This post is a selection of insights from our reports to subscribers this week, showcasing how we build the contextual framework to find daily trade ideas. This is a repeatable process aimed at finding high-risk-reward trades. Note that the onus is on the subscriber to pick and choose which trades fit their overall risk.

In this week’s blog post, as part of the insights and trade ideas shared with subscribers, we delved into vast evidence that the buying flows in the SPX are set to wane post Friday’s OPEX, buying VIX call spreads as a way to express this view that the probability of a vol spike has increased, the good timing to potentially hedge some Nikkei exposure via call overwriting, or the interest dynamics in NatGas.

For a deeper dive into how I structure my trade ideas and to learn my thorough process, join our next Free Options Trading Webinar.

Equity Buying Flows Set to Recede

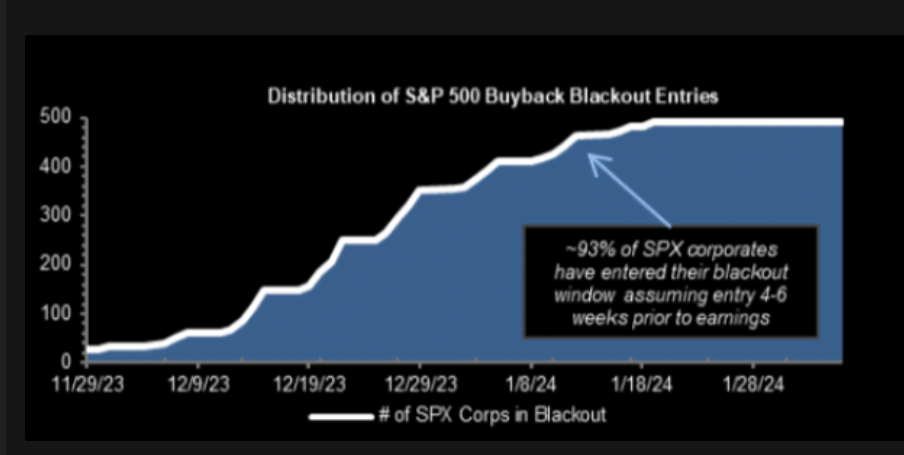

We warned subscribers to be on alert and properly hedged with some Feb24 or Mar24 put spreads in whichever US index exposure you have. The logic? We had Jan OPEX this Friday, after which much of the supportive flows from CHARM of open options positions will disappear (they largely already have) and this may lead to a market that is less supported. Buybacks are also in blackout for earnings. We are going into the time window that is most likely to see weakness relative to the last few months.

So far, SPX spot refuses to go lower (most likely due to Jan OPEX positions creating buying flows, either through CHARM or GAMMA) and ignores the messaging from the broader stock and bond markets. This setup is not uncommon and therefore presents an opportunity to setup tactical shorts for the next few weeks with a higher probability of success than normal.

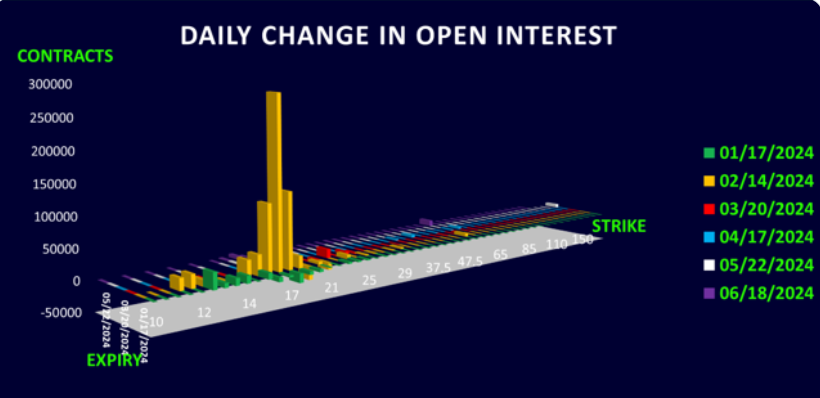

Also, over the week, we collected more pieces of evidence that the end of day buying in SPX is coming from dealers hedging DELTA on Jan24 long GAMMA positions. This will be dampened after Fridays OPEX.

