This post is a selection of insights from my reports to subscribers this week, showcasing how I build the contextual framework to find daily trade ideas. This is a repeatable process aimed at finding high-risk-reward trades. Note that the onus is on the subscriber to pick and choose which trades fit their overall risk.

In this week’s blog post, as part of the trade ideas shared with subscribers, I delved into call spreads partially financed via naked puts on the SPY, taking advantage of NatGas vol surface by finding good risk/reward ways to get long exposure, or a more creative idea where one could take advantage of the relative cross-asset vol divergence in Japanese equities vs the Yen.

For a deeper dive into how I structure my trade ideas and to learn my thorough process, join our next Free Options Trading Webinar.

Last week, I asked what if 420 on SPY breaks down and showed the optimal way investors could hedge the downside if they hadn’t already bought protection. However, what if you did get out of stock longs before the sell-off and now are looking for a smart way to get back in?

This current period of weakness may still last into month end, but the expensive levels of skew and implied vol can offer underwriting opportunities for those who are underweight stocks.

I would be surprised if 400 on SPY didn’t provide some support, so using that as a potential entry-level for longs looks reasonable. Using net short VEGA structures at these higher implied vols makes sense.

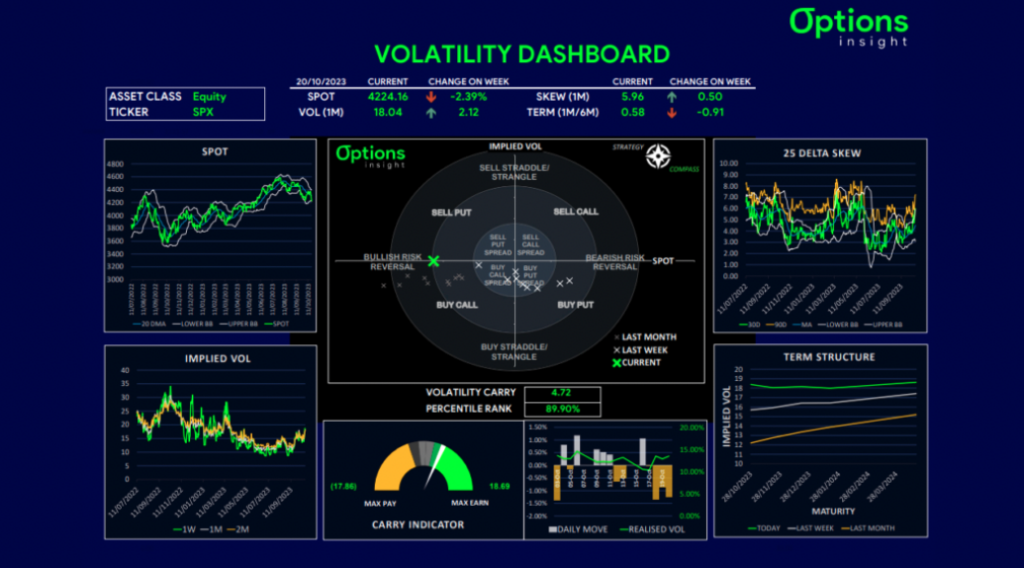

Snapshot of SPY Vol Dashboard:

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar

My trusty SPX vol dashboard has been flagging bullish risk reversals as the optimal trade, which makes sense given higher vols, high skew, and oversold spot. The only issue is that if you rally into long calls, and the vol gets hit, then they might not perform unless the rally is strong.

That’s why I think a more reliable way to add some equity length and take advantage of the higher implied vols is to sell puts and buy call spreads. This means we are net short VEGA and remain that way in a rally, so both our DELTA and VEGA will work together on the upside. You’d also keep carry cost down but sacrifice having GAMMA on the upside, which caps how much one can make in a move higher.

Don’t forget, as a subscriber, you gain exclusive access to the specifics of this daily trade idea via the Macro Options Daily report.

Natgas again faded an upside breakout as US LNG production numbers are at record highs. That said, colder weather is expected, and seasonality is turning more positive. We also had options expiry this week, which may bring selling pressure in the futures market.

