This post is a selection of insights from our reports to subscribers this week, showcasing how we build the contextual framework to find daily trade ideas. This is a repeatable process aimed at finding high-risk-reward trades. Note that the onus is on the subscriber to pick and choose which trades fit their overall risk.

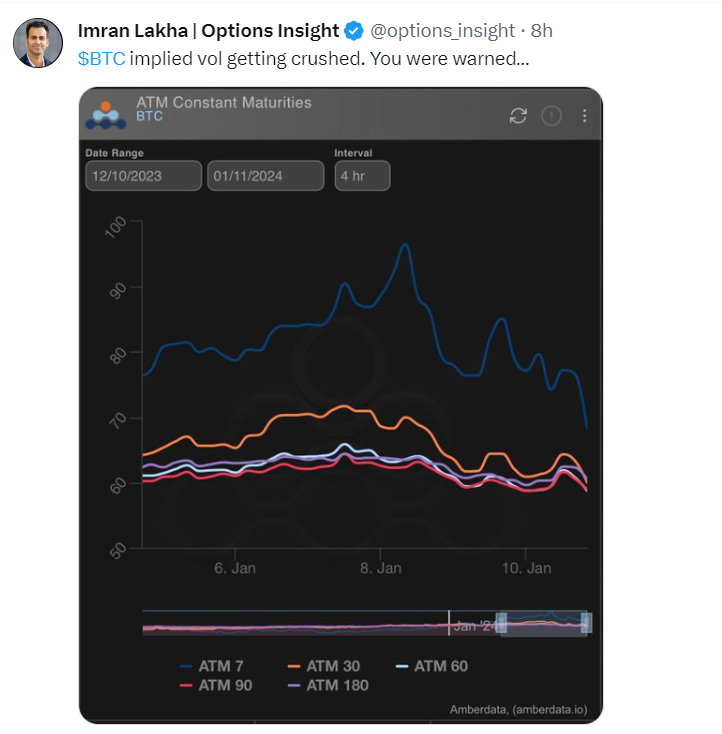

In this week’s blog post, as part of the insights and trade ideas shared with subscribers, we touched on the constant vol supply in the SPX by systematic strategies looking to hunt for extra yields, the cheap left tails available via VIX or the bonds market, and most notably, we also saw the anticipated reduction in BTC implied volatility materialize following the official approval of spot BTC ETFs.

Interested in learning the process I follow, from thesis to trade? Join our next Free Options Trading Webinar.

