This post is a selection of insights from our reports to subscribers this week, showcasing how we build the contextual framework to find daily trade ideas. This is a repeatable process aimed at finding high-risk-reward trades. Note that the onus is on the subscriber to pick and choose which trades fit their overall risk.

In this week’s blog post, as part of the insights and trade ideas shared with subscribers, we focused on a carry trade position in the SPX, the reduction of delta in MARA stock, a ratio calendar in Silver to fade the extreme in upside volatility, while we also suggested to use put spread collars to add hedge in your crypto exposure, whether that’s BTC, ETH, or both.

For a deeper dive into how I structure my trade ideas and to learn my thorough process, watch our Free Options Trading Webinar.

Carry Trade on SPX

We executed a new carry trade as the SPX was in positive carry and we expected the range to hold in the near term. We think the street has a decent supply of gamma and vol was a little pump heading into the NFP.

Reducing Delta in MARA

We reduced delta in MARA and brought in more premium as the stock still looks expensive in terms of implied vol. We still own the stock in the long term portfolio so we are happy to overwrite the upside.

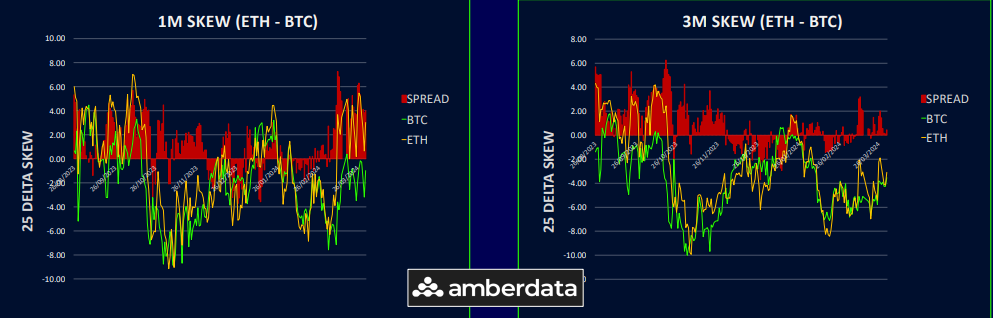

Adding Hedges in Crypto

With vol elevated and crypto markets under pressure, we think using put spread collars to add hedges makes sense. For those looking to buy the dip, we still prefer long dated call spreads to utilise the call skew further out the curve. Those expecting markets to find a range should consider iron condors to harvest the elevated volatility carry that has come back since last week.

Fade Upside Vol in Silver

We used ratio calendar to fade the extreme in Silver upside volatility and the inversion of the term structure as Gold runs into resistance at 2,300 and appears to be slowing down. We were not comfortable selling naked risk on the upside so we used a more defensive calendar strategy instead.

Remember, not only do I share these trade ideas, but the ones I end up adding to my portfolio, are then tracked via a 20-30m weekly webcast as part of our Macro Options Overlay. You get to learn how to break down options trades by Greeks and restructure trades in an optimal way.

We also offer training courses that teach you the concepts and mechanics that affect how options contracts perform. You will learn what makes a great trade, and what is just a gamble. The result? Higher quality ideas, more consistent returns. Find out more in our Educational courses.

Remember, you now have a chance to build your knowledge base via our FREE Options Insight webinar! You will learn the process and tools I follow, from thesis to trade idea and actual execution.

Just click the link below!

Watch Our Free Options Trading Webinar

σ

σ

Thank you for making it this far!

As always, if you have any questions, comments, and/or found this helpful, feel free to reach out and let us know at info@options-insight.com

Cheers!

Imran Lakha

Options Insight