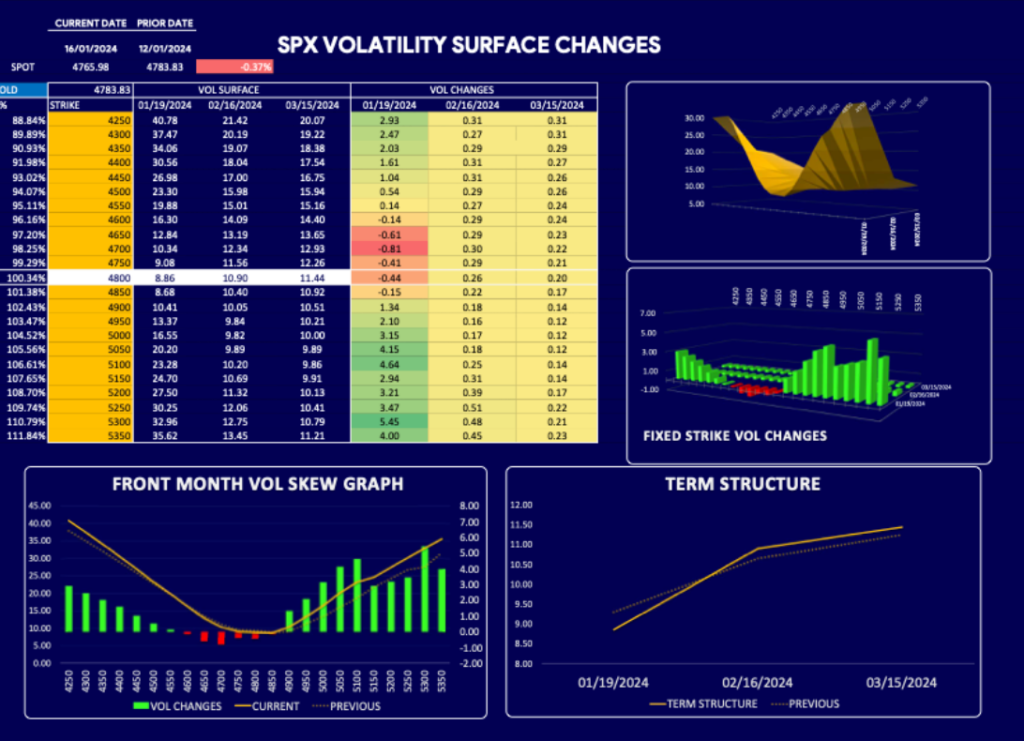

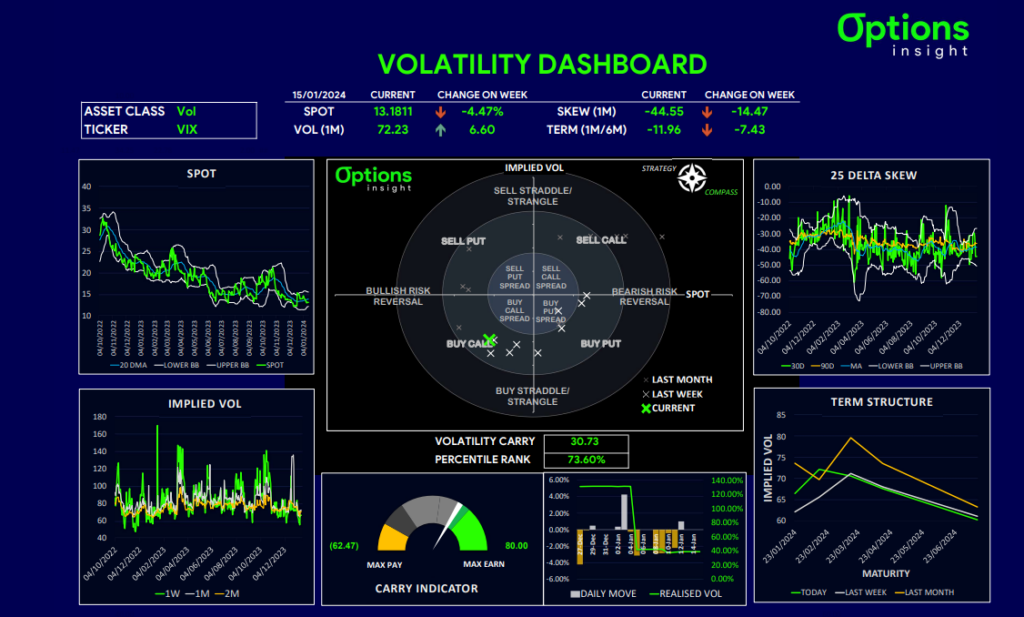

Notice in the data below how 19Jan24 fixed strike vol was lower yesterday, but Feb24 and Mar24 were firmer? This shows that dealers are trying to cover short-term VEGA (likely from the VIX trades). The fact that Jan (GAMMA) was offered likely explains why SPX refuses to sell off materially.

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar.

VIX Upside Caught Bid on Options Flows

VIX call buyers couldn’t stay away for too long! Massive clip of Feb24 17 calls were printed this week taking VVIX up around 10 points from last weeks lows. We had already started to see a little bid last Friday, particularly downside strikes in Feb and Mar which makes sense against this VIX options flow.

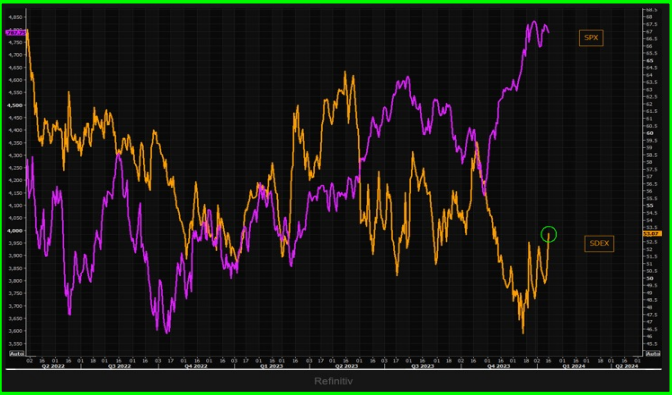

In fact, the VIX flows that we flagged this week triggered an uplift across the equity vol complex. SDEX, a measure of SPX skew had a meaningful bounce, whilst the SPX index level is still not far from its highs.

The bid to skew shows that investors are starting to feel the need to hedge risk, and this normally happens when they are long the market but a bit nervous of the macro environment. We have been advocating de-risking your equity and crypto exposure to be able to take advantage of any weakness in the near term in what we still believe will be a positive year for stocks.