Rich SPX Vol Supply

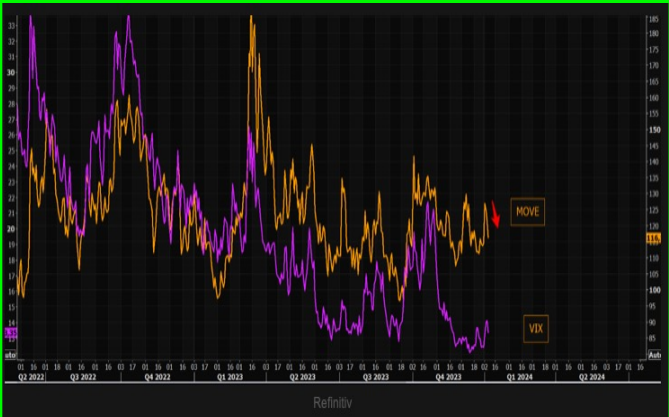

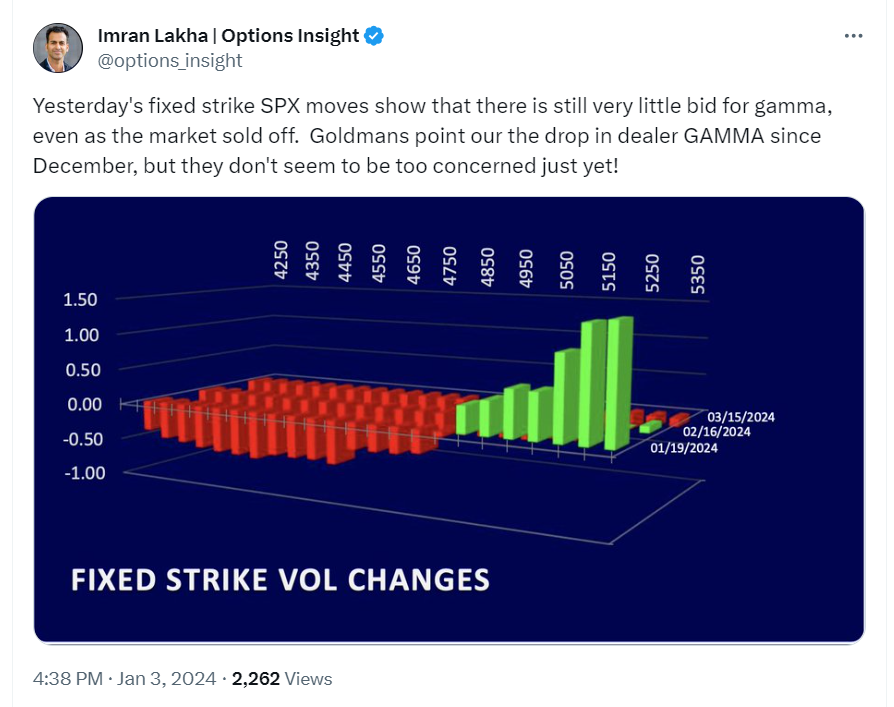

We started the week highlighting that while tech stock volatility has been rising in tandem with rates vol, the broader VIX is still hampered by a good amount of SPX vol supply that comes systematically from yield hunting strategies. Besides, fixed strike vol moves confirm that MMs are not short vol at recent lows.

We’ve been warning about vol supply for a while (posted on Jan 3rd):

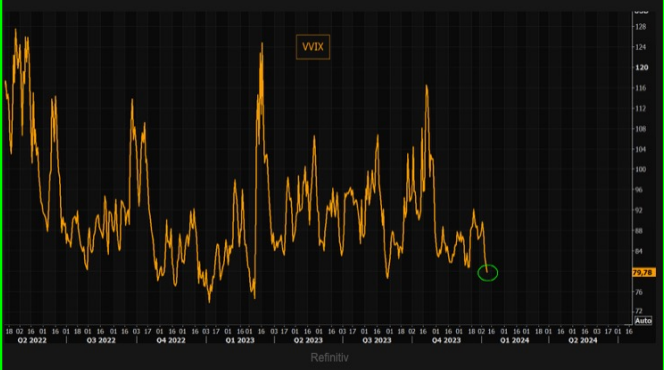

When it comes to the VIX, while VIX spot had a minor uptick after the holiday period, the VIX futures barely moved and VVIX actually lost 4 vols last week.

This often means the VIX move is a fade and likely to turn back lower. We indeed saw VIX got back down to a 12-handle and so far, the vol sellers are still winning the game. Even the release of the CPI figures and upcoming earnings don’t seem to be phasing the options market, apart from a small bid in weekly options.

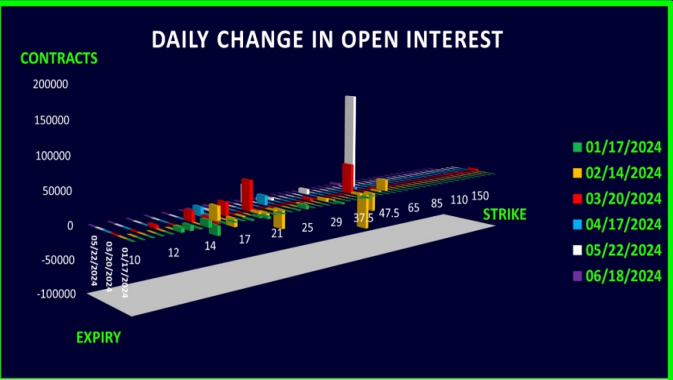

This is all indicative of less VIX call buying and last week’s VIX options flows actually saw some call sellers in Feb24 and Mar24. When we look at potential equity hedges, we think VIX call spreads line up well here, as they achieve a nice balance between manageable THETA bleed and attractive risk/reward.

Also, with VIX near its lows, there may be some investors who prefer to own VIX futures (the 2nd month future is practically on 5-year lows) and overwrite with VIX calls. This is one way to mitigate the roll down on being long VIX futures.

Note, mid week, we did see a large clip of May24 47.5 calls trade in 150k lots, which suggests that hedgers are happy to move further out the term structure to reduce decay and buy more time for a potential vol spike. The thing to realize here is that you don’t get much of a spike in the VIX unless you own the short-end, so there is a trade-off, as always.

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar.

Cheap Left Tail Hedges

The key macro data point this week was the US CPI, which came slightly hotter-than-expected.

After this, the focus now turns to earnings season. Wall St analysts have been cutting earnings estimates over the last few months and so the bar to beat expectations is lower.

Stocks have rallied strongly on rate cut hopes, now that it looks like inflation is headed back to target levels. Therefore, it is unclear how positively stocks will respond to earning beats if everyone is long risk.