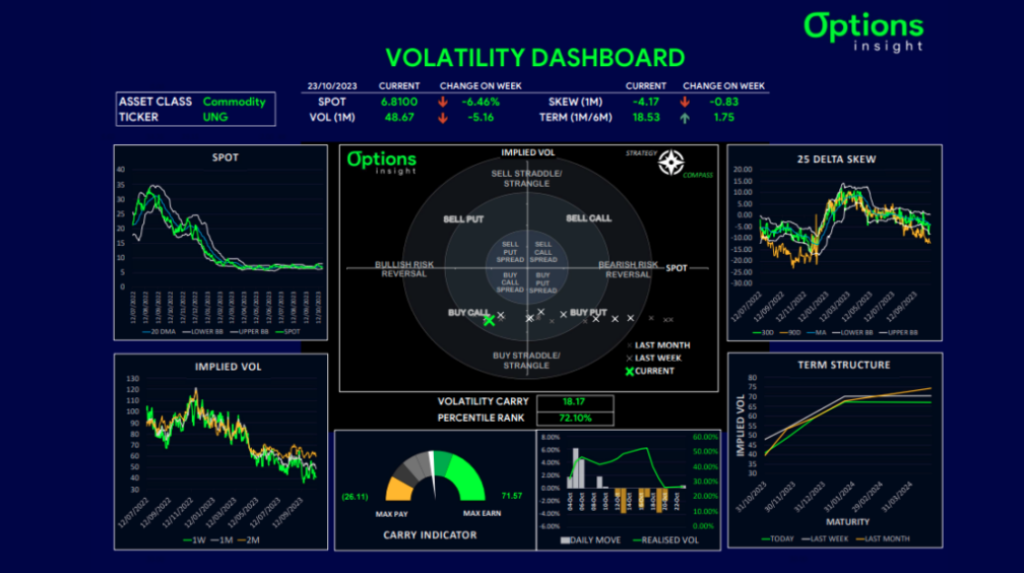

Vols have been collapsing, particularly in the front end as realized vol is in the 20s. Term structure is incredibly steep, and skew is in call premium. That’s why I thought, as part of Tuesday’s trade idea, that the vol surface could be used to one’s advantage and find good risk/reward ways to get long exposure for a near-term pop over the next month.

Snapshot of UNG Vol Dashboard:

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar

Buying outright calls in Natgas doesn’t look great when carry is so positive. I think there are better ways to get long exposure. I proposed to subscribers to ratio this trade, and by selling some extra far upside, you can structure a long DELTA and GAMMA position, one that pays very little THETA as it is short expensive upside VEGA. This way one can benefit from a price rally but lose very little on the way down.

Don’t forget, as a subscriber, you gain exclusive access to the specifics of this daily trade idea via the Macro Options Daily report.

Since September, there has been a rather large disconnect between the Yen and Japanese stocks. Typically, when the yen weakens, NKY rallies and this has been the case since the start of the year. Once the BoJ loosened it’s YCC band to 1.00%, traders had expected to see the Yen strengthen, but it seems that the impact that higher JGB yields had on global bond markets meant that the rates differential increased between USD and JPY, which has turned out to be supportive of USDJPY.

The MoF also has been putting some kind of cap on USDJPY around 150, either verbal or with actual intervention, and so the result has been a complete collapse in Yen volatility (currently realizing 3%). The NKY, in the meantime, has been carving out a double bottom near a Fibonacci retracement of the spectacular rally this year.

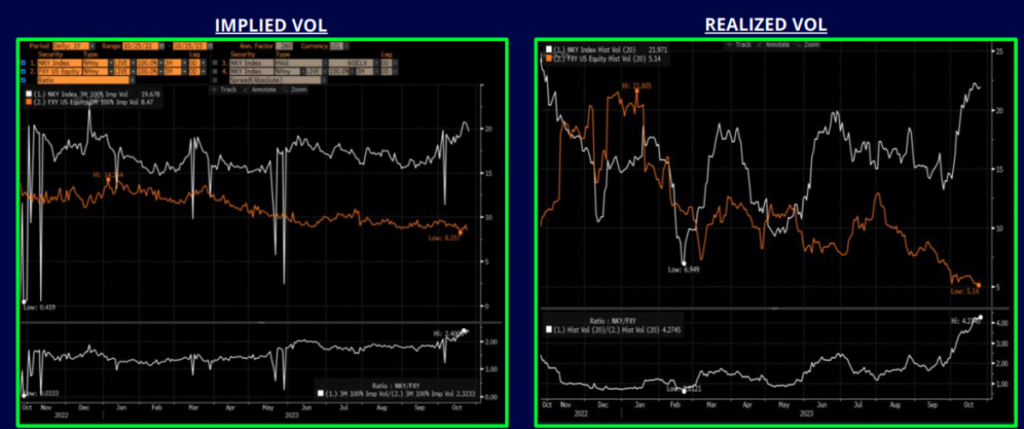

Snapshot of the relative cross asset vol opportunity in Japan:

Interested in learning the process/tools I follow, from thesis to trade idea? Join our next Free Options Trading Webinar

The spread between NKY and FXY vol is as wide as it’s been in a year, and this is because of the extreme low realized vol in Yen, but also an elevation on NKY realized due to the recent market weakness. I don’t think this divergence is sustainable, and with a BoJ meeting coming up at the end of the month, this may be an opportune time to pick up Yen volatility at the lows.

However, just buying straight FXY vol when it’s realising so poorly and not knowing which BoJ meeting will bring policy action can be costly, so financing the vol with some short NKY vol, which happened to be high in its range sounds like an interesting relative value trade to me.

I like the idea of collecting some premium from NKY put spreads to help finance a long vol position. If the BoJ does something, it’s very possible that one can make money on both legs of the trade because a break from 150 on USDJPY may get violent if they let it go.

Remember, not only do I share these trade ideas, but the ones I end up adding to my portfolio, are then tracked via a 20-30m weekly webcast that gives in-depth guidance. In it, you get to learn how to break down options trades by their Greeks and restructure trades in an optimal way to meet desired investment goals in real time. This is part of our Macro Options Overlay.

Remember, you now have a chance to build your knowledge base via our FREE Options Insight webinar!

You will learn the process and tools I follow, from thesis to trade idea and actual execution.

This is a unique chance to learn how to master simple options trading strategies straight from a 20+ year career.

σ

σ

Thank you for making it this far!

As always, if you have any questions, comments, and/or found this helpful, feel free to reach out and let us know at info@options-insight.com

Cheers!

Imran Lakha

Options Insight