Another potential indicator of weakness is the fact that market breadth has turned negative after a prolonged period of positive breadth. Using data from the last couple of years, this has often led to a correction in SPX and therefore increases the need for caution at this juncture.

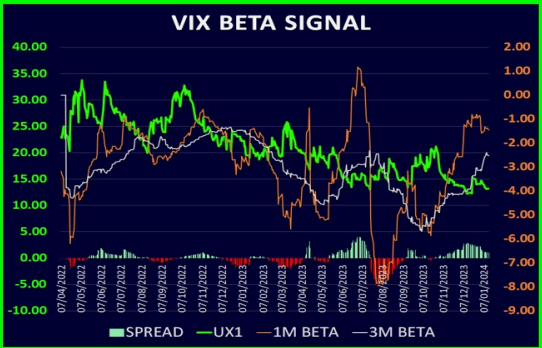

Our VIX beta signal has also been showing that VIX is again running out of downside, even if SPX manages to somehow test 5000 on the upside. We would not expect to see VIX spot trade below 12.

For all these reasons, we sent out an alert to subscribers that we were buying VIX call spreads as a way to express this view that the probability of a vol spike has increased and we like the leverage those structures provide, whilst also controlling the THETA bleed.

Using the call spreads takes advantage of the latest pop in VIX vol and call skew and controls the THETA bleed well. The risk reward on the call spread still looks very good at 8 to 1, but more realistically in a vol spike we’d make 3-4x, which is still good money.

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar.