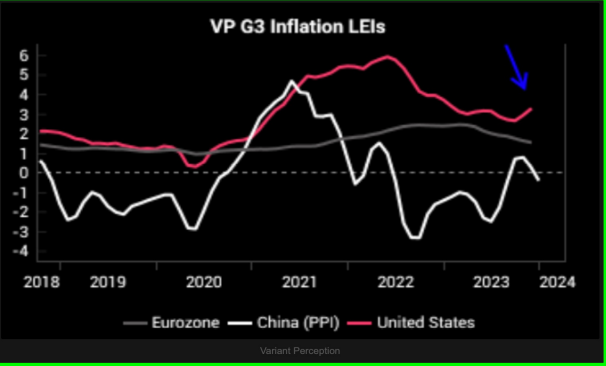

Our friends at VP see leading indicators of inflation in the US turning higher, and all the tension in the Middle East has the potential to disrupt supply chains again.

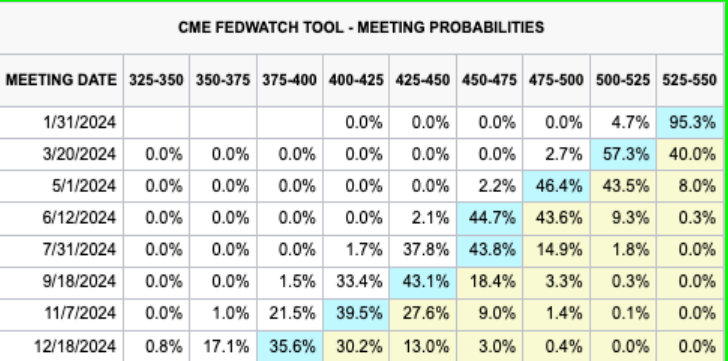

It appears that the 5-6 cuts being priced by the rates market is accounting for very little probability of inflation returning any time soon. Fed speakers have been calling for only 2-3 cuts this year, so some repricing in bond markets may be necessary if the economy stays resilient, the way it did last year.

Whilst not the base case, looking for cheap left tail hedges in Bonds looks sensible. Which led us to…

Owning Left Tail in Bonds

Bonds continued to slip lower, as CPI came in slightly hotter and the FED’s favourite measure of Core CPI Services ex-shelter rose 0.4% MoM which suggests the inflation battle may not be won just yet.

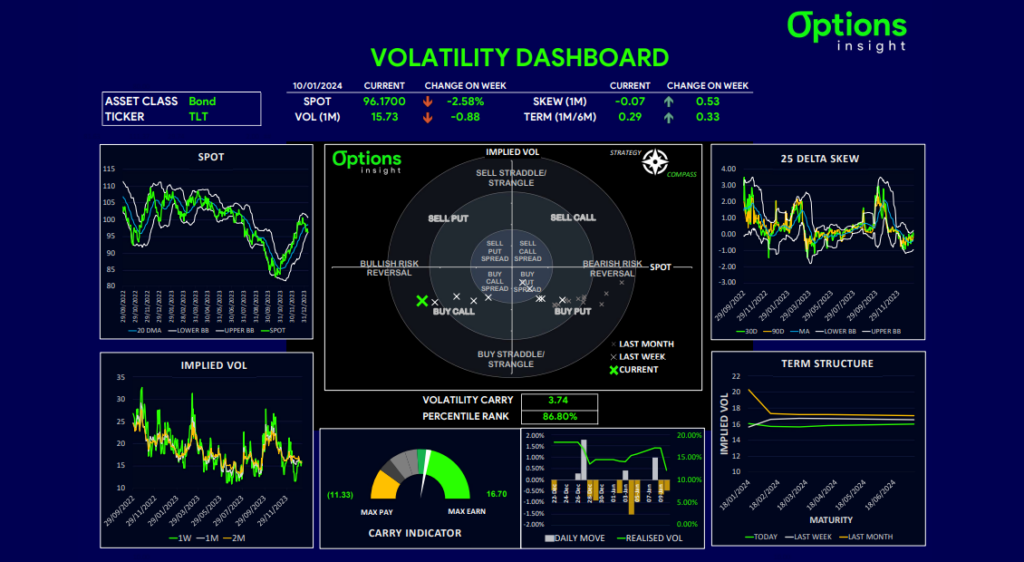

We had been flagging that Bond downside skew looks flat, similar to what we saw in September last year , before the break below 90 on TLT.

With major support around 93, we think Bonds should either bounce soon or a downside break could get ugly. If we go back into the 80s, we expect implied vol to rise.

With spot looking oversold in the near term as bond yields have moved higher over the last couple of weeks, we saw an inflection point approaching. We either get a bounce soon and vol likely continues to decline, or we break key supports and yields have another test of the highs into the summer as the FED is forced to hold rates higher.

