This post is a selection of insights from our reports to subscribers this week, showcasing how we build the contextual framework to find daily trade ideas. This is a repeatable process aimed at finding high-risk-reward trades. Note that the onus is on the subscriber to pick and choose which trades fit their overall risk.

In this week’s blog post, as part of the trade ideas shared with subscribers, we delved into capitalizing on what we believe to be an overshoot in the VIX, the convergence of seasonality and technicals in gold, exposure into Chinese stocks early next year, and a pop in vol via HYG at its key technical juncture.

For a deeper dive into how I structure my trade ideas and to learn my thorough process, join our next Free Options Trading Webinar.

VIX Looking Oversold Relative To VVIX & MOVE

The Thanksgiving VIX collapse we had been expecting managed to take VIX to new lows for the year. In fact, these levels look like an overshoot when comparing to other volatility metrics like VVIX and MOVE.

The chart below shows that the metrics tend to anchor the VIX pretty well, but it does often overshoot on the downside. Aug and Sept this year were examples of this, and we think the latest move is similar.

Snapshot of the VIX, VVIX, MOVE:

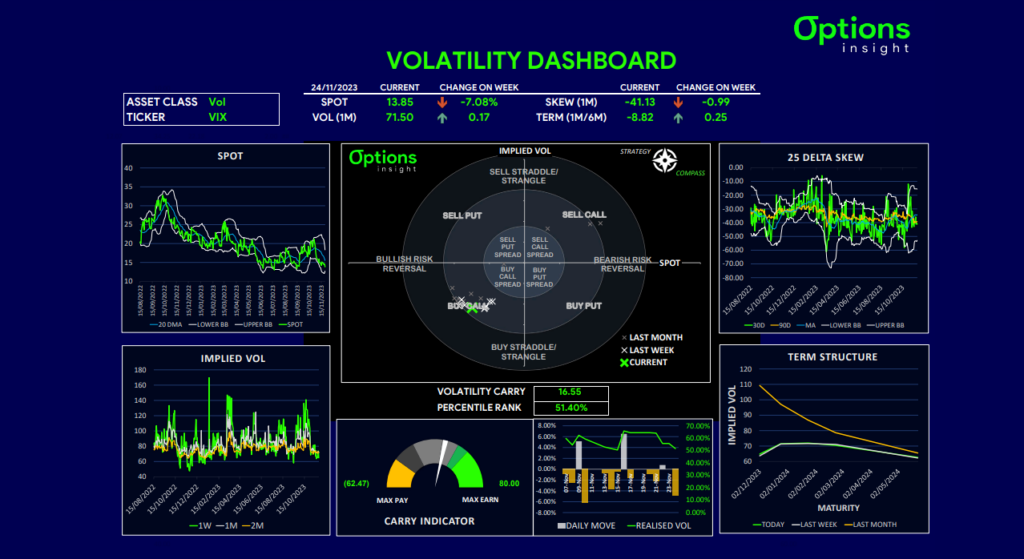

Amid this backdrop, subs received a trade idea around looking for some kind of bounce in VIX back toward 15-16 in the near term, which would be more in line with the other vol indices. With front-end VIX vols so low, we looked for smart ways to own near the money upside on VIX but find a way to finance it due to the high positive carry and steep roll down.

Snapshot of VIX Vol Dashbaord:

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar.

We like selling diagonal call calendars on VXX, which worked fantastically back in September to play a short term VIX pop. The good think about using VXX is that we eliminate basis risk between different expiry VIX futures which is a cleaner way to trade calendars.

This trade takes advantage to contango term structure and still expensive upside skew in VIX. This is the best way to own a VIX spike but to control the THETA in our view. If we get a spike in vol in the next 2 weeks, we can easily monetise this trade.

Don’t forget, as a subscriber, you gain exclusive access to tools that reveal the specifics of this daily trade idea via the Macro Options Daily report.

Gold Looking Overbought But Threatening To Break Higher

Gold popped above 2000 again this week as the dollar came under pressure from lower US rate expectations after a weaker CPI. We have been impressed by the resilience in Gold, even as Middle East concerns are fading, and real rates are well above 2%.

We continue to believe that an eventual break above the highs in Gold at 2080 would trigger a big technical chase and so upside vol seems cheap. We do also think in the near term there is risk of a pullback, but seasonality in December and January for Gold is very strong.

Seasonality in GLD:

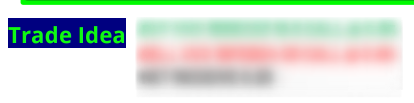

As GLD quietly creeps up to the highs, we thought the vol was underpricing the risk of a breakout. We don’t want to chase the move higher right here, because the break hasn’t happened yet, and in the near-term the metal looks overbought and the dollar looks oversold. So rather than buy calls and get too long DELTA here, we prefer to use a more DELTA neutral structure to get long some vol.