Not a Bad Time to Overwrite Calls in the Nikkei 225

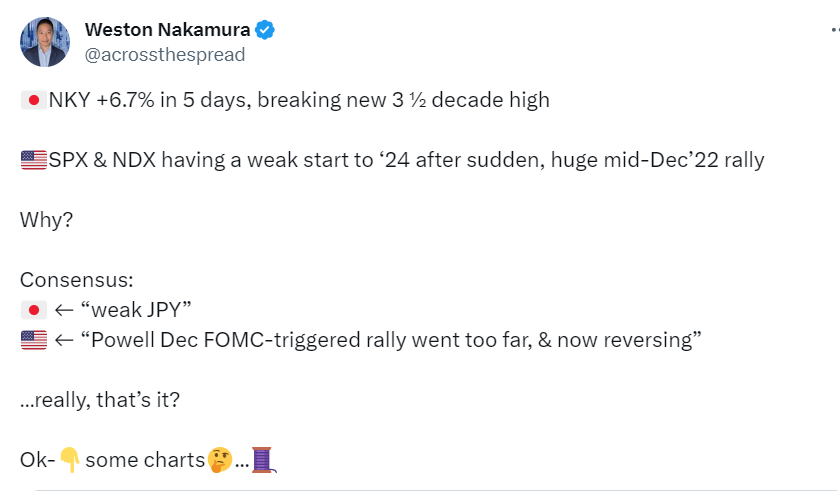

One of the top performer indices this year, one that has been on an absolute tear, is the Nikkei 225. For some insights into the inner works of this rally, check the tweet below by our friend Weston Nakamura.

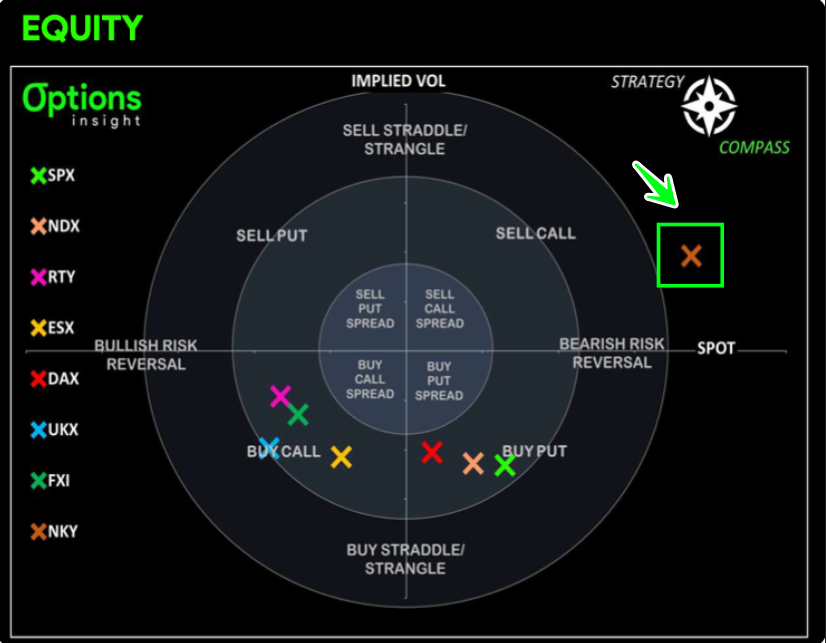

With NKY spot and vol exploding higher as of late, we feel call overwriting looks very attractive for investors that are long Japan.

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar.

NatGas at the Sweet Spot for Bulls?

