This post is a selection of insights from our reports to subscribers this week, showcasing how we build the contextual framework to find daily trade ideas. This is a repeatable process aimed at finding high-risk-reward trades. Note that the onus is on the subscriber to pick and choose which trades fit their overall risk.

In this week’s blog post, as part of the trade ideas shared with subscribers, we delved into BTC hedges, which took no time to work out in our favour, alongside attractive equity hedges via VIX, or potential upside opportunities in both tech (via AAPL) or call ladders in the Russell 2000.

Interested in learning the process I follow, from thesis to trade? Join our next Free Options Trading Webinar.

Hedging BTC Long Exposure

Once BTCUSD broke above 45k, we used the breach of the resistance to take some profit and enter hedges that could benefit from a “sell the news” event post SEC approval for spot ETFs. Long and behold, the idea aged extremely well, with a drastic flush of an uber levered long futures market, which saw the liquidation of over $1bn in open interest.

Subscribers to the crypto weekly report received the insights far before the actual selling took place:

“We struggle to see much upside past 50k in the near term as this is so well anticipated and so we would expect a lot of profit taking in a final move up. Also seeing technical bearish divergence and what looks like a potential 5th wave advance.”

We used short VEGA structures to hedge as vol was pumped into the ETF event and will most likely reset.

Snapshot of the trade ideas:

Interested in learning the process I follow, from thesis to trade? Join our next Free Options Trading Webinar.

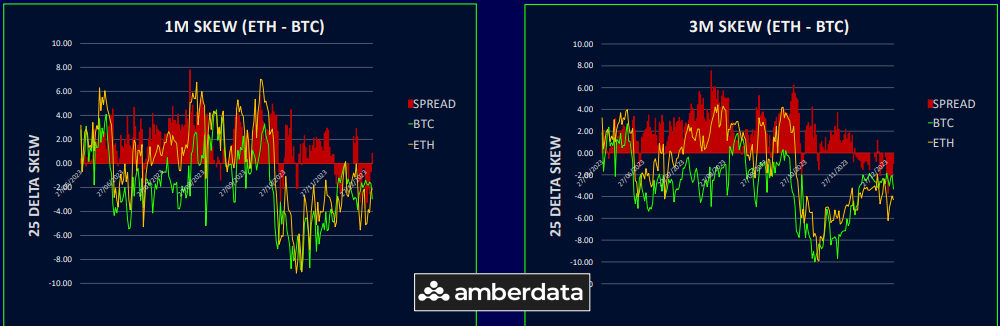

Another reason we were not expecting much further upside is the following observation via BTC skew.

The fact that these skew levels are way off the 2023 highs, even as ETF approval is imminent, shows that options markets think that the news is mostly priced in and a large spike in prices is not expected.

We even warned folks via Twitter that it’s probably a good timing to consider some protection.

Equity Protection via VIX

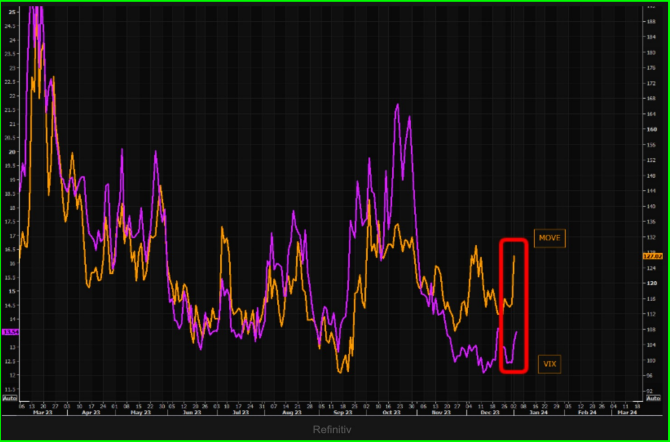

As we kicked off 2024, and look back at the drivers of macro volatility last year, it’s clear that rates volatility was once again a big theme, even as the pace of hikes slowed and we reached terminal rates.

With 5-6 cuts priced into the US rates curve, it seems that any strong data may easily lead to higher yields and hence more rates vol. We already saw yields popping the first days.