Snapshot of GLD Vol Dashbaord:

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar.

This way, if we get a pullback, we can let go of our puts and run the cheaper long calls into the positive seasonality for Dec/Jan. However, if we break higher, then our puts are low premium and the GAMMA of the Jan24 calls kicks in, and VEGA is also likely to work in our favour, assuming the move is large enough.

Overall, we think spending 2% premium on this strangle looked quite attractive given the setup in Gold as metals seem to be where the action is right now.

Don’t forget, as a subscriber, you gain exclusive access to the specifics of this daily trade idea via the Macro Options Daily report.

China Ending The Year With A Whimper

After a spectacular start to 2023 (18% in the first month), Chinese stocks have drifted lower all year and trading new their year lows. As we head into 2024, we wonder if there may be some value in picking up cheap, unwanted exposure to this region which many still feel is uninvestable.

Therefore, we looked for smart options plays to participate in some Q1 upside.

Snapshot of FXI chart:

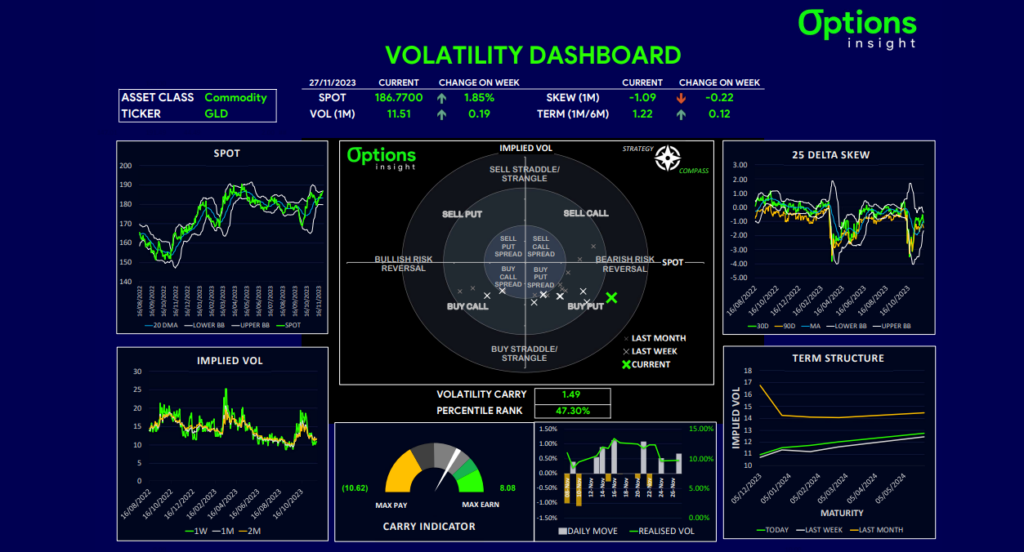

With a slightly inverted term structure and flat skew, using some short-dated upside calls to fund longer term calls works well. This is predicated on the idea that a rally through 27 by 15Dec23 is unlikely and so we get to cheapen the cost of our Feb24 calls considerably.

Snapshot of FXI Vol Dashbaord:

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar.

We don’t want to buy outright calls here and make a strong call on DELTA, given there has been little sign of a reversal higher as yet. These type of structures are nice because we can also start earning THETA in a moderate bounce, which we think is the more likely scenario.

Don’t forget, as a subscriber, you gain exclusive access to the specifics of this daily trade idea via the Macro Options Daily report.