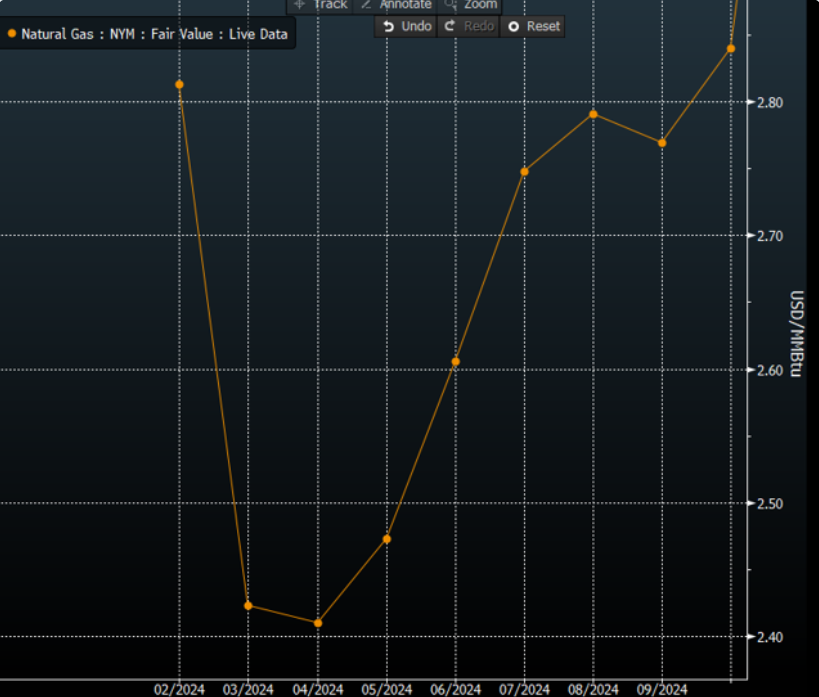

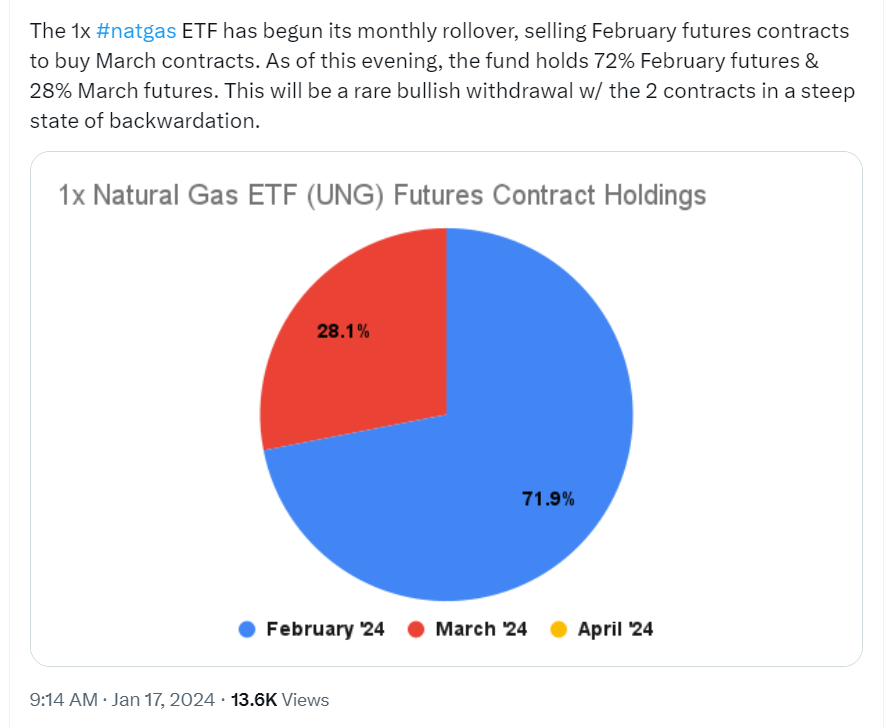

We also highlighted how interesting it was to see Natgas having retraced 50% of the recent spike with UNG having a positive roll of around 15% right now due to the backwardation in NG futures.

For more insights, you can refer to the tweet below:

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar.

Remember, not only do I share these trade ideas, but the ones I end up adding to my portfolio, are then tracked via a 20-30m weekly webcast that gives in-depth guidance. In it, you get to learn how to break down options trades by their Greeks and restructure trades in an optimal way to meet desired investment goals in real time. This is part of our Macro Options Overlay.

And that’s a wrap for this week!

Remember, you now have a chance to build your knowledge base via our FREE Options Insight webinar!

You will learn the process and tools I follow, from thesis to trade idea and actual execution.

This is a unique chance to learn how to master simple options trading strategies straight from a 20+ year career.

Just click the link below!

Free Options Trading Webinar

σ

σ

Thank you for making it this far!

As always, if you have any questions, comments, and/or found this helpful, feel free to reach out and let us know at info@options-insight.com

Cheers!

Imran Lakha

Options Insight