This post is a selection of insights from our reports to subscribers this week, showcasing how we build the contextual framework to find daily trade ideas. This is a repeatable process aimed at finding high-risk-reward trades. Note that the onus is on the subscriber to pick and choose which trades fit their overall risk.

In this week’s blog post, as part of the insights and trade ideas shared with subscribers, we delved into extracting yield safely via AVGO, calendar put spreads in AAPL, the closing of hedges in ETH, owning gamma in this rather frothy stock rally we are seeing, the best approach to play a 12 handle floor in the VIX, and last but not least, fading the AI mania through the juggernaut AMD ahead of earnings.

For a deeper dive into how I structure my trade ideas and to learn my thorough process, join our next Free Options Trading Webinar.

Safely Extracting Yield

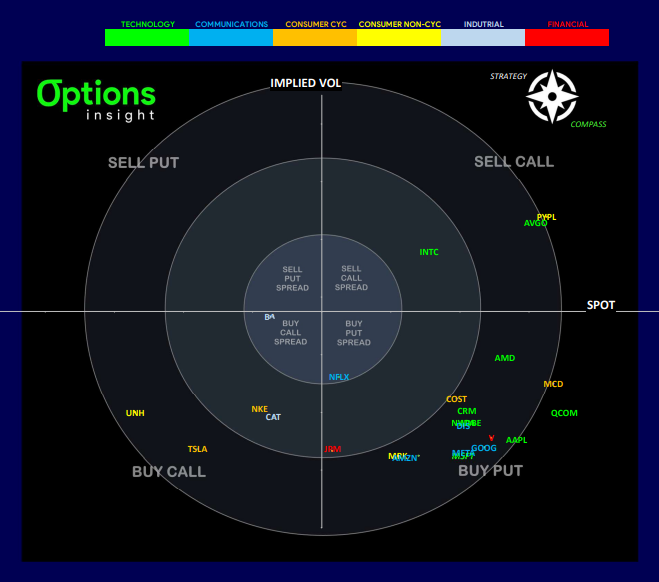

AVGO had a huge move higher along with the semi stocks and on the back of a Goldmans upgrade, targeting 1325. With vol somewhat elevated, we saw short call spreads expiring before earnings in March as a way to safely extract some yield and fade some of this AI mania.

As you can see in our strategy compass, AVGO was a screaming ‘sell calls’ as the stock entered extreme reads in terms of the recent spot move and its implied vol, which made it quite attractive.

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar.

Room for AAPL Consolidation

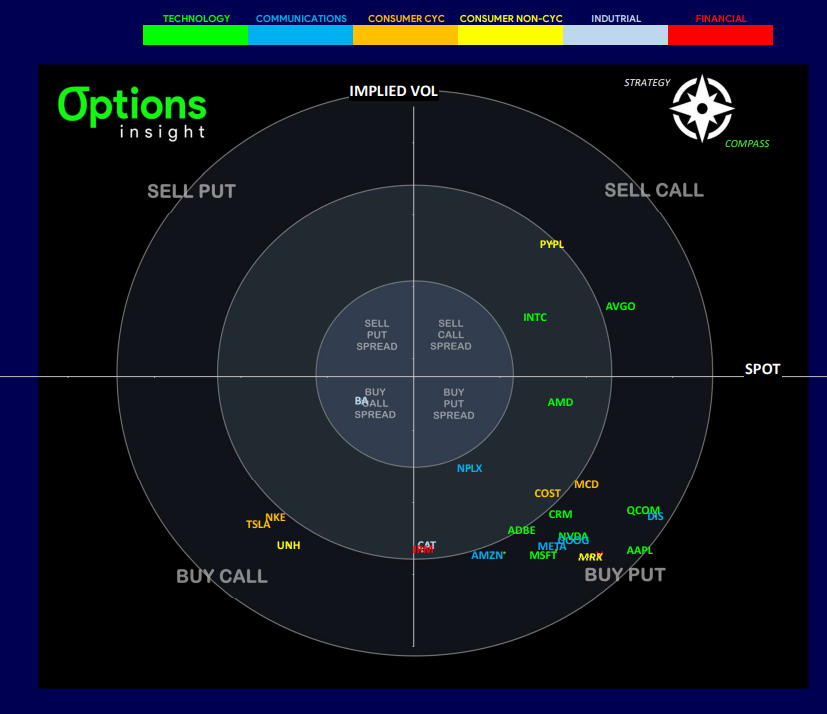

AAPL traded back up near highs this week with the broader market and on optimism about the new Vision Pro. The product remains niche and out of most consumers reach, hence we see room for some consolidation. We recommended to use the earnings vol premium to enter calendar put spreads.

