This post is a selection of insights from our reports to subscribers this week, showcasing how we build the contextual framework to find daily trade ideas. This is a repeatable process aimed at finding high-risk-reward trades. Note that the onus is on the subscriber to pick and choose which trades fit their overall risk.

In this week’s blog post, as part of the insights and trade ideas shared with subscribers, we focus on the move to take profits in ETH calls, the optimal hedging structures for both AMD and BTC, while also a move to roll down and out MARA to increase the chances of making money on our Put Spread.

For a deeper dive into how I structure my trade ideas and to learn my thorough process, watch our Free Options Trading Webinar.

Locking-in Gains in ETH Calls

Last Monday, when ETH was trading well above $4k, we managed to secure hefty profits in ETH ahead of this week’s hotter-than-expected US CPI. Also we saw Put Skew come back in ETH front-end, suggesting some potential downside risks, which eventually did materialize following Friday’s sell-off. Reducing delta gave us bullets to sell Puts into weakness at pumped vol levels.

Since the idea was published, the action to sell the calls could not have been timed better:

Hedges in Chip Names

AMD pulled back sharply intraday Friday March 11th along with other chip names. With vol elevated, those who needed hedges could have used put spread collars as the breakevens looked attractive out to April24. This was precisely the trade idea that we shared with our subscribers.

Since the idea was published, the action to buy put spread collars was again well timed:

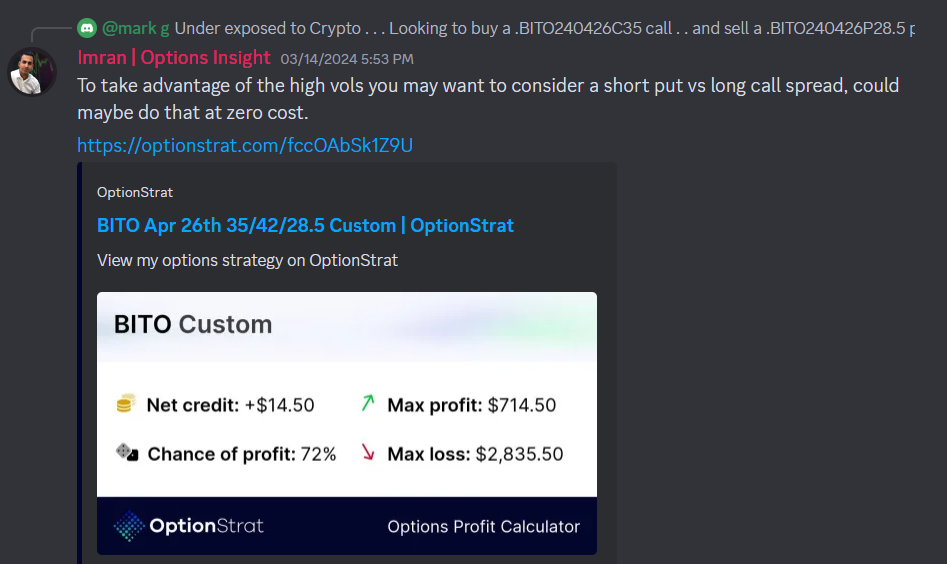

Optimal Hedging Structure in BTC

We felt Put Spread Collars were the optimal hedging structure in BTC with such high implied vols, even if one must sell calls at their own risk. The speed of recovery after last week’s flush out suggests that the underlying demand is so strong and so running partial hedges makes sense but you probably don’t want to give away all your upside just to play a short term correction.

Find below the bearish action in BTC since we shared the idea with our community:

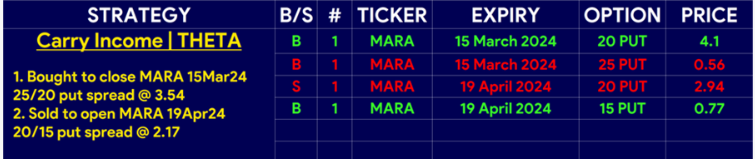

Rolling Down and Out MARA

With 15Mar put spread expiring this week, we were no longer earning theta in MARA, so we rolled down and out to increase the chances of making money on this iron condor trade. As we took in some premium by rolling the calls last week, we can afford to spend some premium to roll the put spread. Since we are still bullish on BTC and the halving is coming up in mid-April, this should be supportive to crypto stocks in general and helps us extract theta in this trade on one of the largest crypto miners.

Find below the bullish price action since Friday when we shared the trade management with subs:

Remember, not only do I share these trade ideas, but the ones I end up adding to my portfolio, are then tracked via a 20-30m weekly webcast as part of our Macro Options Overlay. You get to learn how to break down options trades by Greeks and restructure trades in an optimal way.

We also offer training courses that teach you the concepts and mechanics that affect how options contracts perform. You will learn what makes a great trade, and what is just a gamble. The result? Higher quality ideas, more consistent returns. Find out more in our Educational courses.

Remember, you now have a chance to build your knowledge base via our FREE Options Insight webinar! You will learn the process and tools I follow, from thesis to trade idea and actual execution.

Just click the link below!

Watch Our Free Options Trading Webinar

σ

σ

Thank you for making it this far!

As always, if you have any questions, comments, and/or found this helpful, feel free to reach out and let us know at info@options-insight.com

Cheers!

Imran Lakha

Options Insight