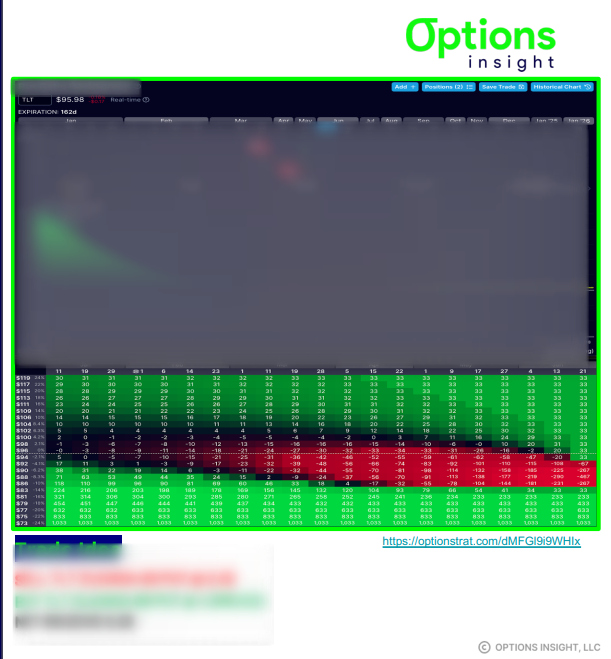

With vol and put skew quite low, we think the left tail is being offered cheaply and so like low DELTA put ratios that get long VEGA in a break lower.

In the type of structure presented to subscribers, there is little risk in the first few months as the THETA is not too large, at which point we can roll or exit the trade. In the meantime, if TLT does break down and vol spike, we get access to make good money in that scenario.

BTC Vol Crushed Post ETF Approvals

If you’ve been following me closely, you knew we were calling for a major vol reset in Bitcoin the moment the spot ETF approvals became a reality.

Those receiving our weekly crypto options report managed to get well prepared ahead of the actual event. Read below the comments we wrote:

“Implied vols have risen in the front end of the curve to negate the THETA impact on options prices, this is a common behaviour around “vol events” where a gap move is expected on a certain date.”

“Volatility carry is therefore still positive due to implied vols staying high. Once the news is out, expect those implied vols to come crashing down into the 50s and be more in line with recent realized vol.”

“That fact that we already saw a strong rally, even before the news is official, bodes well for the long GAMMA players, as no vol reset has occurred yet.“

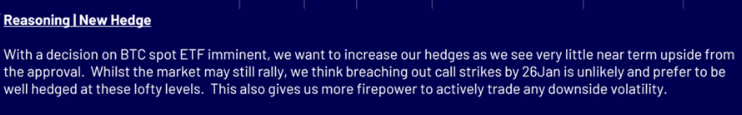

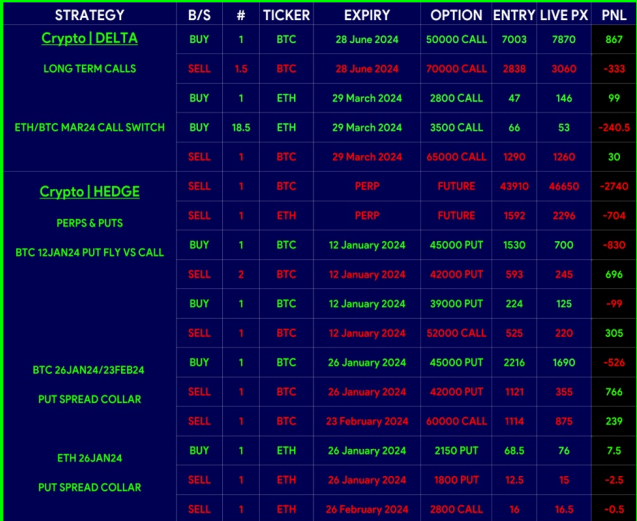

Ahead of the ETF catalyst, we added BTC PERP futures to increase hedge ratio further to 94%.

We also rolled 26Jan BTC call ratio into 28Jun24 higher strikes by taking profits. Besides, we bought ETH 26Jan 2150/1800/2800 put spread collar @ 40 with the ETH hedge ratio at 42%.

Don’t forget, as a subscriber, you gain exclusive access to tools that reveal the specifics of these trade ideas via the Crypto Options Weekly report.

And that’s a wrap for this week!

Remember, not only do I share these trade ideas, but the ones I end up adding to my portfolio, are then tracked via a 20-30m weekly webcast that gives in-depth guidance. In it, you get to learn how to break down options trades by their Greeks and restructure trades in an optimal way to meet desired investment goals in real time. This is part of our Macro Options Overlay.

Remember, you now have a chance to build your knowledge base via our FREE Options Insight webinar! You will learn the process and tools I follow, from thesis to trade idea and actual execution. This is a unique chance to learn how to master option strategies straight from a 20+ year veteran.

Just click the link below!

Free Options Trading Webinar

σ

σ

Thank you for making it this far!

As always, if you have any questions, comments, and/or found this helpful, feel free to reach out and let us know at info@options-insight.com

Cheers!

Imran Lakha

Options Insight