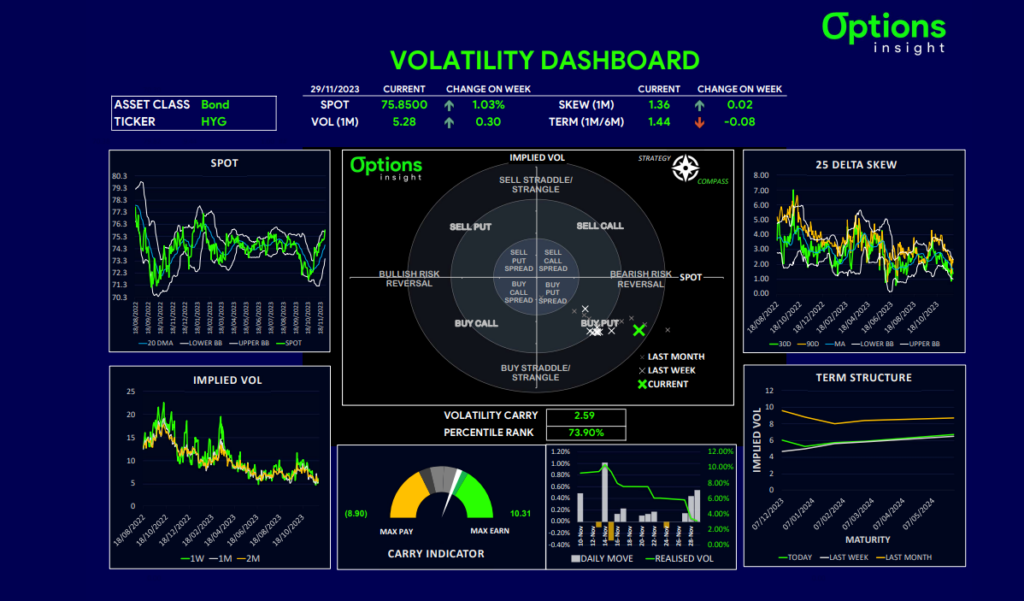

HYG Reaching Big Levels As Vol Hits Lows

Similar to what we pointed out in GLD above, when vol is on the lows and spot is about to break a major resistance zone, it makes sense to pick up some options because a decent move in either direction (breakout or rejection) is likely. Just siting still and going nowhere is probably the least likely outcome, but the options market doesn’t price things based on technical chart levels.

Snapshot of HYG chart:

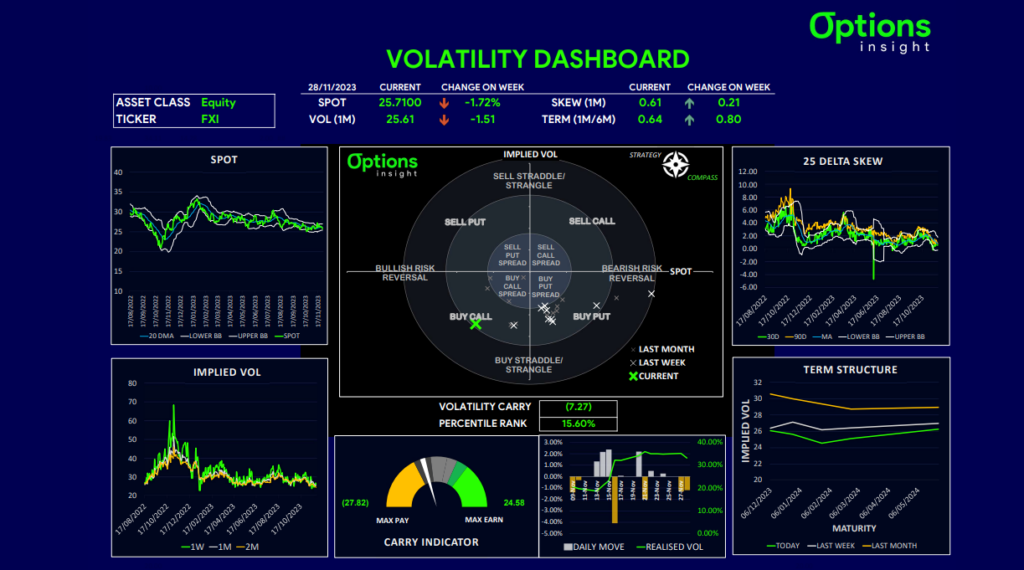

We think owning some delta neutral vol positions in HYG at these levels is looking sensible. If we continue to melt up, it probably happens into year-end, otherwise a rejection here and then more downside in Q1 as growth rolls over would be my main two scenarios.

With vol and skew cheap, spot breaking the highs, and term structure quite flat. We think the best way to play what looks like an unstable level in HYG is to buy a volatility strategy that is delta neutral.

Snapshot of HYG Vol Dashbaord:

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar.

We think the upside break might still continue into year end, so using short-dated calls works for that scenario. If this is a false break and markets come back down to earth in Q1 then Mar24 puts should work as the VEGA reprices higher. If we get a move in either direction, then we can roll or take profits on one of the legs but overall locking in such cheap vols looks attractive right now.

Don’t forget, as a subscriber, you gain exclusive access to the specifics of this daily trade idea via the Macro Options Daily report.

Remember, not only do I share these trade ideas, but the ones I end up adding to my portfolio, are then tracked via a 20-30m weekly webcast that gives in-depth guidance. In it, you get to learn how to break down options trades by their Greeks and restructure trades in an optimal way to meet desired investment goals in real time. This is part of our Macro Options Overlay.

And that’s a wrap for this week!

Remember, you now have a chance to build your knowledge base via our FREE Options Insight webinar!

You will learn the process and tools I follow, from thesis to trade idea and actual execution.

This is a unique chance to learn how to master simple options trading strategies straight from a 20+ year career.

Just click the link below!

Free Options Trading Webinar

σ

σ

Thank you for making it this far!

As always, if you have any questions, comments, and/or found this helpful, feel free to reach out and let us know at info@options-insight.com

Cheers!

Imran Lakha

Options Insight