Our strategy compass clearly highlighted AAPL as a stock selection that may do well via the buying of puts as spot rises and the vol crush is set to occur after their earnings call on Feb 2nd.

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar.

Sudden Rush in ETH Skew

The sudden rush for ETH skew is a function of the call selling flows from overwriters, and the break below key technical support at 2400, which has led to quick slide down towards 2200. The huge level for ETH is 2150, which if broken could lead us back down to 1900. Investors may have got a bit too optimistic on ETH in the near-term and are now showing some nerves and reaching for hedges.

Still, we felt at the levels tested this week, it was an apt time to close the short leg of Jan 26 put spread as ETH approaches the key 2,150 support. We want to be able to add risk if the market overshoots lower.

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar.

Owning Gamma a No-Brainer

After lats week’s expiry rolled off, we expected the SPX dealer’s books to lose a lot of long gamma exposure, which would open up room for more realized vol in SPX. So far, this has not materialised, as according to Goldmans, the local gamma position got replenished very quickly.

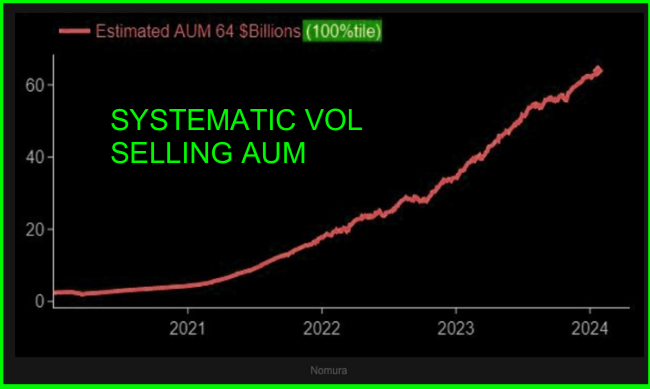

This type of local peak in gamma is down to very short dated options selling from clients (most likely systematic vol sellers) who aren’t too sensitive to the vol levels they are selling. You can see that plus or minus 2%, most of the gamma dissipates. What this means for markets is fatter tails, where we either sit hear and go nowhere, or moves become exaggerated if there is a catalyst to move markets. Say, a massive China stimulus bazooka, or blow out earnings from Mag7.

We can see how the AUMs in these vol selling strategies have grown, and being someone who has traded for a while, this is starting to smell a lot like early 2018, just before “volmageddon” which wiped out the XIV ETN. Therefore, we still think owning gamma is a bit of a no brainer for the next two weeks as there are many potential catalysts to move us away from these very local positions.

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar.

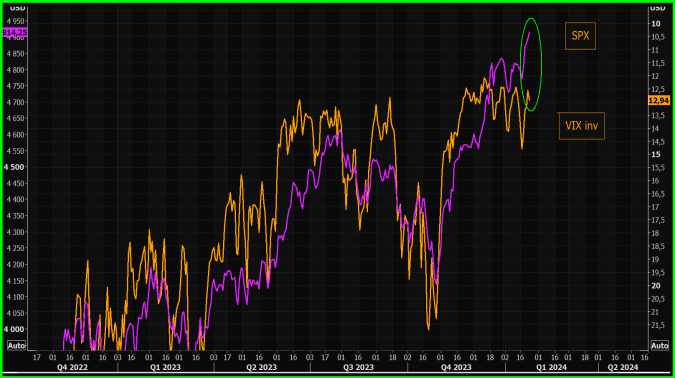

VIX Call Spreads Way to Go

VIX once again showing that 12 may be the floor as SPX tagged 4900 and we couldn’t make now lows. This once again highlights why we like VIX call spreads as our favoured way to hedge equity exposure and we would be using Feb and March expiries for these structures.

So far, we haven’t seen a major pullback in stocks but the big earnings reports keep rolling in and the bar for earnings beats, particularly in big tech, look high.

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar.

