This post is a selection of insights from our reports to subscribers this week, showcasing how we build the contextual framework to find daily trade ideas. This is a repeatable process aimed at finding high-risk-reward trades. Note that the onus is on the subscriber to pick and choose which trades fit their overall risk.

In this week’s blog post, as part of the insights and trade ideas shared with subscribers, we covered the option structure to earn some income via MARA, the switch to collect VIX put premium, and last but not least, the logic behind our total hedging in BTC as the rally gets overextended and funding unsustainable.

For a deeper dive into how I structure my trade ideas and to learn my thorough process, watch out for our next Free Options Trading Webinar.

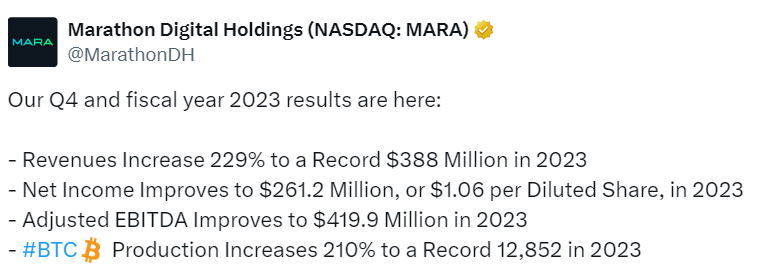

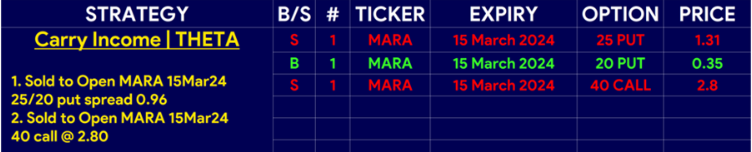

Earning Income via MARA

One of the trades we shared with our subs this week was the opportunity to earn some income and sell MARA vol before earnings. The stock showed signs that it was struggling to rally on a day when BTC had gone up 7%.

This suggested that the stock wasn’t about to squeeze much higher even on good earnings after the spectacular run it had. Fast forward, earnings came strong but the price action has since underwhelmed.

We own the stock in the long term portfolio, so we were happy to overwrite some upside, yet on the downside, we also wanted to limit risk, that’s why our preferred options structure was a Put Spread.

For a deeper dive into how I structure my trade ideas and to learn my thorough process, watch out for our next Free Options Trading Webinar.

Vega Trade in the VIX

The way implied vol has been behaving made us think that the VIX is going to have a hard time going up unless we get a major shock event of some kind. Therefore, we preferred to switch our remaining premium from VIX calls to puts and play a vol decline into Easter, which seems more likely.

For a deeper dive into how I structure my trade ideas and to learn my thorough process, watch out for our next Free Options Trading Webinar.

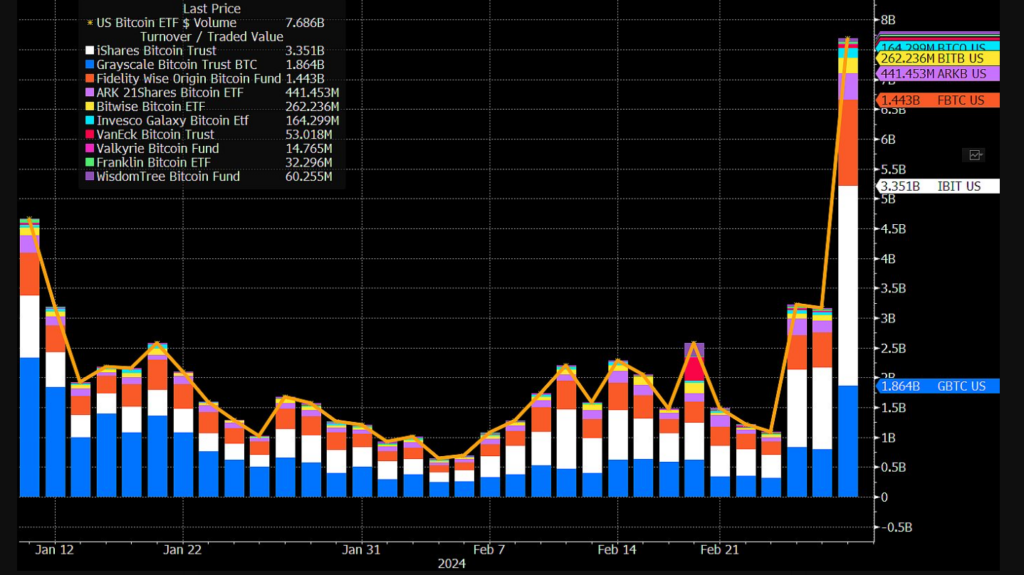

Time to Hedge the Crypto Exposure

We’ve been surprised that BTC and ETH keep charging the way they have. The rally looks overdone but if the inflows keep coming, the rise keeps being justified. In fact, on Feb 28th, we had a new record for Bitcoin ETF trading volume, officially at $7.69 billion. Previous record was $4.66 billion from launch day.

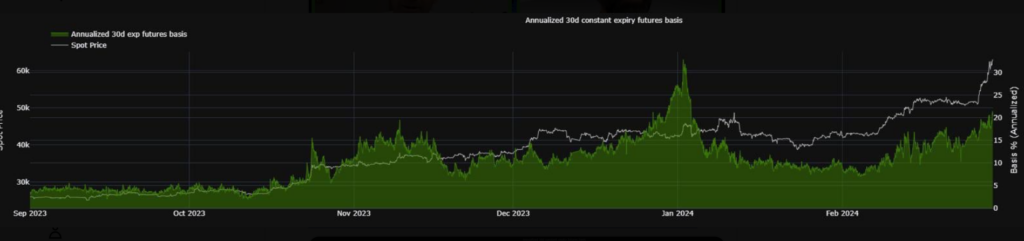

Besides, another strong reason why we’ve entirely hedged the BTC exposure up here is that the futures basis has gone nuts with a 20% annualised, which isn’t sustainable in my opinion. Institutions should be all over piling into this arbitrage. Again, for these reasons, we went 100% hedged on BTC and around 50% on ETH, with the latter offering more potential given the upcoming catalysts and the catch-up with BTC.

For a deeper dive into how I structure my trade ideas and to learn my thorough process, watch out for our next Free Options Trading Webinar.

Remember, not only do I share these trade ideas, but the ones I end up adding to my portfolio, are then tracked via a 20-30m weekly webcast that gives in-depth guidance. In it, you get to learn how to break down options trades by their Greeks and restructure trades in an optimal way to meet desired investment goals in real time. This is part of our Macro Options Overlay.

And that’s a wrap for this week!

Remember, you now have a chance to build your knowledge base via our FREE Options Insight webinar!

You will learn the process and tools I follow, from thesis to trade idea and actual execution.

This is a unique chance to learn how to master simple options trading strategies straight from a 20+ year career.

Just click the link below!

Watch Out Free Options Trading Webinar

σ

σ

Thank you for making it this far!

As always, if you have any questions, comments, and/or found this helpful, feel free to reach out and let us know at info@options-insight.com

Cheers!

Imran Lakha

Options Insight