework to find daily trade ideas. This is a repeatable process aimed at finding high-risk-reward trades. Note that the onus is on the subscriber to pick and choose which trades fit their overall risk.

In this week’s blog post, as part of the insights and trade ideas shared with subscribers, we delved into BTC call ladders in order to take advantage of the bullish seasonals on the asset, we also touched on why we felt it was a good timing to hedge some of our $CCJ (Uranium stock) exposure, and lastly, we proposed option structures on both $META and $NVDA to leverage on a retrace from overbought reads.

For a deeper dive into how I structure my trade ideas and to learn my thorough process, watch out for our next Free Options Trading Webinar.

BTC Call Ladder to Play Bullish Seasonals

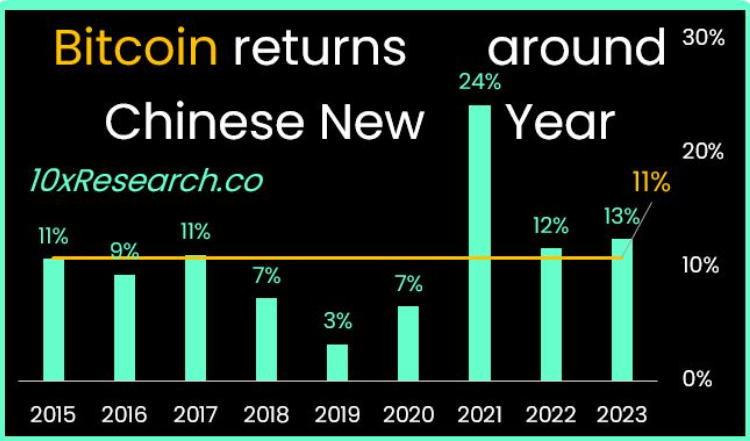

Our subs received a new trade notification on BTC this week. As BTC consolidated the recent rally, we saw potential for a Chinese New Year-led rally into the end of Feb. Historically, this has been a very positive period for BTC, where it has moved higher 10 out of 11 years and returned an average of 10%.

The chart below shows the stats, courtesy of 10x Research.

We thought that using call ladders was a cheap way to access this scenario. We have rallied quite fast since the opening of the trade, leading to the trade moving from a delta to a theta trade now. It will require carefully monitoring to decide the optimal exit timing.

For a deeper dive into how I structure my trade ideas and to learn my thorough process, watch out for our next Free Options Trading Webinar.

Hedging Uranium Exposure

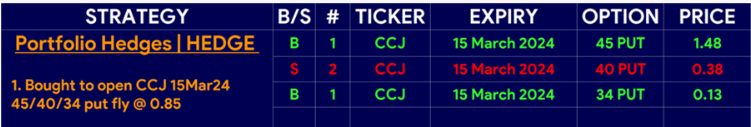

We also felt compelled to hedge $CCJ by rolling up put spreads from a drawdown post earnings on Feb 8th, which indeed came to fruition, with the stock -7%.

We had made good money on our long-term portfolio, where we keep a sizeable chunk in Uranium, so we could afford to re-invest some premium to own closer to the money strikes via a Put Fly.

For a deeper dive into how I structure my trade ideas and to learn my thorough process, watch out for our next Free Options Trading Webinar.

META & NVDA – Overbought Conditions

Firstly, META exploded up 20% on earnings as they announced a $50Bn buyback and a dividend. So we thought put spreads (trade idea shared with subs) would be a sensible move that offers good leverage to a scenario where the stock retraces a bit into mib-Feb. The stock is just simply very overbought up here.

Secondly, NVDA once again hit a new high, and is now up 40% in the last month. Those looking for some consolidation and thinking the 700 area should provide resistance can get leverage to a pullback using 16Feb broken wing put flys (trade idea shared with subs). Earnings are the week after expiry.

Remember, not only do I share these trade ideas, but the ones I end up adding to my portfolio, are then tracked via a 20-30m weekly webcast that gives in-depth guidance. In it, you get to learn how to break down options trades by their Greeks and restructure trades in an optimal way to meet desired investment goals in real time. This is part of our Macro Options Overlay.

And that’s a wrap for this week!

Remember, you now have a chance to build your knowledge base via our FREE Options Insight webinar!

You will learn the process and tools I follow, from thesis to trade idea and actual execution.

This is a unique chance to learn how to master simple options trading strategies straight from a 20+ year career.

Just click the link below!

Watch Out Free Options Trading Webinar

σ

σ

Thank you for making it this far!

As always, if you have any questions, comments, and/or found this helpful, feel free to reach out and let us know at info@options-insight.com

Cheers!

Imran Lakha

Options Insight