Fading AI Mania via AMD

Subs also received the following earnings idea…

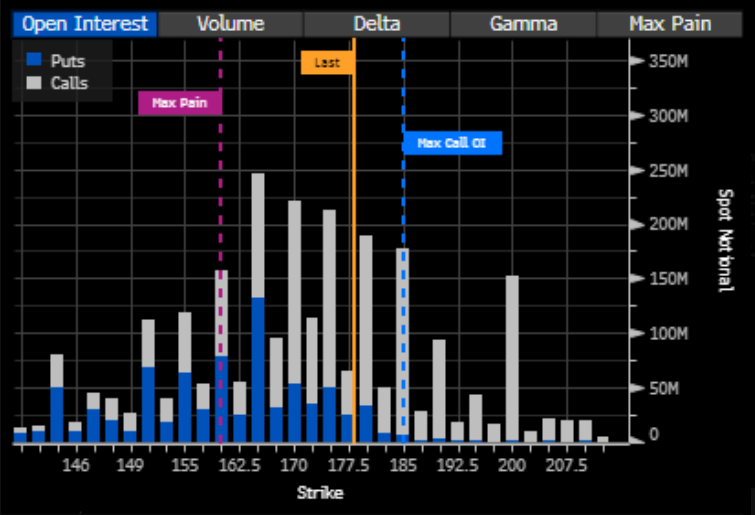

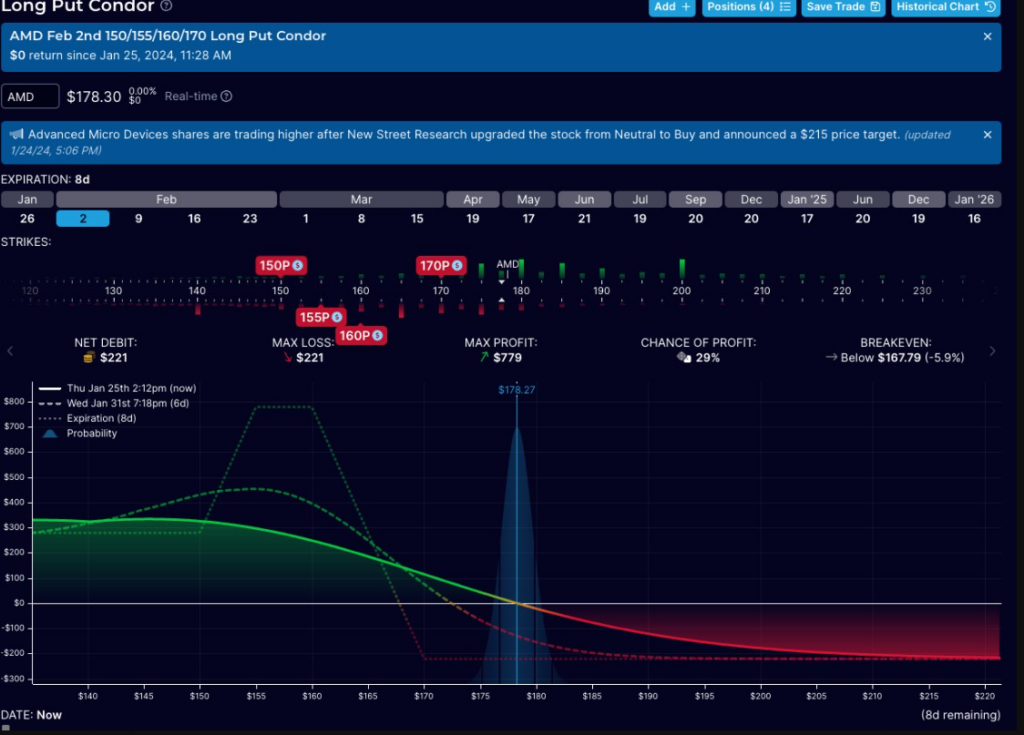

$AMD went parabolic recently and has been trading more expensive than $NVDA on Forward PE. We can’t help wanting to fade this AI mania and think things have got overblown into earnings next week.

We think outright short stock or short naked calls are asking for trouble with reasonable open interest in calls all the way to 200 for next week’s 02Feb expiry. However, owning puts outright to play a short is expensive with and implied move of 7.5%.

For me, the best way to play a pull back in the stock on earnings is to use put condors. These offer a decent risk reward and benefit from a spot down / vol down dynamic, which is very likely if the stock corrects.

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar.

Remember, not only do I share these trade ideas, but the ones I end up adding to my portfolio, are then tracked via a 20-30m weekly webcast that gives in-depth guidance. In it, you get to learn how to break down options trades by their Greeks and restructure trades in an optimal way to meet desired investment goals in real time. This is part of our Macro Options Overlay.

And that’s a wrap for this week!

Remember, you now have a chance to build your knowledge base via our FREE Options Insight webinar!

You will learn the process and tools I follow, from thesis to trade idea and actual execution.

This is a unique chance to learn how to master simple options trading strategies straight from a 20+ year career.

Just click the link below!

Free Options Trading Webinar

σ

σ

Thank you for making it this far!

As always, if you have any questions, comments, and/or found this helpful, feel free to reach out and let us know at info@options-insight.com

Cheers!

Imran Lakha

Options Insight