While equities have been supported by the Santa rally, it’s unlikely they will completely ignore a pop in bond yield if it were to materialize. Tactically, subscribers were offered the following insights:

“Stocks look a bit fragile here, so stock replacement with calls may be a sensible strategy with vols still quite low. CTA positioning has got quite long since the October lows and hence a flush-out could easily be on the cards. Whilst dips are still likely a buy in this Goldilocks macro regime with net liquidity increasing, we wouldn’t get over our skis with long risk right now.”

In fact, some Feb 17/21 call spreads printed on $VIX mid week. Decent leverage one could get if you are willing to pay the debit for these as Feb24 VIX has barely budged, in case you need protection.

Bottom line, equity skew has been very low, and while it is currently increasing a tad, still remains quite suppressed, so those who are still long risk may want to own some cheap hedges.

Interested in learning the process I follow, from thesis to trade? Join our next Free Options Trading Webinar.

Tech Unloved vs Passive Flows

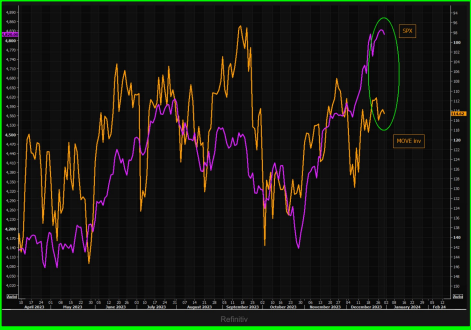

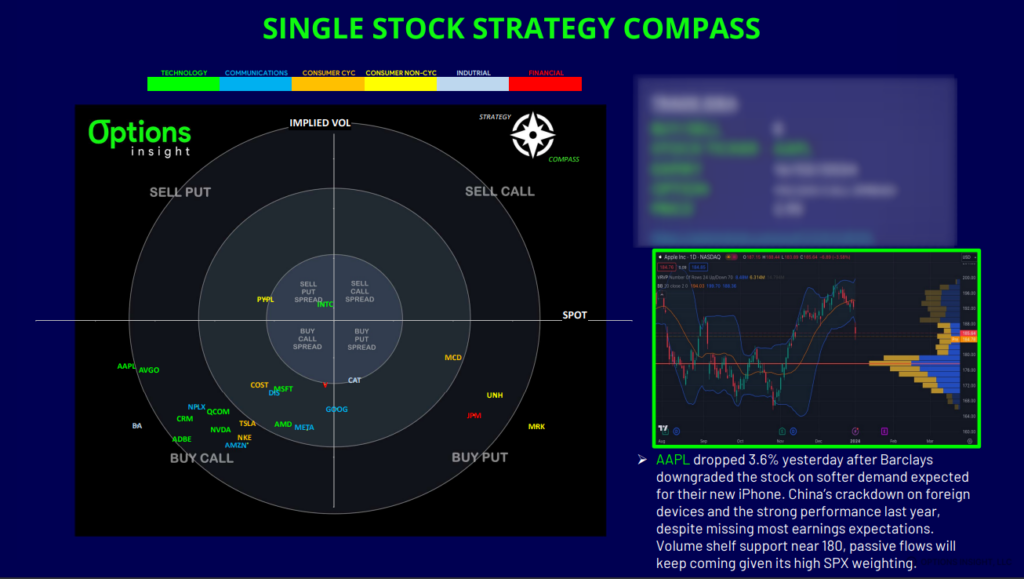

Straight out the gates in 2024 we have seen some action under the hood in markets. The MOVE index has been rising as rates volatility refuses to go anywhere. This is not being ignored by tech stock volatility, as can be seen by the significant rise in AAPL, AMZN and GOOG vols from the chart below.

Passive inflows into the stock market will ultimately bring consistent buyers of these large cap names, but for now it seems positioning got a bit crowded, particularly from hedge funds, and so Mr. Market once again looks to inflict pain where it can. Ultimately, we think that dips will continue to be a buy for the next few months, but 4600 looks like an interesting place to add length if we can get that far in a correction.

One of the top stocks we believe will continue to be supported on these passive flows, and therefore where our attention has turned this week with a trade idea, is none other than Apple.

Snapshot of the trade idea:

Interested in learning the process I follow, from thesis to trade? Join our next Free Options Trading Webinar.

