This post is a selection of insights from our reports to subscribers this week, showcasing how we build the contextual framework to find daily trade ideas. This is a repeatable process aimed at finding high-risk-reward trades. Note that the onus is on the subscriber to pick and choose which trades fit their overall risk.

In this week’s blog post, as part of the insights and trade ideas shared with subscribers, we felt it was an apt time to enter credit put spreads in ADBE, selling call spreads in MCD on elevated volatility was also another interesting proposition, and to top it off, we decided to take off our Mar29 2,800 calls in ETH which were up 6x from the purchase price.

For a deeper dive into how I structure my trade ideas and to learn my thorough process, watch out for our next Free Options Trading Webinar.

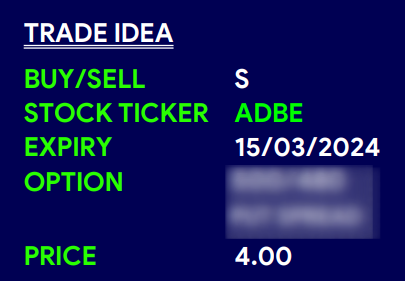

Counting on $500 to Hold in $ADBE

ADBE was smashed lower last week after openAI released Sora, an AI tool that could make realistic videos from text prompts which would challenge Adobe’s creative cloud suite.

Using further weakness from here into volume shelf support at the big $500 psychological number to enter credit put spreads looked interesting, as vol is pumped for earnings in mid-March.

For a deeper dive into how I structure my trade ideas and to learn my thorough process, watch out for our next Free Options Trading Webinar.

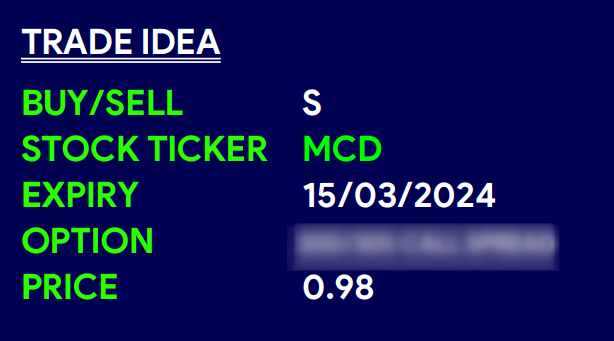

Selling Call Spread in $MCD

MCD back at downtrend resistance and with slightly elevated volatility as our prop metrics show.

Selling call spreads to collect some premium can make sense as there is a lot of supply up to 300 in the stock. We would nonetheless run a stop on these if stock breaks 300.

For a deeper dive into how I structure my trade ideas and to learn my thorough process, watch out for our next Free Options Trading Webinar.

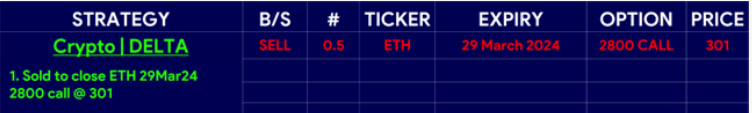

Closing ETH Call for 6x Risk Reward

This week we’ve taken off our Mar29 2,800 calls in ETH which were up 6x from the purchase price. We have reached a near term target of 3,000, which makes us more cautious.

We still have longs in the underlying asset and Jun 24 calls, but we see a risk of a pullback, which is why we want to reduce length and bank profits. 2700 should now act very strong support in a pullback.

For a deeper dive into how I structure my trade ideas and to learn my thorough process, watch out for our next Free Options Trading Webinar.

Remember, not only do I share these trade ideas, but the ones I end up adding to my portfolio, are then tracked via a 20-30m weekly webcast that gives in-depth guidance. In it, you get to learn how to break down options trades by their Greeks and restructure trades in an optimal way to meet desired investment goals in real time. This is part of our Macro Options Overlay.

And that’s a wrap for this week!

Remember, you now have a chance to build your knowledge base via our FREE Options Insight webinar!

You will learn the process and tools I follow, from thesis to trade idea and actual execution.

This is a unique chance to learn how to master simple options trading strategies straight from a 20+ year career.

Just click the link below!

Watch Out Free Options Trading Webinar

σ

σ

Thank you for making it this far!

As always, if you have any questions, comments, and/or found this helpful, feel free to reach out and let us know at info@options-insight.com

Cheers!

Imran Lakha

Options Insight