This post is a selection of insights from our reports to subscribers this week, showcasing how we build the contextual framework to find daily trade ideas. This is a repeatable process aimed at finding high-risk-reward trades. Note that the onus is on the subscriber to pick and choose which trades fit their overall risk.

In this week’s blog post, as part of the insights and trade ideas shared with subscribers, we focused on the opportunities presented in the crypto market to fade the spike in implied vol via call ratios, the management to take profits in TLT, as well as the adjustments made on HYG and SPY.

For a deeper dive into how I structure my trade ideas and to learn my thorough process, watch our Free Options Trading Webinar.

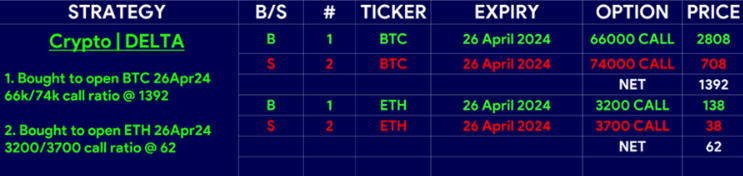

Capitalizing on Crypto Vol Spike

We used the dip on the Iranian drone strike as well as the bid to implied vol earlier in the week to buy the dip in both BTC and ETH using call ratios. We were not expecting to see new highs getting taken out by month-end but a bounce was always likely if geopolitics de-escalated, which is so far what has occurred. We expect vol to retrace in a spot recovery, making long delta and short vega the optimal setup.

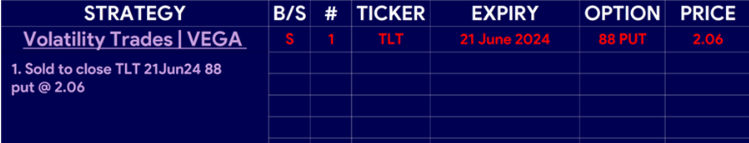

Taking Profits in Bonds

During the bull stampede in bond prices as the market prices out rate cuts by the Fed, we took advantage to reduce the delta and take profits on the put positions we had running via 88.00 TLT 21June 24.

HYG Back to Life & Buy Back on SPY

We closed out HYG puts that had come back to life on the recent selloff and expired on Friday. Besides, we also bought back SPY June calls as they were low premium and wanted to increase the delta on the dip seen in equities.

Remember, not only do I share these trade ideas, but the ones I end up adding to my portfolio, are then tracked via a 20-30m weekly webcast as part of our Macro Options Overlay. You get to learn how to break down options trades by Greeks and restructure trades in an optimal way.

We also offer training courses that teach you the concepts and mechanics that affect how options contracts perform. You will learn what makes a great trade, and what is just a gamble. The result? Higher quality ideas, more consistent returns. Find out more in our Educational courses.

Remember, you now have a chance to build your knowledge base via our FREE Options Insight webinar! You will learn the process and tools I follow, from thesis to trade idea and actual execution.

Just click the link below!

Watch Our Free Options Trading Webinar

σ

σ

Thank you for making it this far!

As always, if you have any questions, comments, and/or found this helpful, feel free to reach out and let us know at info@options-insight.com

Cheers!

Imran Lakha

Options Insight