Buying the Dip in Russell 2000

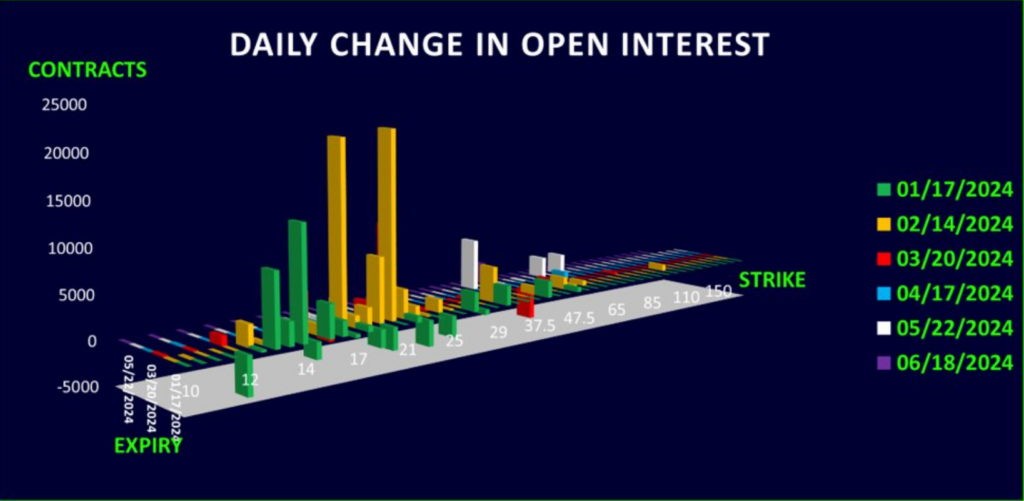

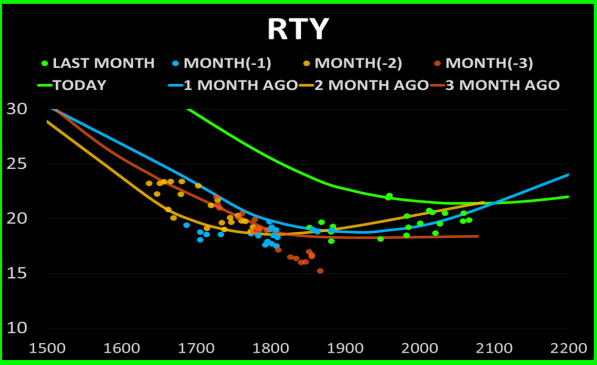

The Russell 2000 (IWM) had an incredible rally late last year as the market priced in a definitive FED pivot and massive upside buying triggered a gamma squeeze that took dealer short on the move higher.

RTY vol is still elevated relative to other broad indices and provides an interesting opportunity to gain cheap upside exposure via call ladders.

We still think the broader market will be supported into mid/late Jan. We think low delta/ low premium structures are a good way to play a move back towards the highs. If we get the lowest support near 188 on IWM, and see some bullish divergence, we may increase delta exposure.

With IWM implied vol standing out as the most elevated and the term structure inverted, we see some opportunity in being short short-dated upside as part of a bullish structure. If IWM bounces from support levels, we think a retest of the highs is possible before FOMC at the end of January. The skew is very flat due to all the call buying and so this lends itself well to call ladders.

If the rally happens too fast, we will manage the DELTA by buying back higher strikes to turn the trade into a call condor, but for now we like the short upside vol at these levels. The risk/reward if me max out is around 3 to 1 and there is very little decay for another 2 weeks at which point we can re-evaluate the trade. We are basically looking for a near-term bounce from this correction to get into the THETA earning zone, with vol having lots of room to fall.

Remember, not only do I share these trade ideas, but the ones I end up adding to my portfolio, are then tracked via a 20-30m weekly webcast that gives in-depth guidance. In it, you get to learn how to break down options trades by their Greeks and restructure trades in an optimal way to meet desired investment goals in real time. This is part of our Macro Options Overlay.

And that’s a wrap for this week!

Remember, you now have a chance to build your knowledge base via our FREE Options Insight webinar!

You will learn the process and tools I follow, from thesis to trade idea and actual execution.

This is a unique chance to learn how to master simple options trading strategies straight from a 20+ year career.

Just click the link below!

Free Options Trading Webinar

σ

σ

Thank you for making it this far!

As always, if you have any questions, comments, and/or found this helpful, feel free to reach out and let us know at info@options-insight.com

Cheers!

Imran Lakha

Options Insight